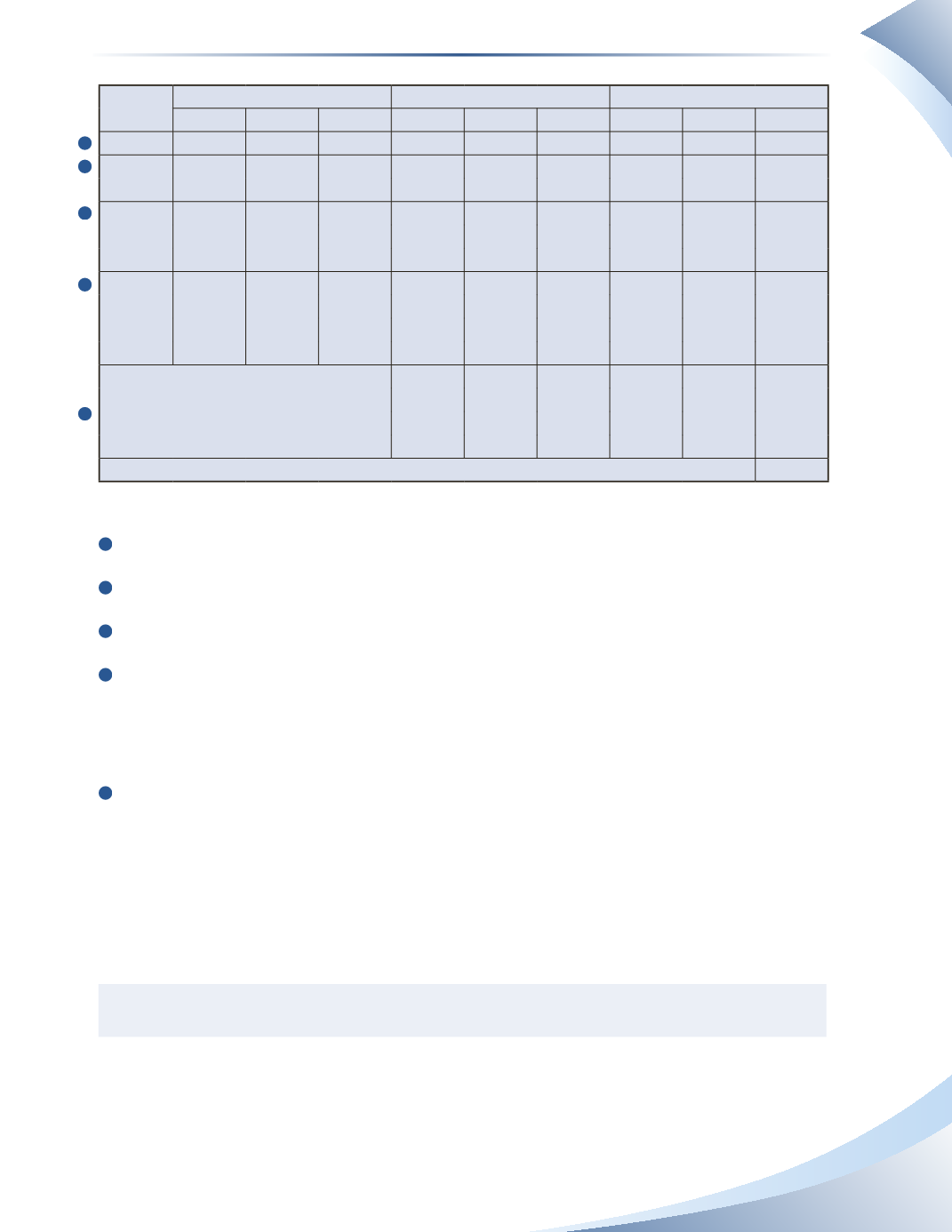

251

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

March 1

10

$10

$100

March 5

50

$12

$600

10

$10

$100

50

$12

$600

March 15 40

$14

$560

10

$10

$100

50

$12

$600

40

$14

$560

March 19 20

$16

$320

10

$10

$100

50

$12

$600

40

$14

$560

20

$16

$320

Sales for the Month

10

$10

$100

50

$12

$600

5

$14

$70

35

$14 $490

20

$16 $320

Ending Inventory

$810

________________

FIGURE 8A.3

1

The purchase of 50 pens on March 5 is added to the value of inventory.

2

The purchase of 40 pens on March 15 is added to the value of inventory.

3

The purchase of 20 pens on March 19 is added to the value of inventory.

