Appendix I

Review Exercise Solutions

401

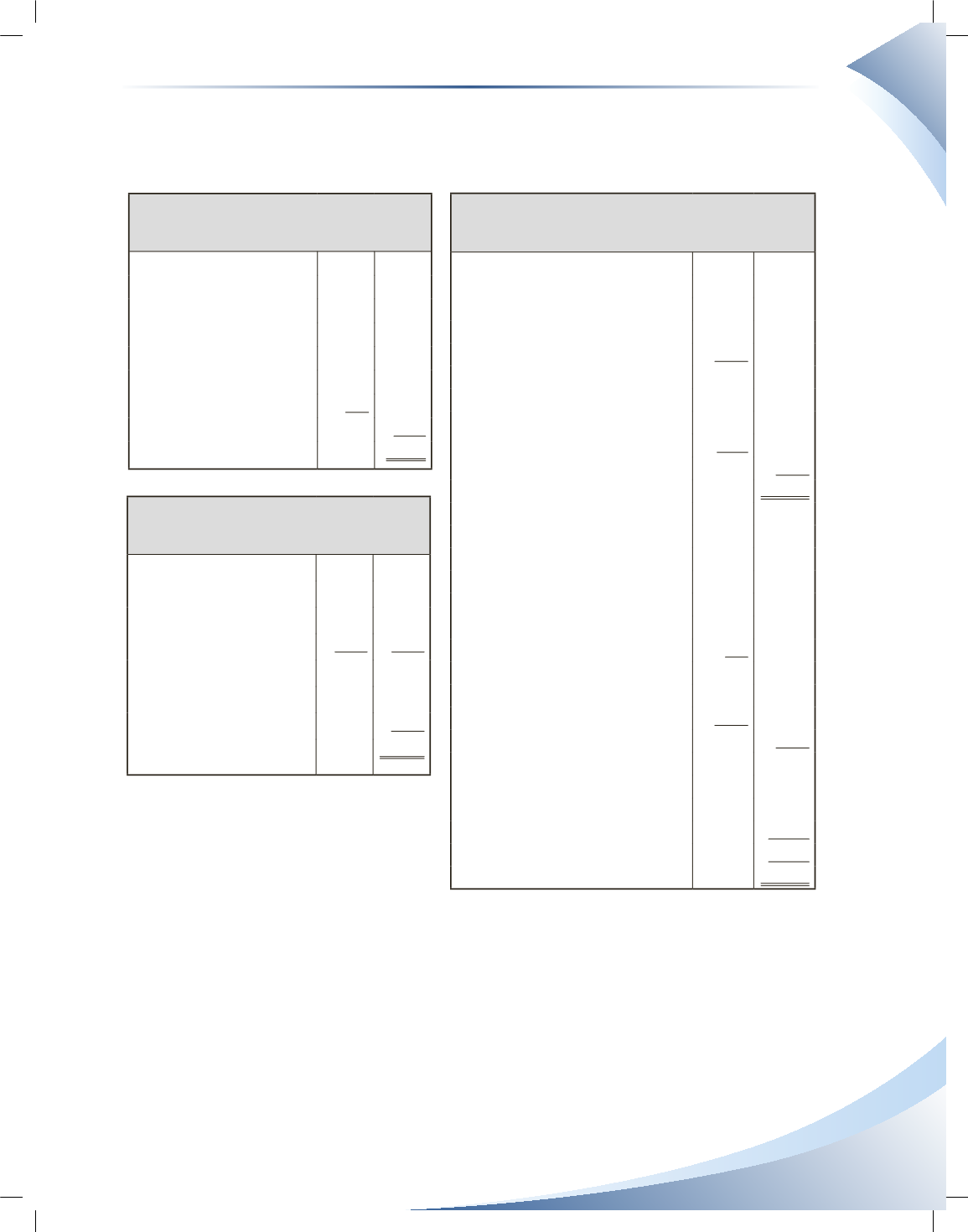

Chapter 6 Review Exercise—Solutions

a) Prepare the income statement, statement of owner’s equity and the classified balance sheet.

