Appendix I

Review Exercise Solutions

408

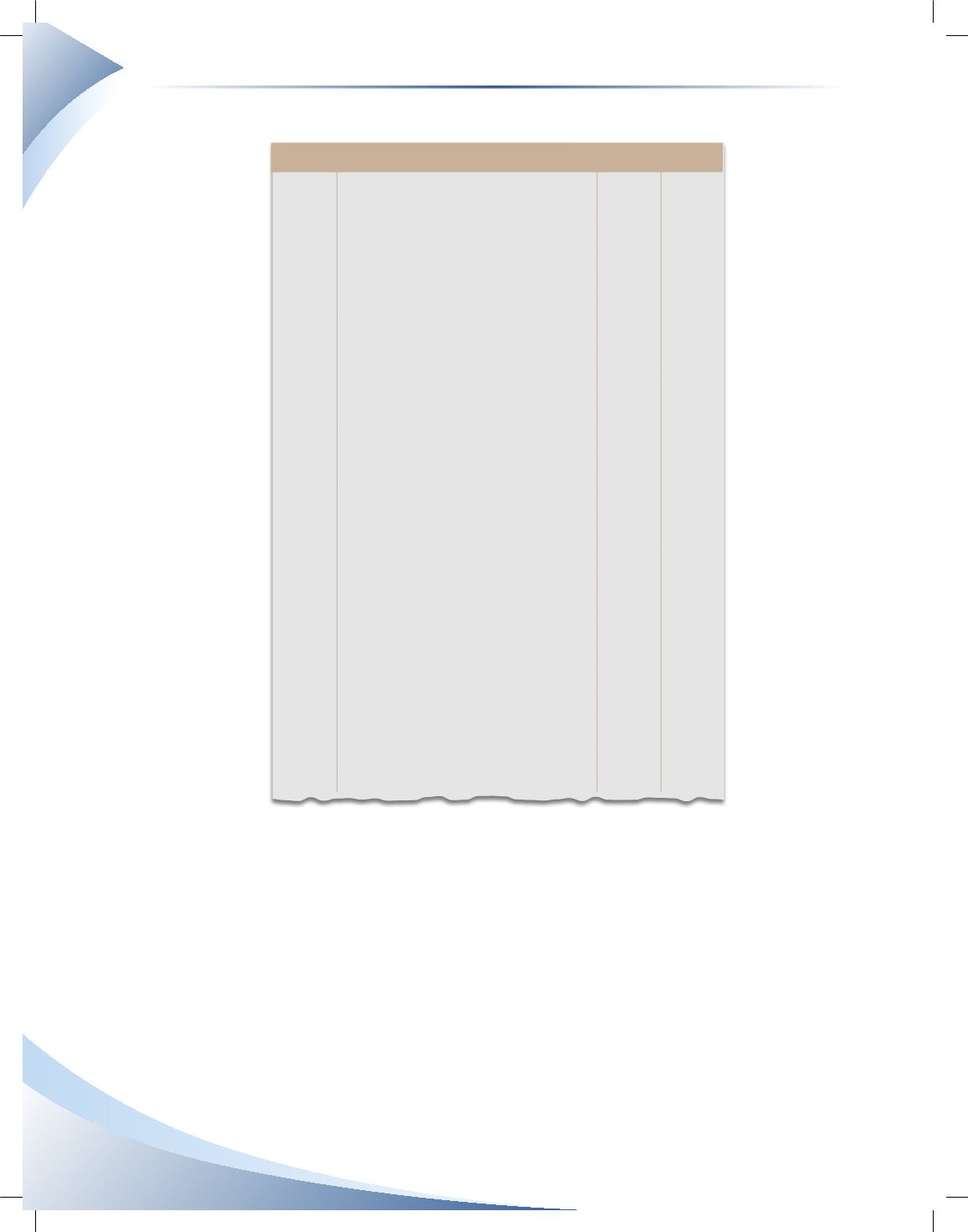

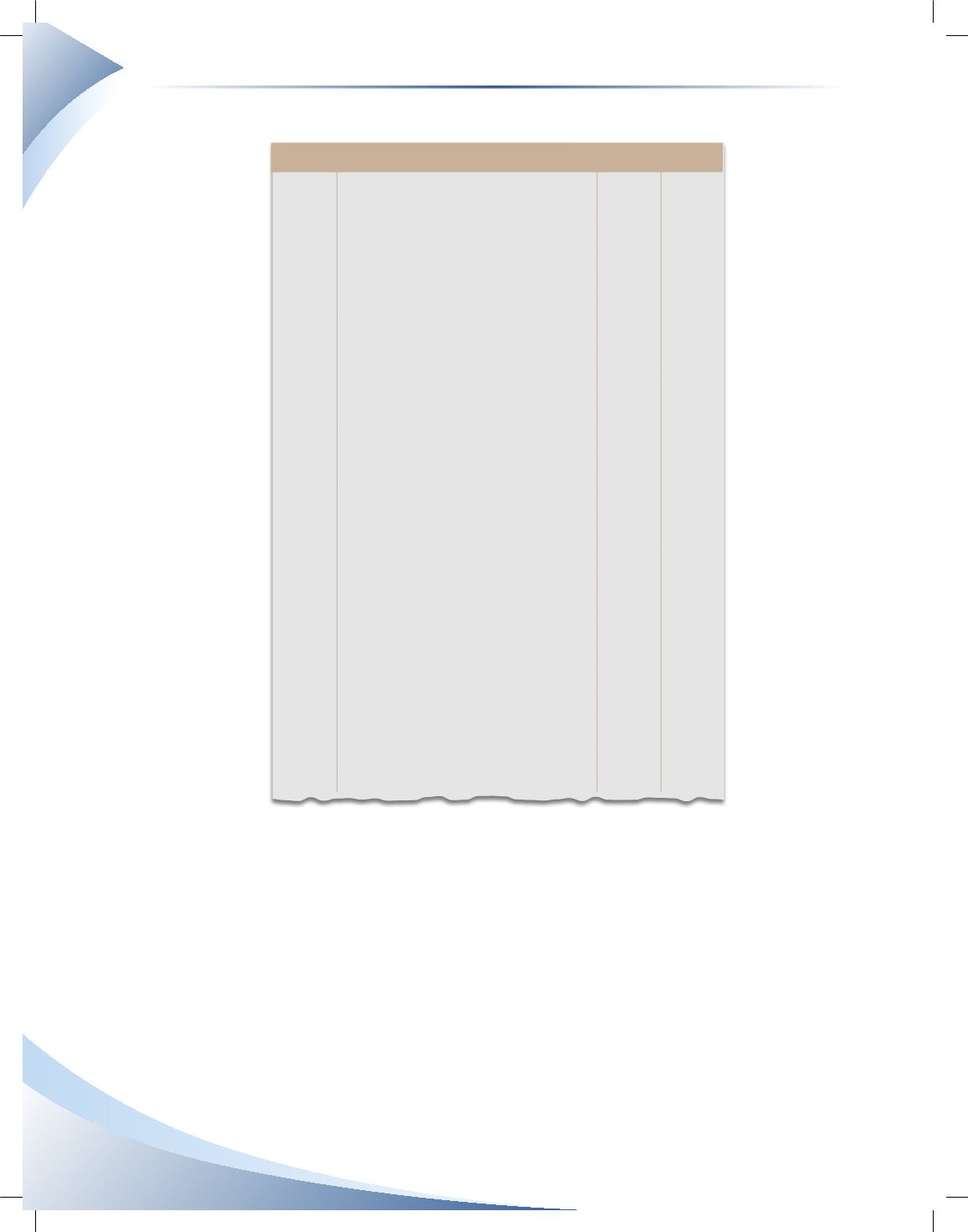

b) Journalize the December transactions. Assume the goods were shipped FOB destination.

JOURNAL Page 1

Date

2016

Account Title and Explanation

Debit Credit

Dec 3 Accounts Receivable

50,000

Sales Revenue

50,000

Sold inventory on account

Dec 3 Cost of Goods Sold

35,000

Inventory

35,000

Cost of goods sold for above sale

Dec 6 Delivery Expense

200

Cash

200

Paid freight charges

Dec 8 Sales Returns and Allowances

2,000

Accounts Receivable

2,000

Customer returned incorrect merchandise

Dec 8 Inventory

700

Cost of Goods Sold

700

Inventory returned to stock

Dec 11 Cash

48,000

Sales Discounts

960

Accounts Receivable

47,040

Received payment from customer