Appendix I

Review Exercise Solutions

417

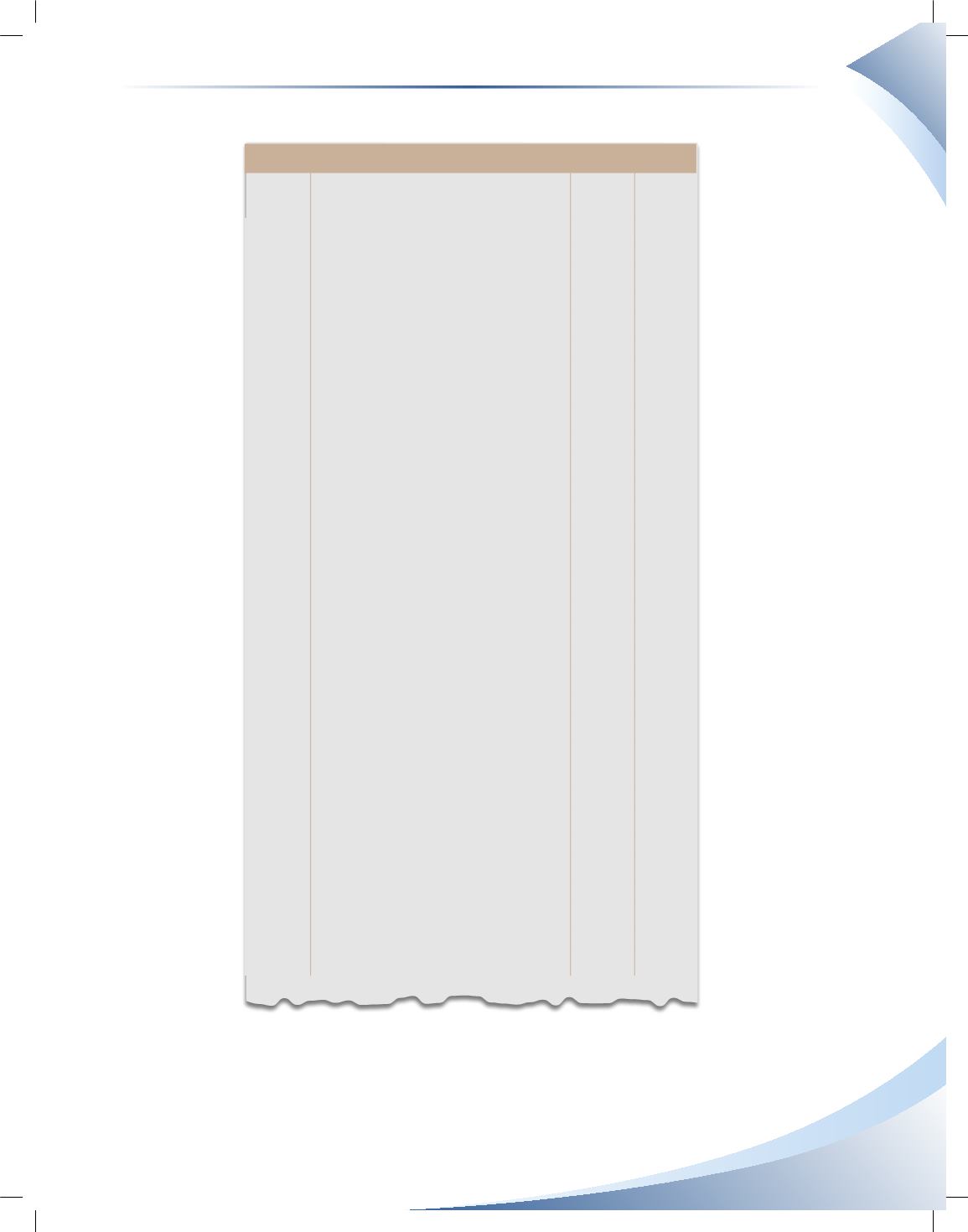

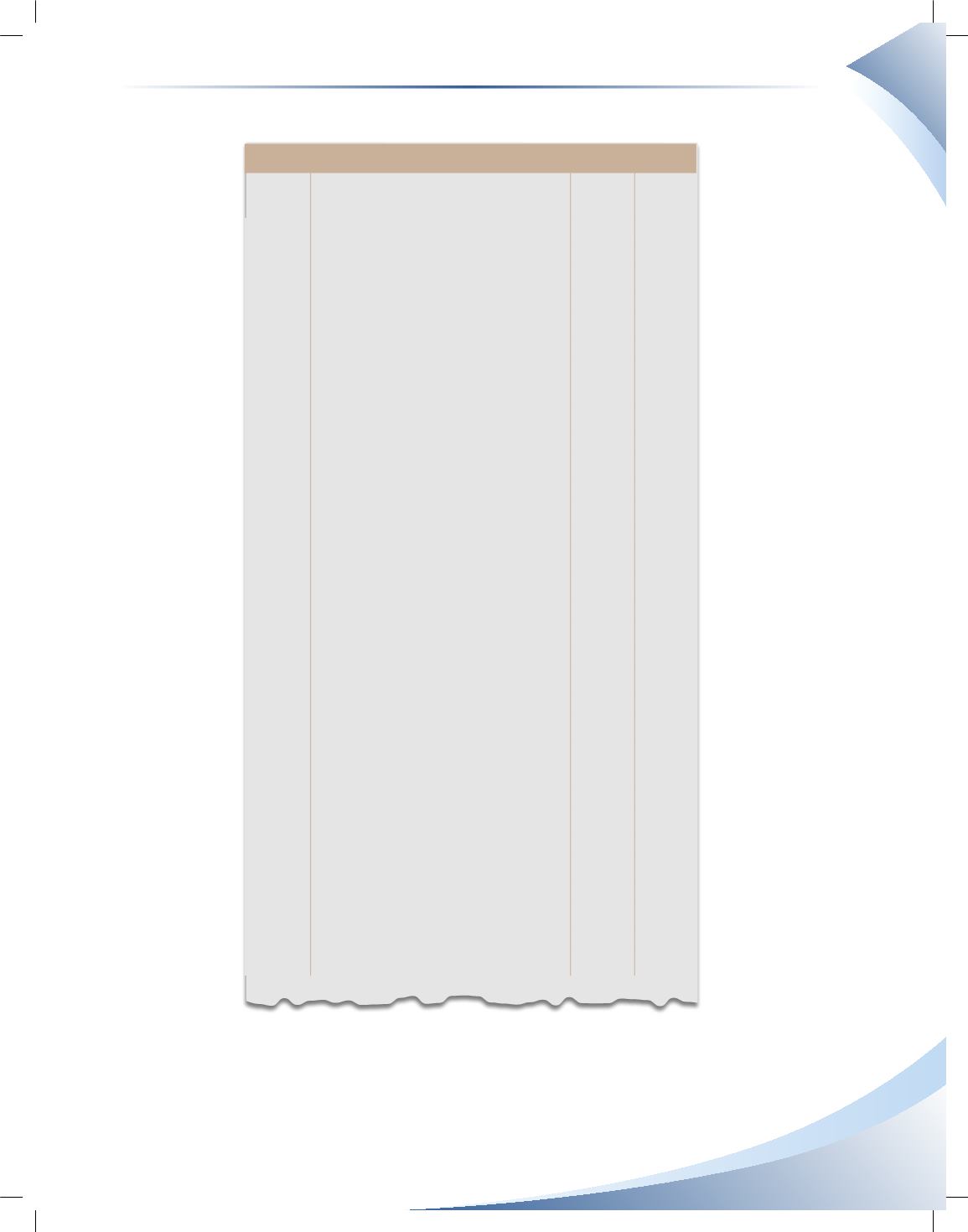

d) Journalize the closing entries using the income summary method

JOURNAL Page 1

Date

2016

Account Title and Explanation

Debit Credit

Dec 31 Sales Revenue

113,500

Interest Revenue

6,500

Inventory

33,440

Purchase Returns & Allowances

5,800

Purchase Discounts

3,200

Income Summary

162,440

Close revenue and credit accounts and

update inventory balance

Dec 31 Income Summary

122,070

Inventory

16,140

Sales Returns & Allowances

1,000

Sales Discounts

1,580

Purchases

70,000

Freight-In

1,000

Depreciation Expense

5,000

Insurance Expense

2,500

Interest Expense

2,600

Rent Expense

6,000

Salaries Expense

11,000

Supplies Expense

4,500

Utilities Expense

750

Close expense and debit accounts and

update inventory balance

Dec 31 Income Summary

40,370

Gregg, Capital

40,370

Close income summary

Dec 31 Gregg, Capital

5,000

Gregg, Drawings

5,000

Close drawings account