Appendix I

Review Exercise Solutions

396

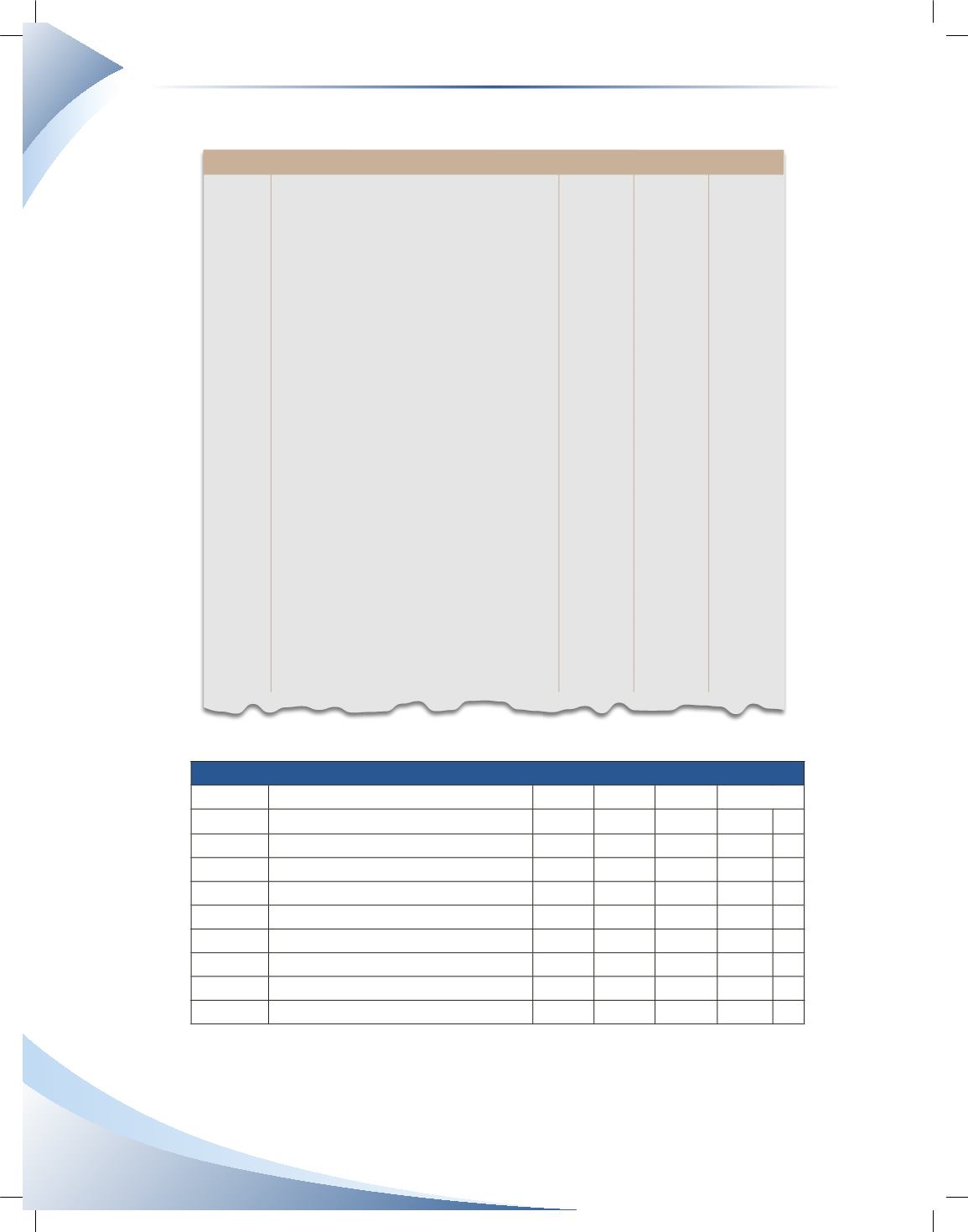

b) Prepare the adjusting journal entries.

