285

Accounting Information Systems

c) Post from the special journals to the accounts payable subledger and then to the general ledger

control account at the end of the month. Assume the following opening subledger balances.

• Stapl-EZ: $500 (CR)

• Building Services Inc: $750 (CR)

• Brick & Mortar Inc: $2,500 (CR)

Note that Lin-Z’s accounts payable records consist of only these three subledgers. Assume

no entries were made directly to accounts payable through the general journal. Reconcile the

subledger to the control account at the end of the month.

See Appendix I for solutions.

a) Record transactions in the Cash Receipts, Sales, Purchases, and Cash Payments journals.

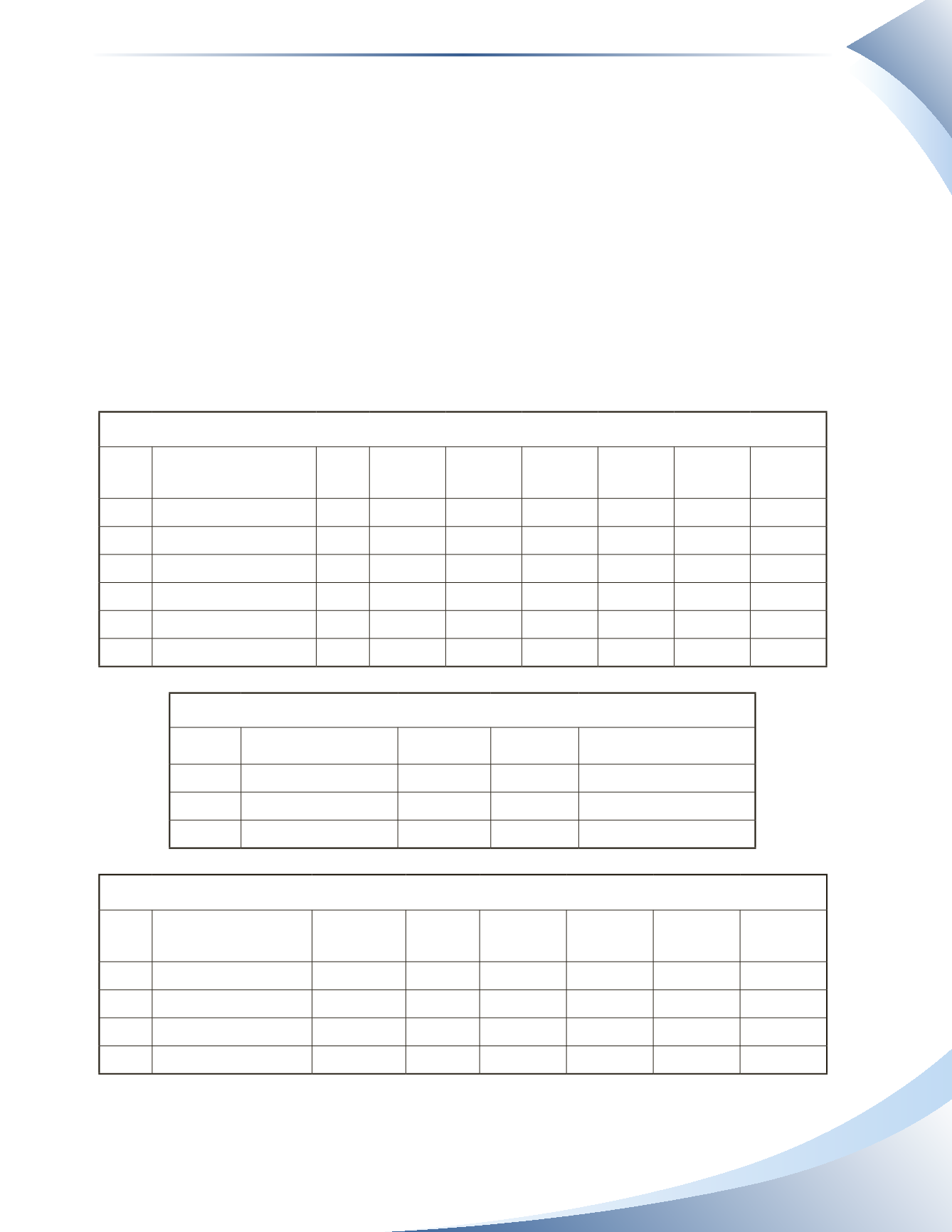

Cash Receipts Journal

Page 1

Date

Account

PR

Cash

(DR)

