Chapter 12

Using Accounting Information

372

Inventory Days on Hand

This ratio states the same thing as the inventory turnover ratio but in a different way.

Inventory

days on hand

is equal to the average number of days that it took to turn over inventory during the

year. Some users prefer to use this ratio because they are familiar with working in units such as days

and months.The formula is shown below.

=

365

Inventory Days on Hand

Inventory Turnover Ratio

This ratio converts the number of times inventory is turned over into the average number of days

it took to turn over inventory. For example, a company that sells its entire inventory twice a year

would have an inventory turnover ratio of 2 and an inventory days on hand of 182.5 days.The ratio

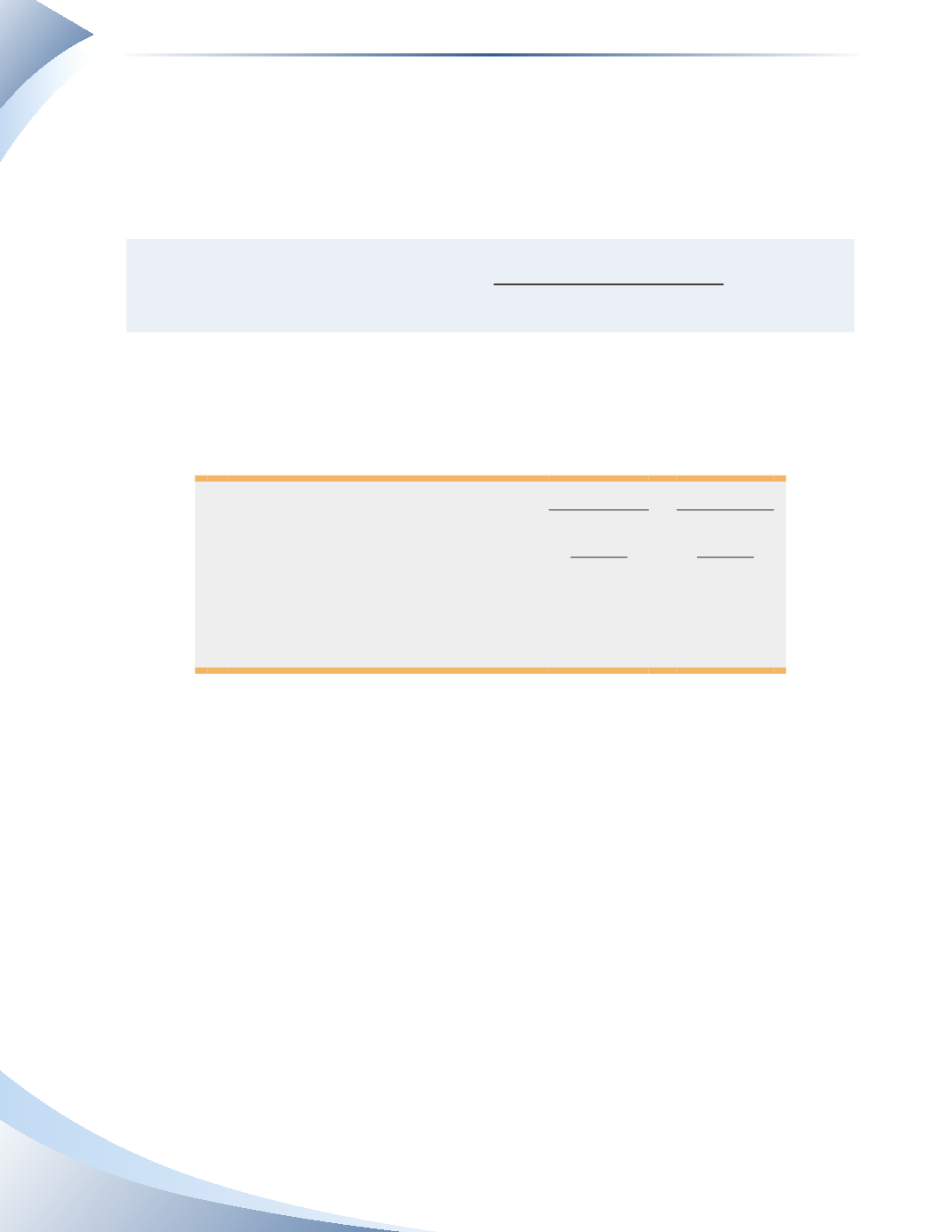

is calculated for Second Cup in Figure 12.21.

2014

2013

Days in a Year

365 days

365 days

Inventory Turnover Ratio

44.6

31.2

Days Inventory on Hand

8.2

11.7

Industry Average

14.1

15.8

_______________

Figure 12.21

The lower the result, the faster inventory is sold on average. This means that on average it took

just over a week for Second Cup to sell the inventory on hand in 2014. It likely purchased new

inventory once a week to keep its products fresh.This is a sign of good inventory management.

Leverage Analysis

There are two ways to finance a business: debt and equity. Debts are the liabilities of the business,

such as bank loans and accounts payable. Equity is generated by selling shares and generating

profits.

Leverage

relates to the amount of debt and risk the company has. Companies often take

on debt to finance the purchase of large assets. It then uses these assets to expand operations and

generate sales. However, there is usually a high cost of debt in the form of interest expense, which

is where the risk comes in.The company must be able to increase profits by more than the interest

expense to benefit the shareholders. One measure of leverage is the debt-to-equity ratio.