Chapter 10

Cash Controls

295

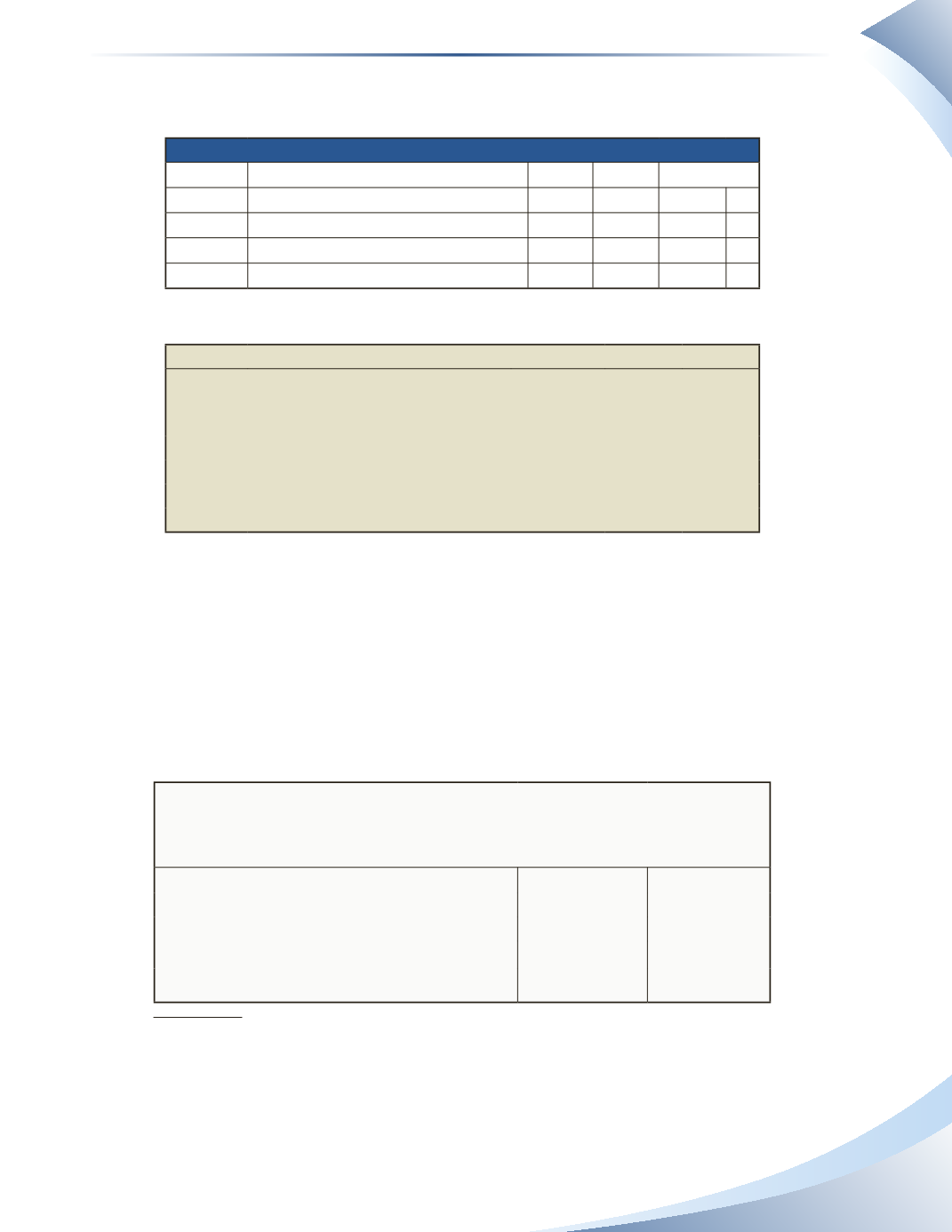

Company’s Records

GENERAL LEDGER

Account: Cash

GL. No. 101

Date

Description

DR CR

Balance

Jun 1 Opening Balance

5,000 DR

Jun 2 Cheque #1

300 4,700 DR

Jun 3 Cheque #2

500 4,200 DR

Jun 10 Cheque #3

700 3,500 DR

Bank’s Records

Bank Statement

June 1–June 30, 2016

Date

Description

Withdrawal Deposit Balance

Jun 1 Opening Balance

5,000

Jun 2 Cheque #1

300

4,700

Jun 3 Cheque #2

500

4,200

Jun 10 Cheque #3

700

3,500

Jun 30 Interest

5

3,505

______________

FIGURE 10.5

If the deposit is correct, you will have to record it in the ledger account. For example, in Figure 10.5,

the bank has recorded interest of $5 in the account of HR Clothing on June 30. All the other

cheques have been recorded by the bank as well as by the company. Since the interest earned is

correctly shown on the bank statement, it should also be recorded in the general ledger by debiting

(increasing) cash and crediting (increasing) interest revenue.

