Chapter 12

Using Accounting Information

380

Review Exercise 1

Use the financial statements for Basil’s Bakery to perform a horizontal and vertical analysis and

calculate the following financial ratios and figures for 2016.

• Working capital

• Current ratio

• Quick ratio

• Gross profit margin

• Net profit margin

• Return on equity

• Inventory turnover ratio

• Inventory days on hand

• Debt-to-equity ratio

After calculating the ratios, comment on the result for each ratio. In your explanation, ensure you

state whether or not the result is good along with the possible reasoning behind that determination.

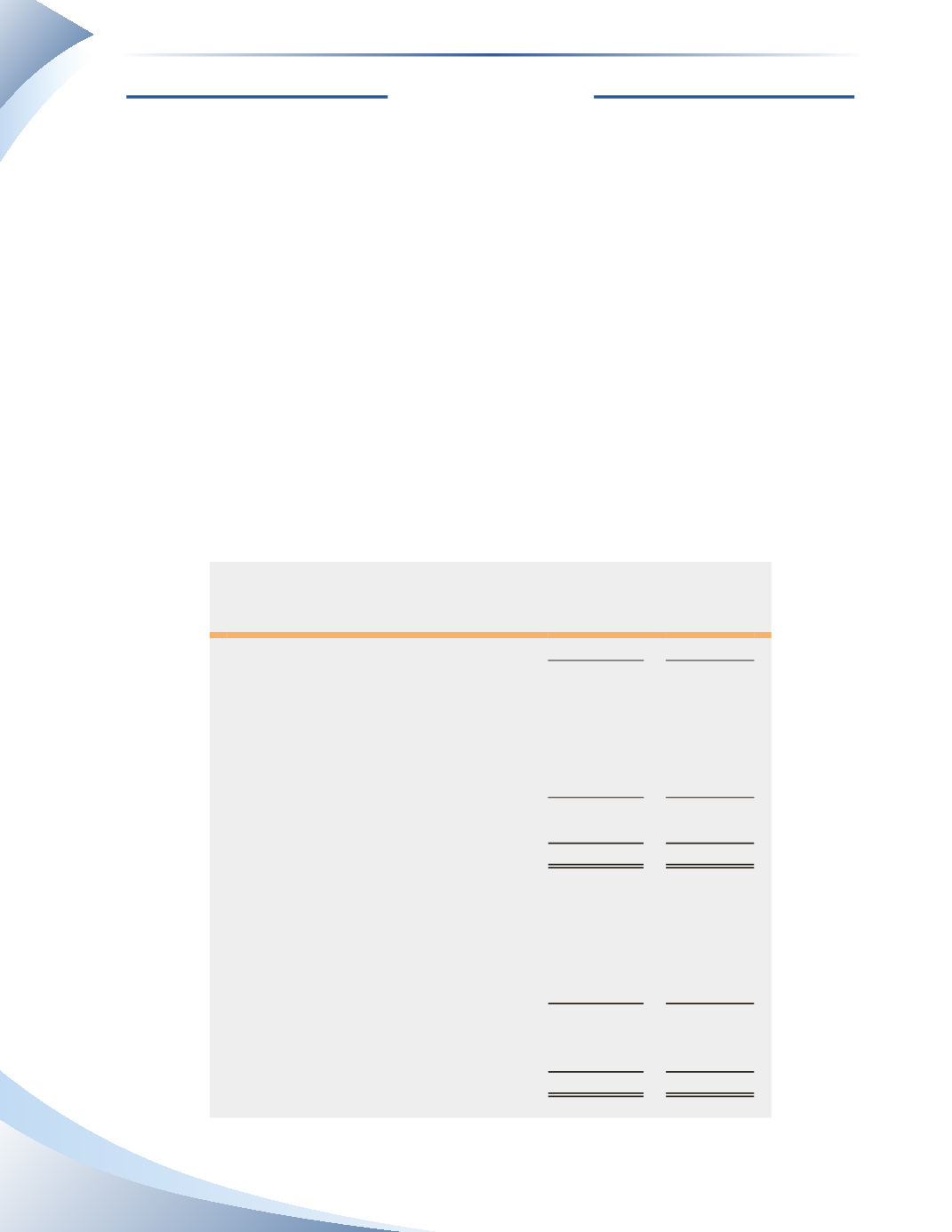

Basil's Bakery

Balance Sheet

As at December 31, 2016 and 2015

2016

2015

ASSETS

Current Assets

Cash

$1,605

$987

Accounts receivable

1,175

573

Inventory

396

256

Other current assets

301

103

Total Current Assets

3,477

1,919

Property, plant & equipment

2,034

1,170

TOTAL ASSETS

$5,511

$3,089

LIABILITIES AND EQUITY

Liabilities

Current liabilities

$1,474

$547

Non-current liabilities

104

58

TOTAL LIABILITIES

1,578

605

Shareholders’ Equity

3,933

2,484

TOTAL LIABILITIES AND EQUITY

$5,511

$3,089

*Note: the numbers in this financial statement is expressed in thousands of Canadian dollars.