Chapter 10

Cash Controls

293

Debit and Credit Card transactions

In addition to receiving cash from customers for payment,many businesses will also allow customers

to pay using debit or credit cards. From the business perspective, these payments are like cash since

they will be deposited into the business bank account. The business may have the amounts from

debit and credit card sales transferred into the bank account each day or less frequently if it does

not have many daily sales.

A debit card sale transfers cash from the customer’s bank account to the business bank account.

This limits the customer to spending only what they have in their account. A credit card sale gives

the customer access to credit which usually available through their bank. This is like a loan from

the bank to the customer.

In both cases, a sale paid for by credit card or debit card will result in a small transaction fee

the business must pay to the bank or processing company. This fee is to cover the bank’s cost of

providing the equipment and technology to allow these transactions. In the case of credit card fees,

it also covers the risk that the customer may not repay the bank the money they borrowed. From

the business’ perspective, this fee is a cost of processing the sale and is recorded as an expense.

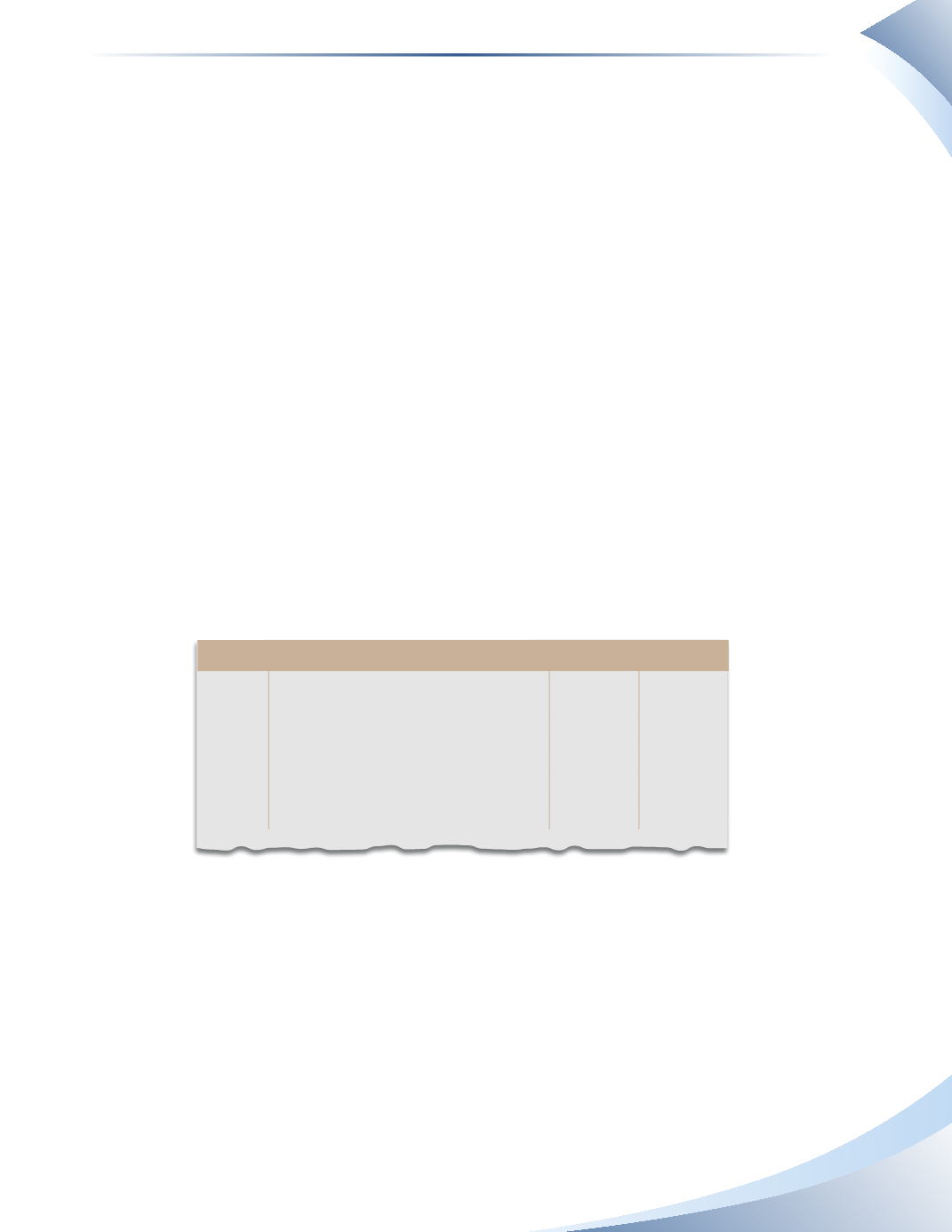

For example, suppose a business made total credit card sales of $2,000 on May 25, 2016.The bank

will charge 2.5% of total sales as the transaction fee to the business. Thus, $50 ($2,000 x 2.5%)

will be kept by the bank and only $1,950 will be deposited to the business bank account. The

transaction is illustrated in Figure 10.4.

Journal

Page 1

Date

2016

account title and explanation

Debit

Credit

May 25 Debit/Credit Card Expense

50

Cash

1,950

Sales Revenue

2,000

To record credit card sales

______________

FIGURE 10.4

On the other hand, a bank can charge a fixed percentage of all debit transactions, such as 1% or 2%,

or charge a per-transaction fee, such as $0.006 per transaction, depending on the terms of the bank

account. This debit card expense is recorded in the journal under the Debit/Credit Card Expense

account as shown in Figure 10.4.