Appendix I

Review Exercise Solutions

418

Chapter 8 Review Exercise—Solutions

a) Using FIFO, prepare the inventory record to show the closing inventory balance

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

June 1

100

$12 $1,200

June 3

500

$15 $7,500

100

500

$12

$15

$1,200

$7,500

June 10

100

100

$12

$15

$1,200

$1,500

400

$15 $6,000

June 12

300

$18 $5,400

400

300

$15

$18

$6,000

$5,400

June 20

300

$15 $4,500

100

300

$15

$18

$1,500

$5,400

Ending Inventory

$6,900

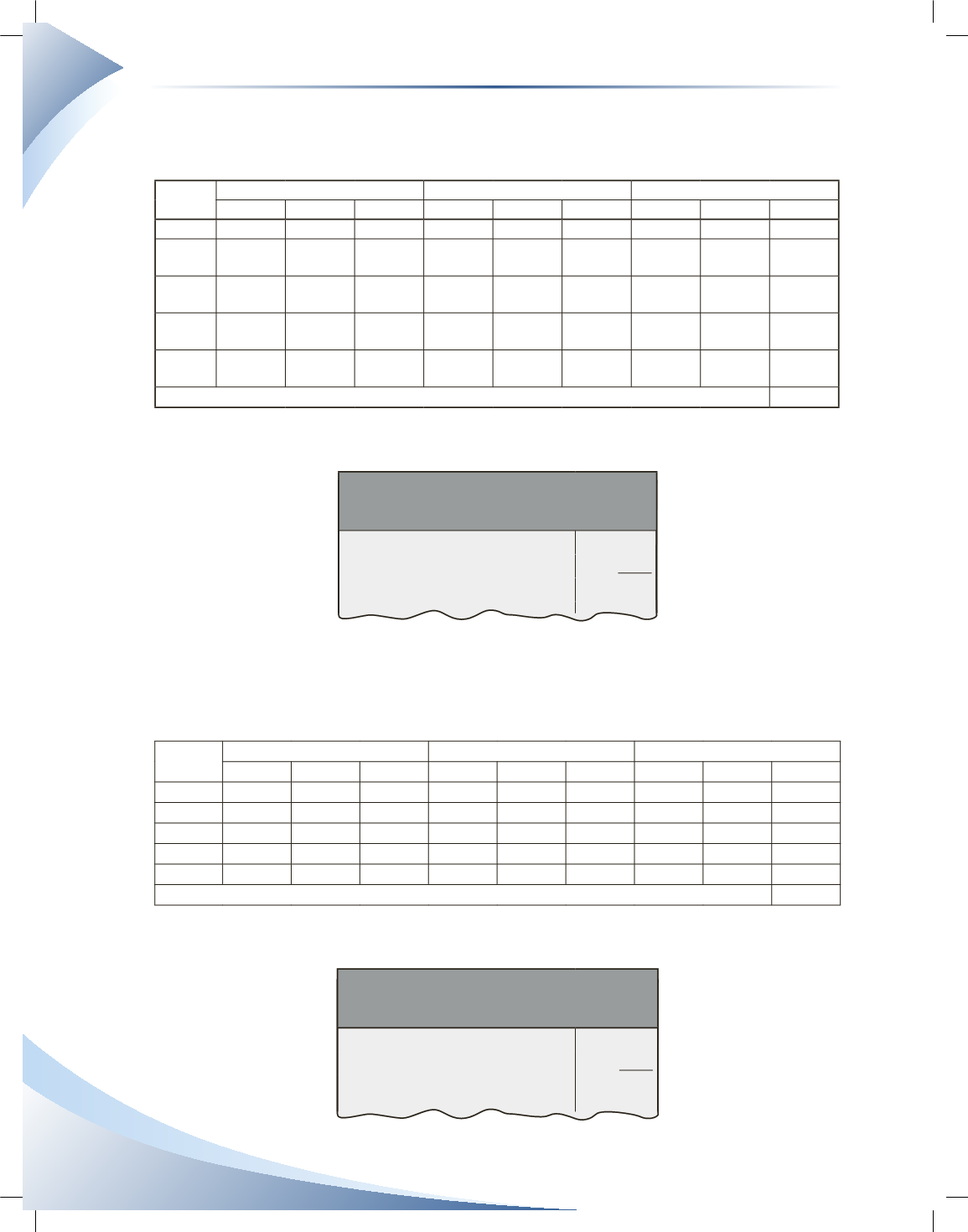

b) Multistep income statement showing sales revenue, cost of goods sold, and gross profit—using

information from part a)

Mike’s Tikes Toys

Income Statement (Excerpt)

For the Month Ended June 30, 2016

Sales Revenue*

$24,000

Cost of Goods Sold**

7,200

Gross Profit

16,800

*$24,000 = (200 × $45) + (300 × $50)

