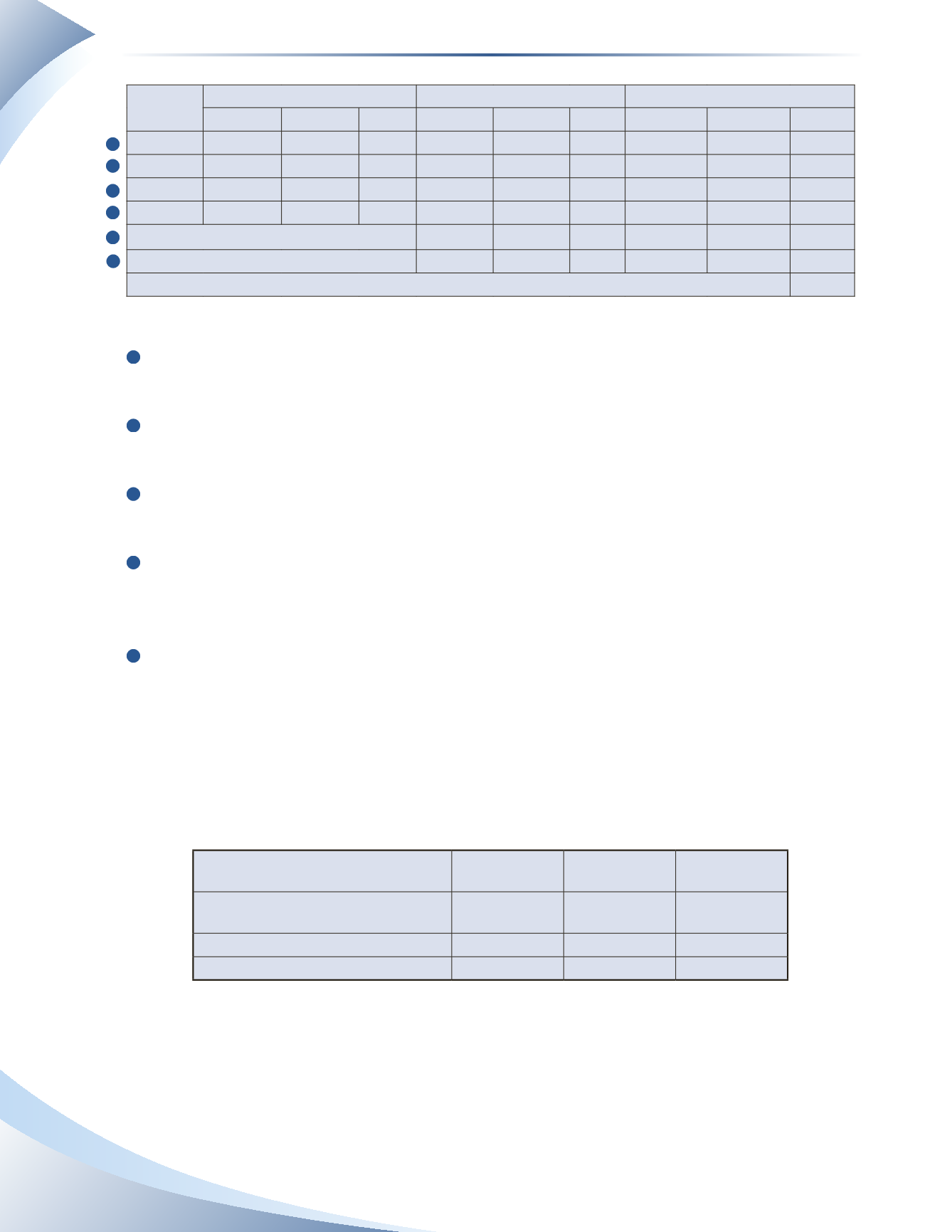

252

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

March 1

10

$100

March 5

50

$12 $600

60

$700

March 15

40

$14 $560

100

$1,260

March 19

20

$16 $320

120

$1,580

Average Inventory for the Month

120

$13.17 $1,580

Sales for the Month

65

$13.17 $856

55

$13.17

$724

Ending Inventory

$724

________________

FIGURE 8A.4

1

The purchase of 50 pens on March 5 is added to the quantity on hand.The value of the 50 pens

is added to the value of the opening inventory.

2

The purchase of 40 pens on March 15 is added to the quantity on hand. The value of the 40

pens is added to current value of inventory.

3

The purchase of 20 pens on March 19 is added to the quantity on hand. The value of the 20

pens is added to current value of inventory.

4

At the end of the month, there are 120 pens available for sale with a total cost of $1,580. The

average cost per pen is approximately $13.17 ($1,580 ÷ 120 units).This average cost is applied

to the total sales of 65 pens for the month.Total cost of goods sold is $856 (65 units × $13.17).

