Appendix I

Review Exercise Solutions

411

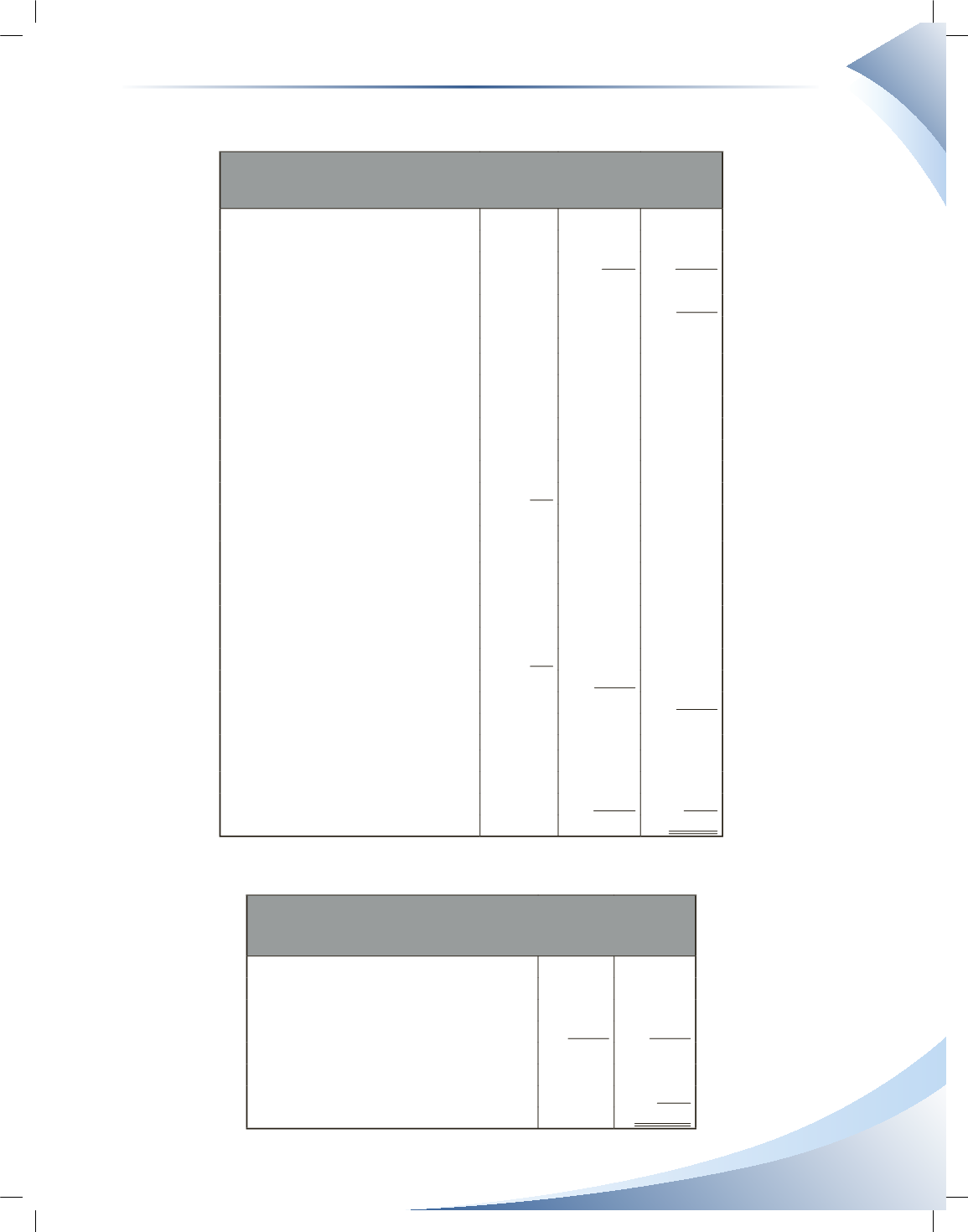

c) Prepare a classified multistep income statement

George’s Gardening Supplies

Income Statement

For the Year Ended December 31, 2016

Sales Revenue

$113,500

Less: Sales Returns and Allowances

$1,000

Sales Discounts

1,580

(2,580)

Net Sales

110,920

Cost of Goods Sold

44,700

Gross Profit

66,220

Operating Expenses

Selling Expenses

Depreciation Expense

$5,000

Insurance Expense

1,750

Rent Expense

4,200

Salaries Expense

7,700

Utilities Expense

525

Total Selling Expenses

19,175

Administrative Expenses

Insurance Expense

750

Rent Expense

1,800

Salaries Expense

3,300

Supplies Expense

4,500

Utilities Expense

225

Total Administrative Expenses

10,575

Total Operating Expenses

29,750

Operating Income

36,470

Other Revenue and Expenses

Interest Revenue

6,500

Interest Expense

(2,600)