JOURNAL

Page 2

Date Account Title and Explanation

PR

Debit

Credit

2016

Jun 30 Insurance Expense

515

100

Prepaid Insurance

110

100

Recognized one month of insurance used

Jun 30 Unearned Revenue

210

450

Service Revenue

400

450

Recognized revenue previously unearned

Jun 30 Interest Expense

520

25

Interest Payable

205

25

Accrued interest on bank loan

Jun 30 Depreciation Expense

510

100

Accumulated Depreciation

125

100

Recorded depreciation of equipment

Jun 30 Accounts Receivable

105

900

Service Revenue

400

900

Record accrued revenue

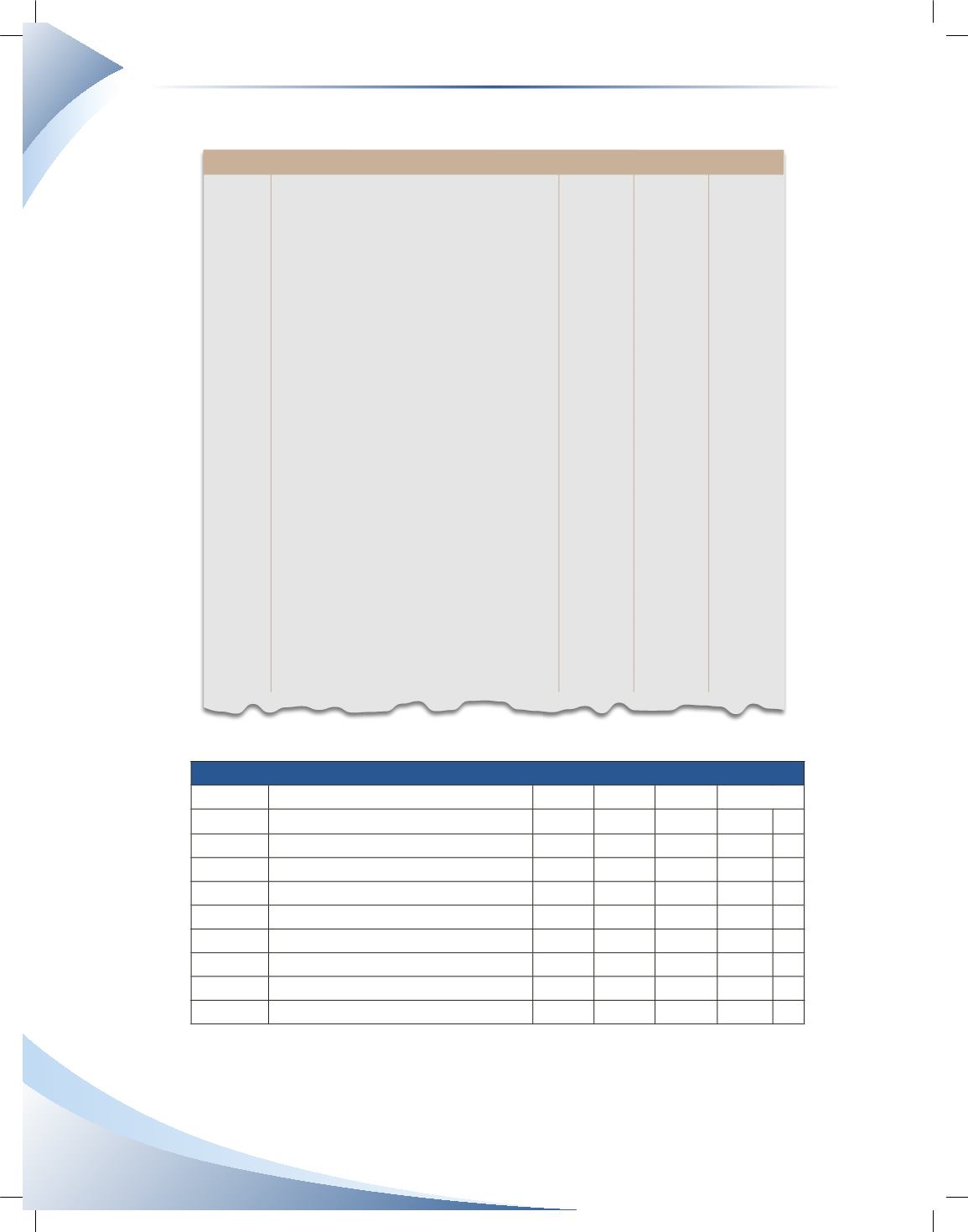

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

PR DR CR Balance

2016

Jun 1 Opening Balance

4,200 DR

Jun 1

J1

900 3,300 DR

Jun 3

J1

1,200 2,100 DR

Jun 6

J1

2,100

4,200 DR

Jun 13

J1

3,000

7,200 DR

Jun 16

J1

300

7,500 DR

Jun 23

J1

950 6,550 DR

Jun 30

J1

1,000 5,550 DR