CG Accounting

Statement of Owner's Equity

For the Month Ended June 30, 2016

Gordon, Capital at June 1

$6,400

Add:

Additional Investment

$3,000

Net Income

3,375 6,375

Subtotal

12,775

Less:

Gordon, Drawings

1,000

Gordon, Capital at June 30

$11,775

CG Accounting

Income Statement

For the Month Ended June 30, 2016

Service Revenue

$4,950

Expenses

Advertising Expense

$450

Depreciation Expense

100

Insurance Expense

100

Interest Expense

25

Rent Expense

900

Total Expenses

1,575

Net Income (Loss)

$3,375

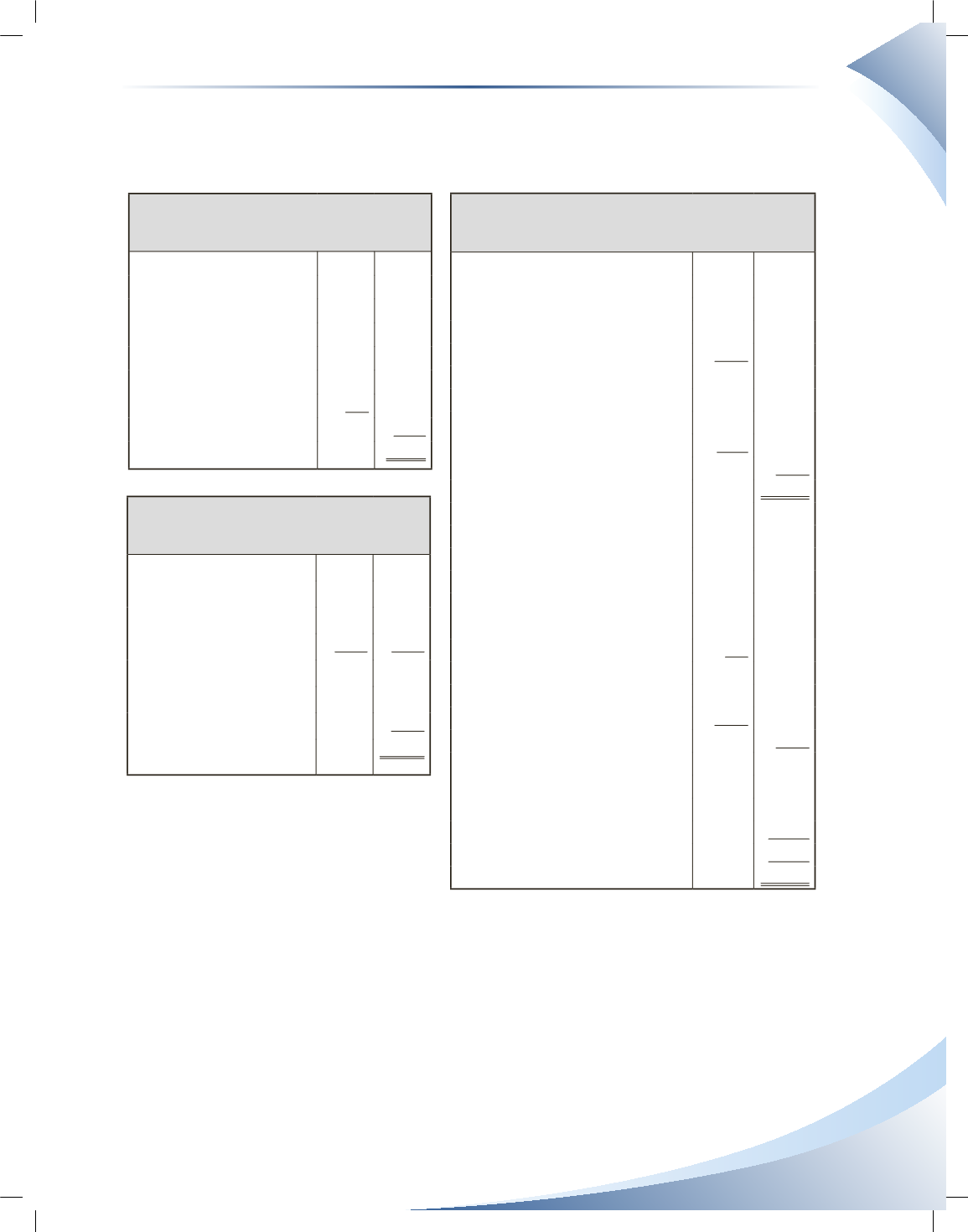

CG Accounting

Classified Balance Sheet

As at June 30, 2016

Assets

Current Assets

Cash

$5,550

Accounts Receivable

5,500

Prepaid Insurance

1,100

Total Current Assets

$12,150

Property, Plant & Equipment

Equipment

6,000

Less: Accumulated Depreciation

(100)

Total Property, Plant & Equipment

5,900

Total Assets

$18,050

Liabilities

Current Liabilities

Accounts Payable

$2,750

Interest Payable

25

Unearned Revenue

450

Current Portion of Bank Loan

800

Total Current Liabilities

$4,025

Long-Term Liabilities

Long-Term Portion of Bank Loan

2,250

Total Long-Term Liabilities

2,250

Total Liabilities

6,275

Owner's Equity

Gordon, Capital

11,775

Total Owner's Equity

11,775

Total Liabilities and Owner's Equity

$18,050