3,900

Net Income

$40,370

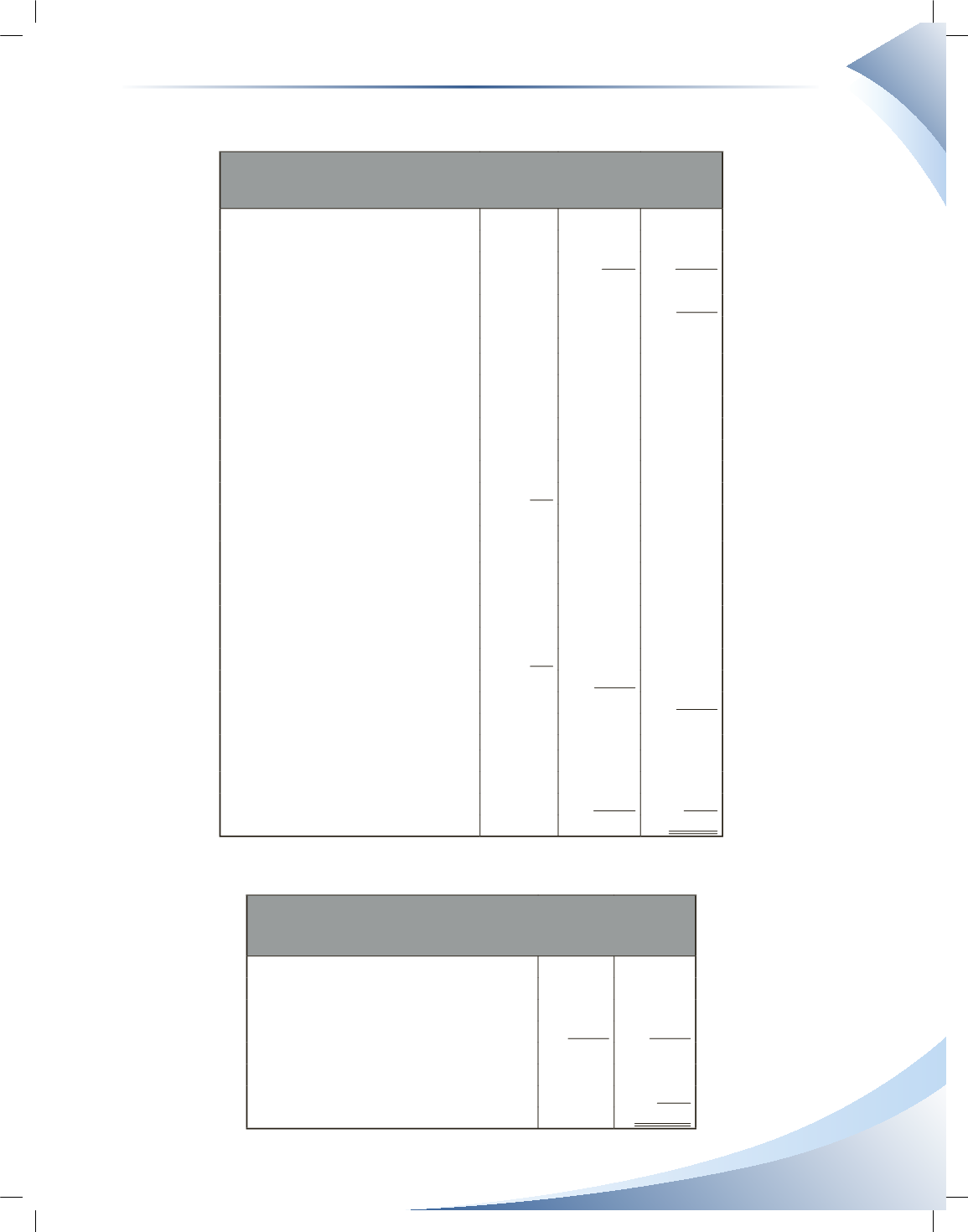

d) Statement of owner’s equity

George’s Gardening Supplies

Statement of Owner’s Equity

For the Year Ended December 31, 2016

Gregg, Capital at January 1, 2016

$80,000

Add

Additional Investment

$10,000

Net Income

40,370

50,370

Subtotal

130,370

Less

Gregg, Drawings

5,000

Gregg, Capital at December 31, 2016

$125,370