Appendix I

Review Exercise Solutions

405

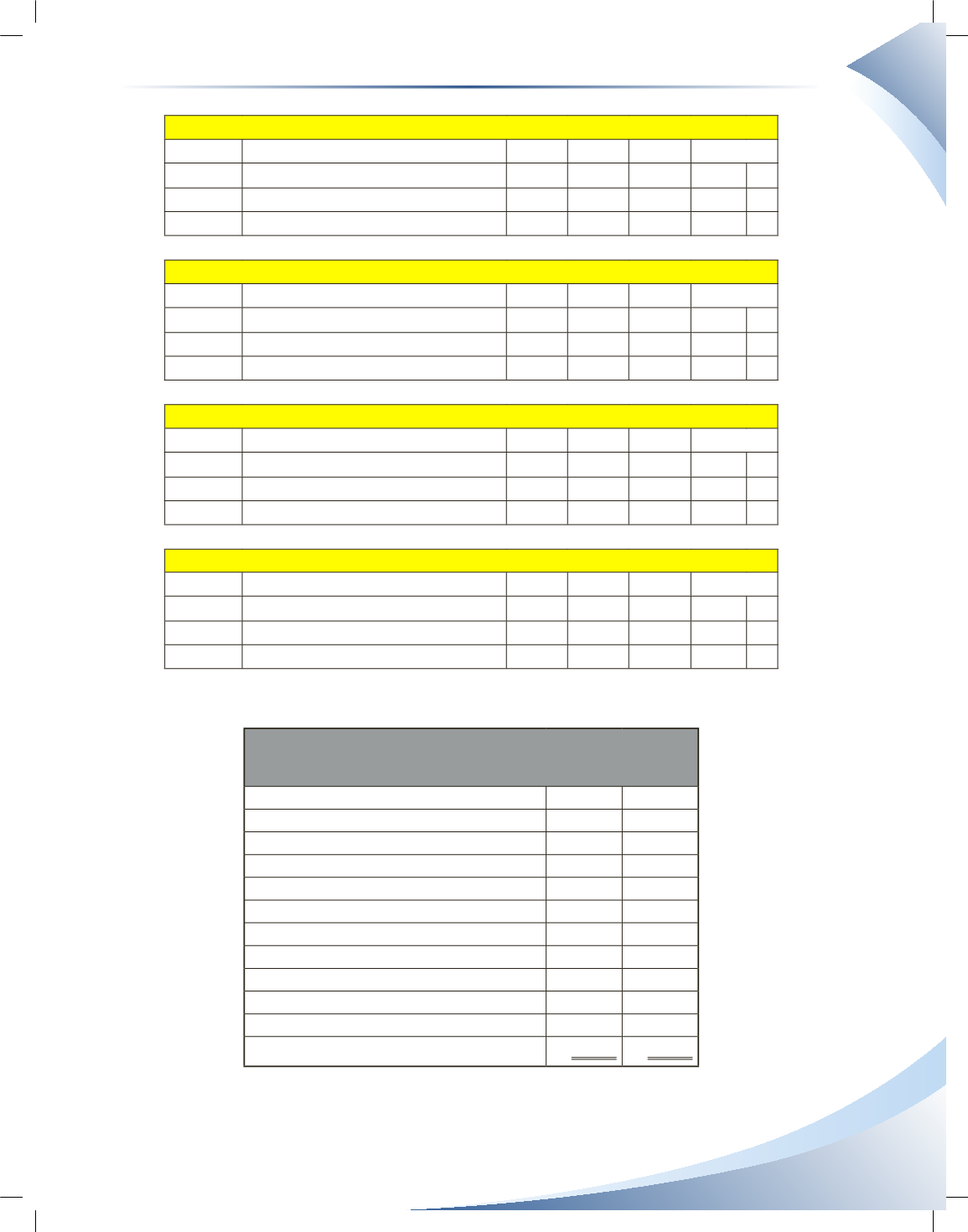

Account: Depreciation Expense

GL. No. 510

Date

Description

PR DR CR Balance

2016

Jun 30 Adjusting Entry

J2

100

100 DR

Jun 30 Closing Entry

J3

100

0 DR

Account: Insurance Expense

GL. No. 515

Date

Description

PR DR CR Balance

2016

Jun 30 Adjusting Entry

J2

100

100 DR

Jun 30 Closing Entry

J3

100

0 DR

Account: Interest Expense

GL. No. 520

Date

Description

PR DR CR Balance

2016

Jun 30 Adjusting Entry

J2

25

25 DR

Jun 30 Closing Entry

J3

25

