253

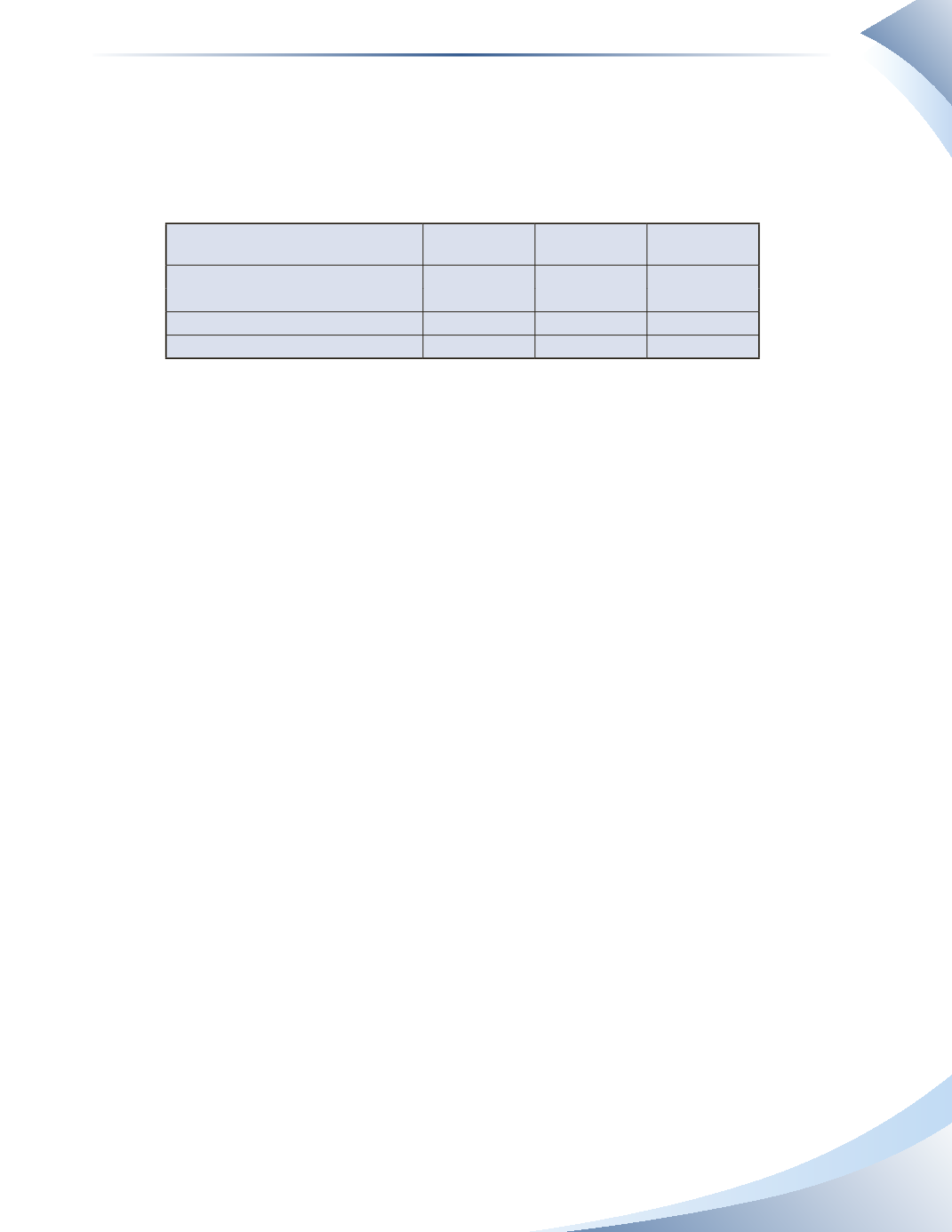

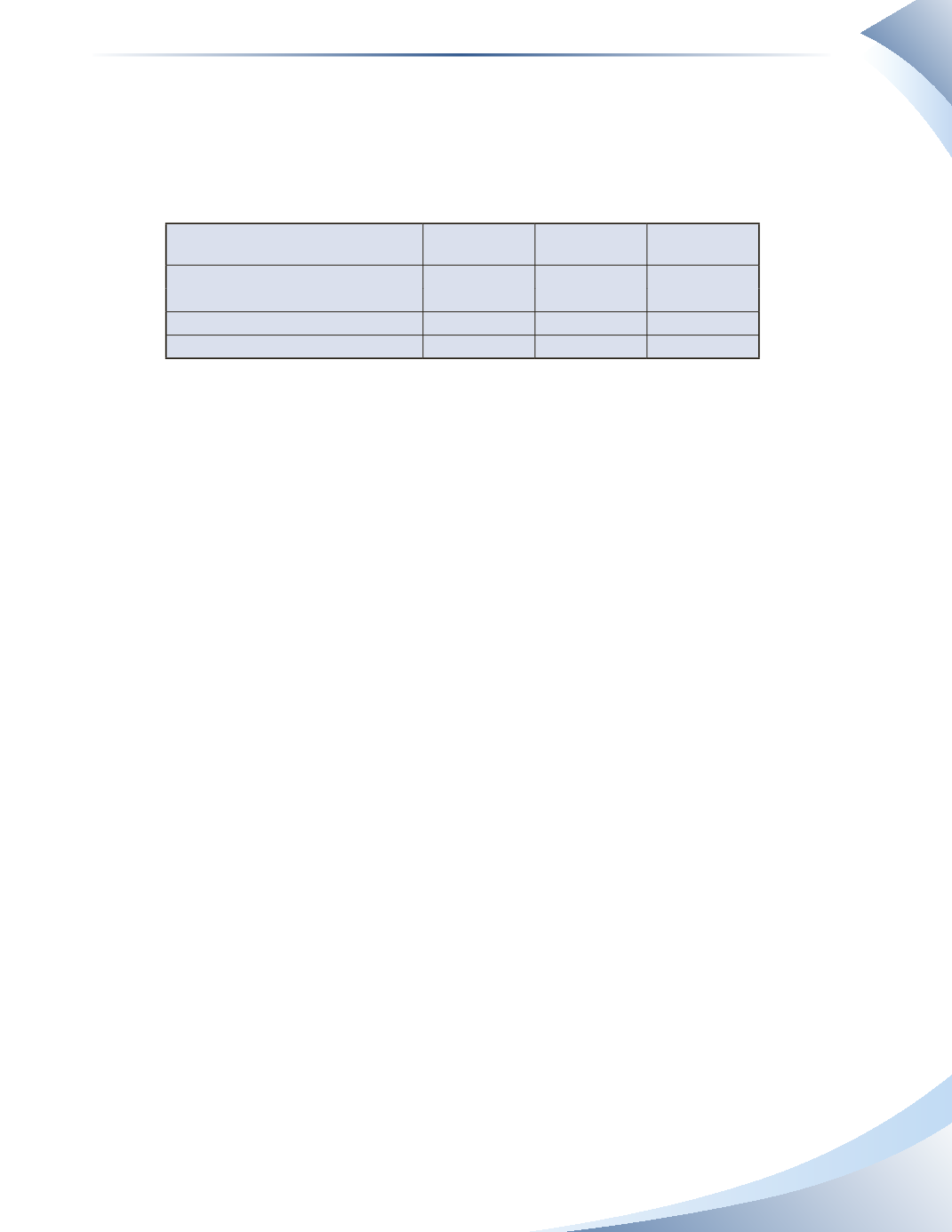

Figure 8A.6 shows the results from the perpetual inventory system using the same example.

Compare the values in Figures 8A.5 and 8A.6. Specific identification will always provide the same

values under both systems since the company is able to specifically identify which items are being

sold, regardless of the inventory system being used. FIFO will also provide the same values under

both systems because the most recent purchases are always in ending inventory.

Perpetual Inventory System Specific

Identification

FIFO

Weighted-

Average Cost

Inventory Available for Sale

$1,580

$1,580

$1,580

(beginning inventory + purchases)

Ending Inventory

790

810

736

Value of COGS

790

770

844

________________

FIGURE 8A.6

The weighted-average cost method shows different values for ending inventory and COGS. This

is because the perpetual inventory system assigns costs as the items are sold, whereas the periodic

inventory system only assigns costs at the end of the period.

Chapter 8 Appendix

Inventory Valuation