4

There was a total of 65 items sold (15 units + 40 units). Costs are taken from the balance

of inventory, starting with the first item at the top of the list. The entire amount of opening

inventory, the entire amount of the March 5 purchase, and five items from the March 15

purchase are considered sold. Total cost of goods sold is $770 ($100 + $600 + $70).

5

The value of ending inventory is made up of 35 pens remaining from the March 15 purchase

and the 20 pens remaining from the March 19 purchase.Total value of inventory is $810 ($490

+ $320).

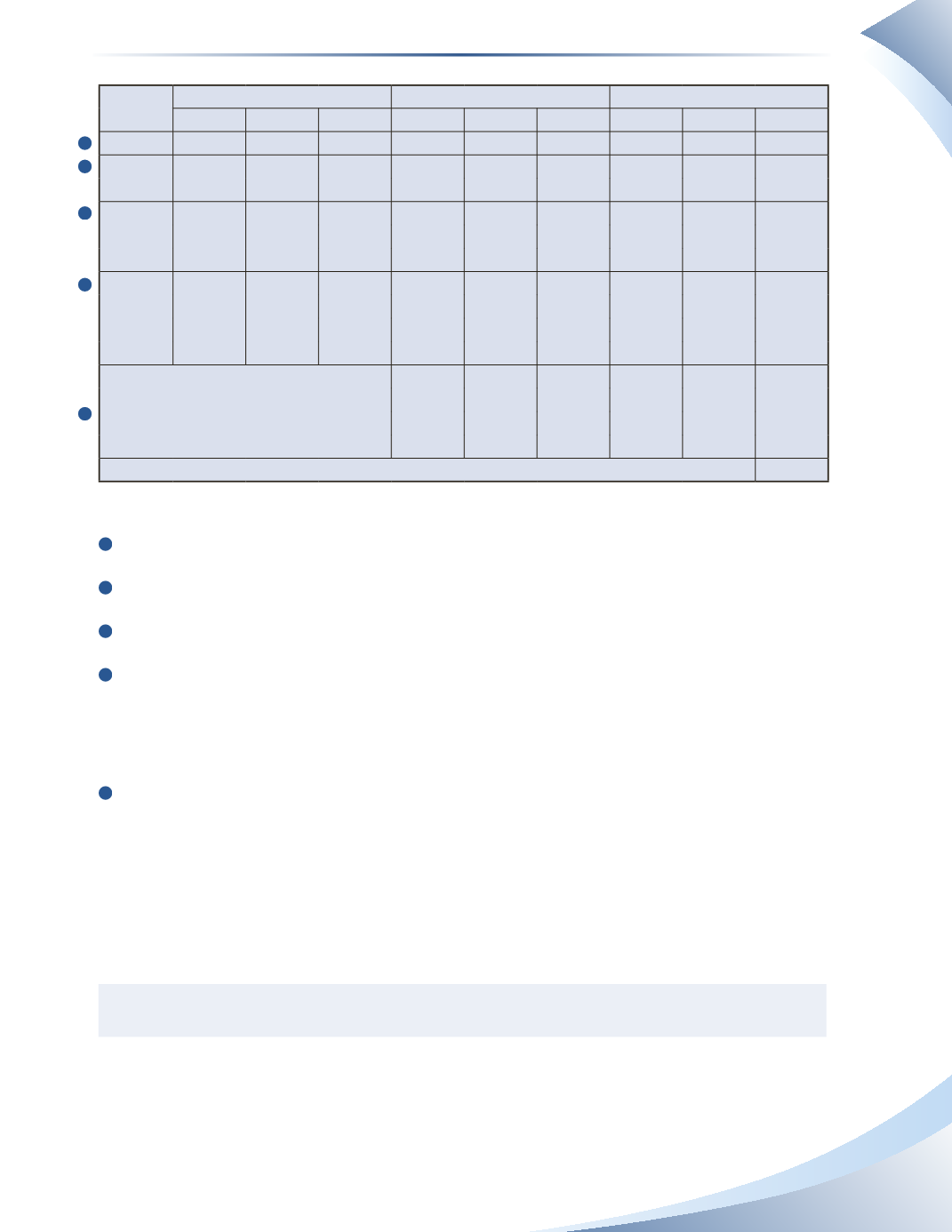

UsingWeighted-Average Cost

When using the weighted-average cost method, the average cost per unit is only calculated once, at

the end of the period.This is done by using a table as shown in Figure 8A.4. Recall that

Average Unit Cost = Total Quantity ÷ Total Value

The opening balance and the transactions from Figure 8A.1 are listed in the table. At the bottom

of the figure is the value of ending inventory.

1

2

3

4

5

Chapter 8 Appendix

Inventory Valuation