Chapter 12

Using Accounting Information

370

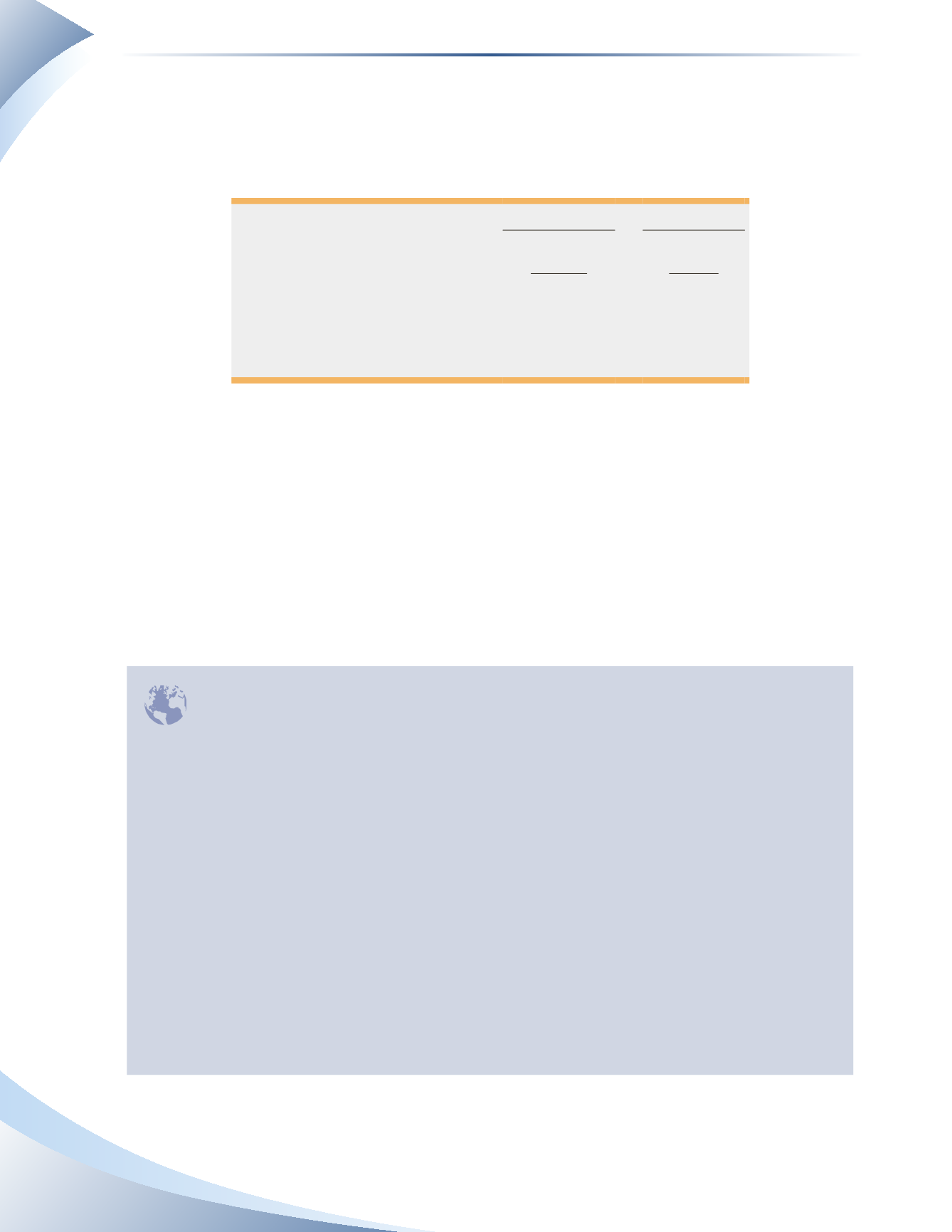

Although not shown in Figure 12.14, we need to know the balance of shareholders’ equity at

December 29, 2012 to calculate the average shareholders’ equity for 2013. Assume that the balance

on this date was $56,700,000. Then, the calculations of ROE for Second Cup in 2013 and 2014

are shown in Figure 12.19.

2014

2013

Net Income (Loss)

($27,032)

($7,369)

Average Shareholders’ Equity

(1)

$35,479

$51,332

Return on Equity

−

76%

−

14%

Industry Average

13%

16%

(1) Average Shareholders’ Equity for 2013: ($56,700 + $45,964) ÷ 2 = $51,332

Average Shareholders’ Equity for 2014: ($45,964 + $24,994) ÷ 2 = $35,479

_______________

Figure 12.19

A high ROE is desirable because it means that investors made a good decision by investing in the

company. Shareholders like to see a return that is as good or better than they could have received

by investing elsewhere. A negative ROE indicates that shareholders actually lost money on their

investments over the year. It also deters investors from investing more money at the risk of losing

it. Second Cup’s return on equity has gone from bad to worse recently while other companies in the

same industry have been able to generate a positive return for their shareholders.

One of the most important assessments that owners of a business can make is to know if they are

getting a decent return on their investment. How is this done and how do they know if they are

getting their money’s worth out of the business?

Any determination of return on investment revolves around shareholders’ equity. In other words, how much

cash would the owners have left if they sold all the assets of the business and paid off all their debt? Given

that this is a hypothetical question, and that the owners do not have to sell everything to assess the return

on investment, there are other ways of assessing the value of the investment in the business.

For example, the owners could ask themselves another theoretical question: Should we keep our money in

the business, or put it elsewhere? Safe investments such as fixed deposit accounts come with relatively lower

returns on investment. Investing in a friend’s new business comes with a potentially much larger return on

investment—but also with greater risk.

In fact, a general rule of thumb can be applied to assessing return on investment associated with certain

levels of risk. Generally speaking, investments in publicly traded companies come with the expectation

of a return ranging from 15% – 25%. Alternatively, the rate of return associated with private companies

is expected to be much higher. In fact, it is not unusual to expect a rate of return of 100% or more for an

investment in a small private company.

As with most things in life, everything comes at a price. With return on investment, the price can be a matter

of risk. If owners want a better return, they must have a greater tolerance for risk.

IN THE REAL WORLD