**$7,200 = $1,200 + $1,500 + $4,500

c) Using the weighted-average cost method, prepare the inventory record to show the closing

inventory balance

Date

Purchases

Sales

Balance

Quantity Unit Cost Value Quantity Unit Cost Value Quantity Unit Cost Value

June 1

100 $12.00 $1,200

June 3

500

$15 $7,500

600 $14.50 $8,700

June 10

200 $14.50 $2,900

400 $14.50 $5,800

June 12

300

$18 $5,400

700 $16.00 $11,200

June 20

300 $16.00 $4,800

400 $16.00 $6,400

Ending Inventory

$6,400

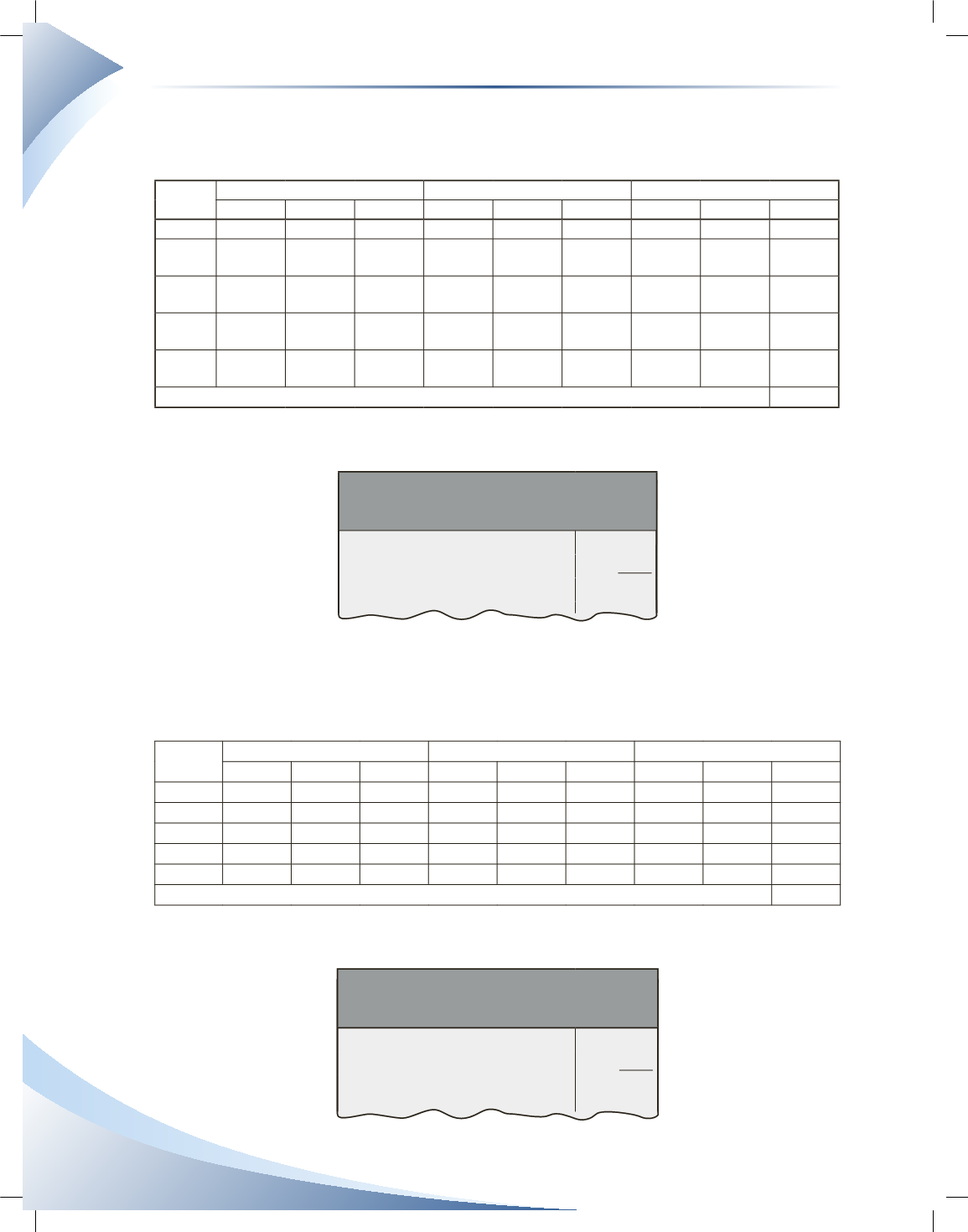

d) Multistep income statement showing sales revenue, cost of goods sold, and gross profit—using

information from part c)

Mike’s Tikes Toys

Income Statement (Excerpt)

For the Month Ended June 30, 2016

Sales Revenue

$24,000

Cost of Goods Sold*

7,700

Gross Profit

16,300

* $7,700 = $2,900 + $4,800