Sales

(CR)

Accounts

Receivable

(CR)

Interest

Revenue

(CR)

Loans

Payable

(CR)

Other (CR)

TOTAL

Sales Journal

Page 1

Date

Account

Invoice #

PR

Accounts Receivable/Sales

(DR/CR)

TOTAL

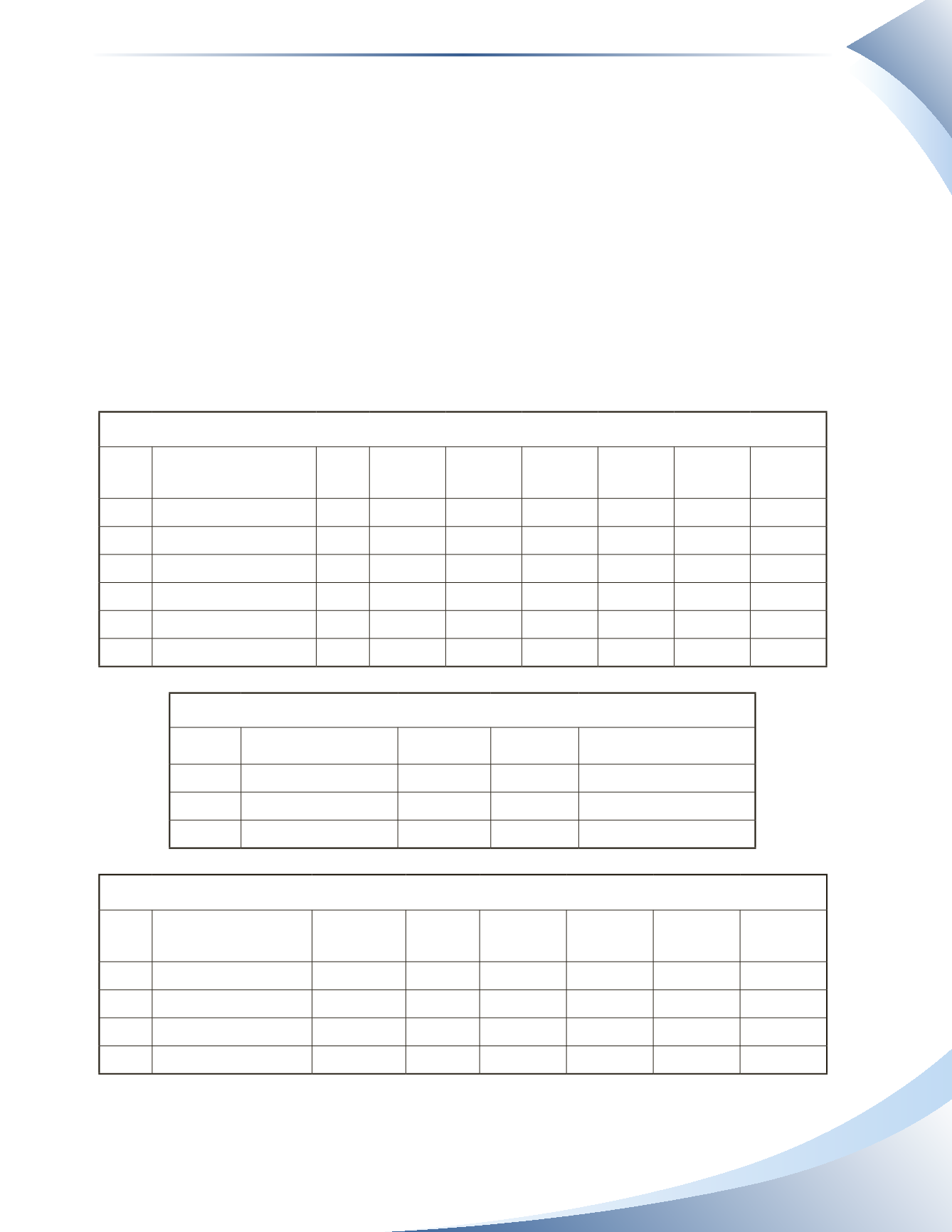

Purchases Journal

Page 1

Date

Account

Invoice #

PR

Repairs

Expense

(DR)

Office

Supplies

(DR)

Purchases

(DR)

Accounts

Payable

(CR)

TOTAL

Chapter 9 Appendix