5

The value of ending inventory is 55 pens at the average unit cost of approximately $13.17. Total

value of inventory is $724.

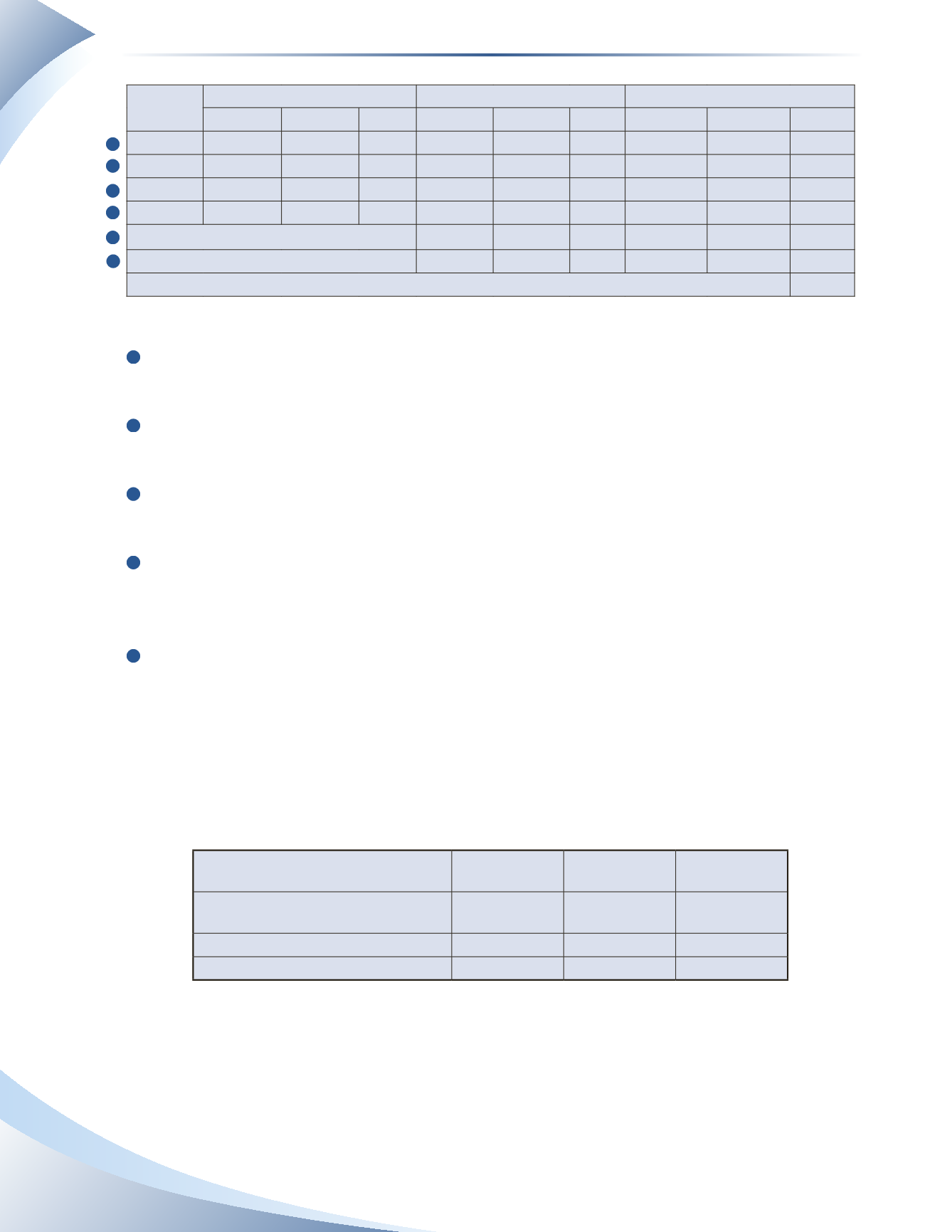

The Effect of Different Valuation Methods: Periodic

As the previous example with Cool Ink Company demonstrates, different ending inventory figures

are produced by using different valuation methods. The chart in Figure 8A.5 summarizes these

differences for the Cool Ink example.

Periodic Inventory System Specific

Identification

FIFO

Weighted-

Average Cost

Inventory Available for Sale

(beginning inventory + purchases)

$1,580

$1,580

$1,580

Ending Inventory

790

810

724

Value of COGS

790

770

856

________________

FIGURE 8A.5

Note that the FIFO method resulted in the highest value of ending inventory and the lowest value

of COGS during a period in which prices were rising. This is the same result as the perpetual

inventory system.

1

2

3

4

5

6

Chapter 8 Appendix

Inventory Valuation