0 DR

Account: Rent Expense

GL. No. 540

Date

Description

PR DR CR Balance

2016

Jun 1

J1

900

900 DR

Jun 30 Closing Entry

J3

900

0 DR

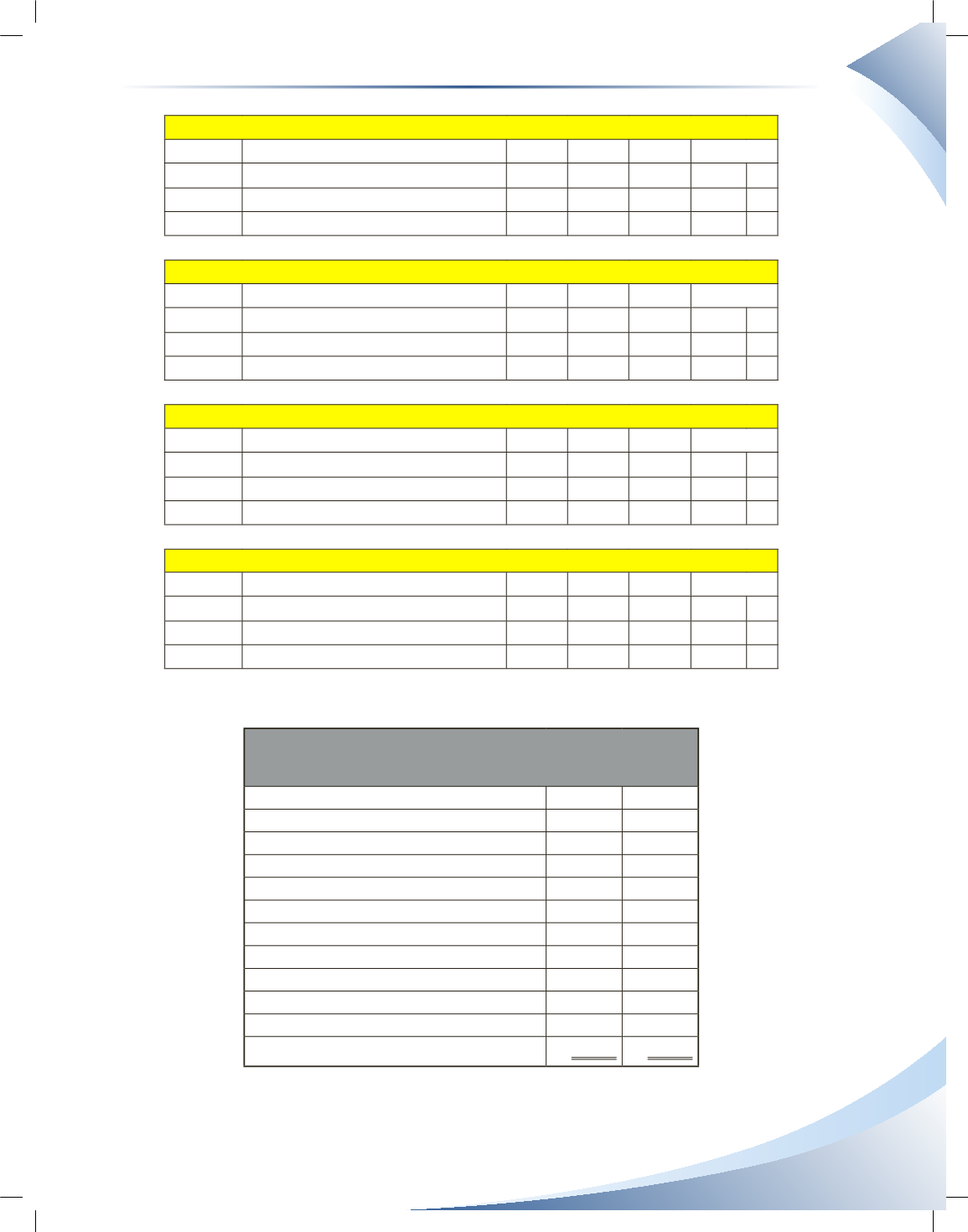

c) Prepare the post-closing trial balance.

CG Accounting

Post-Closing Trial Balance

June 30, 2016

Account Titles

DR

CR

Cash

$5,550

Accounts Receivable

5,500

Prepaid Insurance

1,100

Equipment

6,000

Accumulated Depreciation

$100

Accounts Payable

2,750

Interest Payable

25

Unearned Revenue

450

Bank Loan

3,050

Gordon, Capital

11,775

Total

$18,150

$18,150