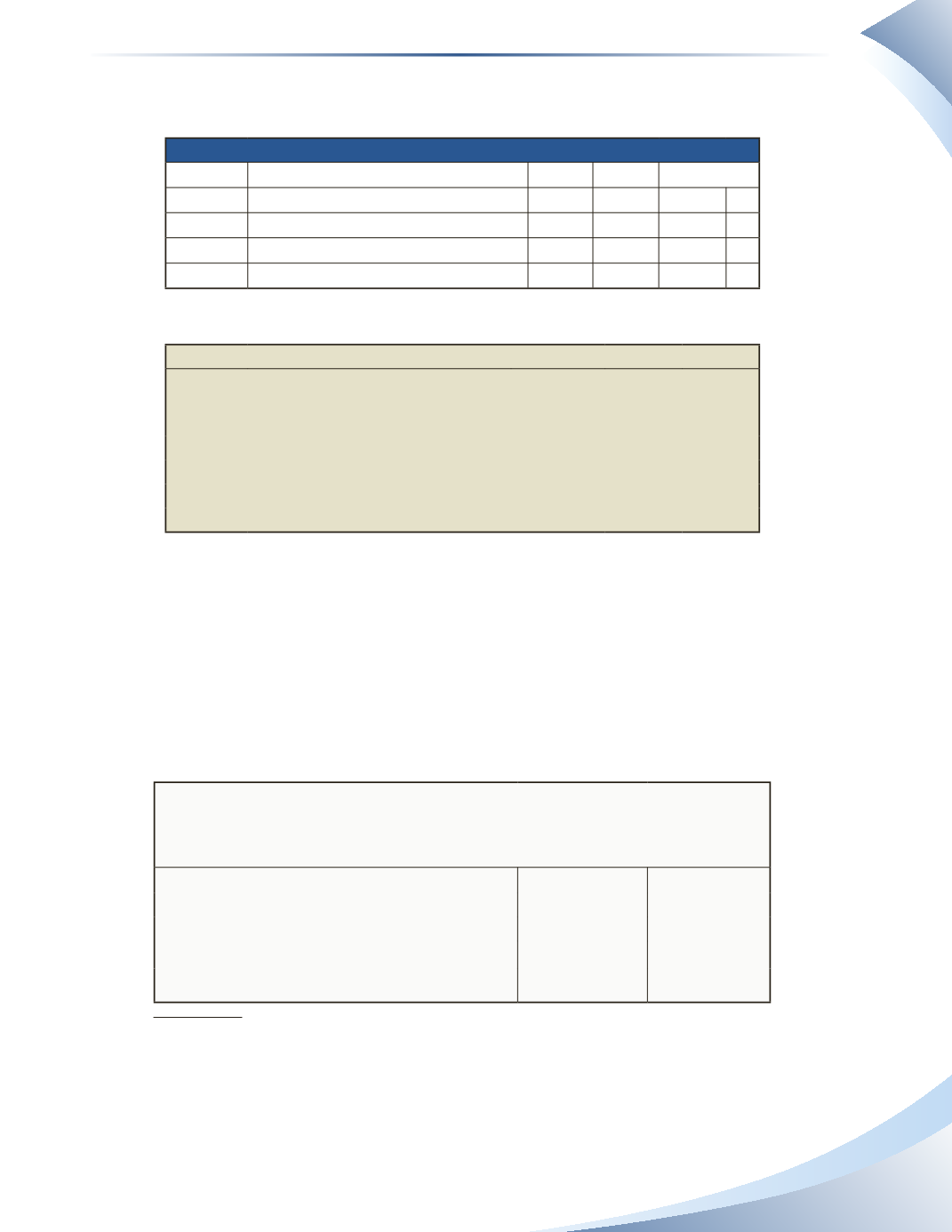

Assume that HR Clothing’s ledger balance is $3,500, and the bank statement for the month shows

a balance of $3,505.The bank reconciliation for this is shown in Figure 10.6.

HR Clothing

Bank Reconciliation

June 30, 2016

Ledger

Bank

Balance as per records

$3,500

$3,505

Add: Unrecorded deposits

Interest June 30

5

Reconciled balance

$3,505

$3,505

Figure 10.6

Notice that the adjusting amount is in the ledger column. This means that you must correct the

general ledger balance with an adjusting journal entry.The entry is shown in Figure 10.7. Notice

that the journal entry includes interest revenue. On the Accounting Map, interest revenue is listed

under other revenue on the income statement.