Introduction

viii

At the end of the chapter is a summary, highlighting key points for each learning outcome.

Chapter 4

The Accounting Cycle: Journals and Ledgers

97

in summary

Distinguish between debits and credits

➭

Debits are recorded on the left side of an account and credits are recorded on the right side.

For the accounting equation to be correct, the total value of the debits must equal the total

value of the credits.This will ensure that the accounting equation stays in balance.

➭

Assets, expenses, and owner’s drawings increase with debits and decrease with credits.

Liabilities, revenues, and owner’s capital increase with credits and decrease with debits.

Describe the accounting cycle

➭

The accounting cycle consists of the steps required to prepare financial statements.The cycle

repeats every period.

Explain how to analyze a transaction

➭

Analysis of transactions begins with source documents which indicate a transaction has oc-

curred.The analysis helps to determine which accounts are affected, whether they are increas-

ing or decreasing, and whether they are debited or credited.

Record transactions in the general journal

➭

A journal is a record in which transactions are recorded before they are posted. Journals are

known as books of original entry.

➭

Double-entry transactions are called journal entries. Every journal entry must have at least

one debit and one credit entry so that the total of the debits equals the total of the credits.

➭

Journal entries are dated and are listed in chronological order. Accounts which are debited in

a journal entry are listed first, followed by the accounts which are credited (indented). A short

explanation is included for every journal entry.

Post journal entries to the general ledger

➭

The general ledger is a book used to record all the accounts and balances of the business.

These accounts represent the complete financial position of the business.They also make up

the accounting data from which all reports are generated.

➭

The listing of all the accounts being used by a business is called a chart of accounts.

➭

The general ledger is similar to a collection of T-accounts. The debits and credits of each

account are shown along with the current balance of the account.

Prepare a trial balance

➭

The trial balance lists all accounts in the general ledger and their balances. If the total debits

equals total credits, then the trial balance is balanced.

➭

If the trial balance is not balanced, an error has occurred and must be fixed before continuing

with the accounting cycle.

Access

ameengage.com

for integrated resources including tutorials, practice exercises, the digital textbook

and more.

Each chapter has a Review Exercise overing the major topics of the chapter.The Review Exercises

are prepared so students can complete them and then compare their answers to the solutions.

Solutions to the Review Exercises are in Appendix I of the textbook.

Chapter 4

The Accounting Cycle: Journals and Ledgers

review exercise

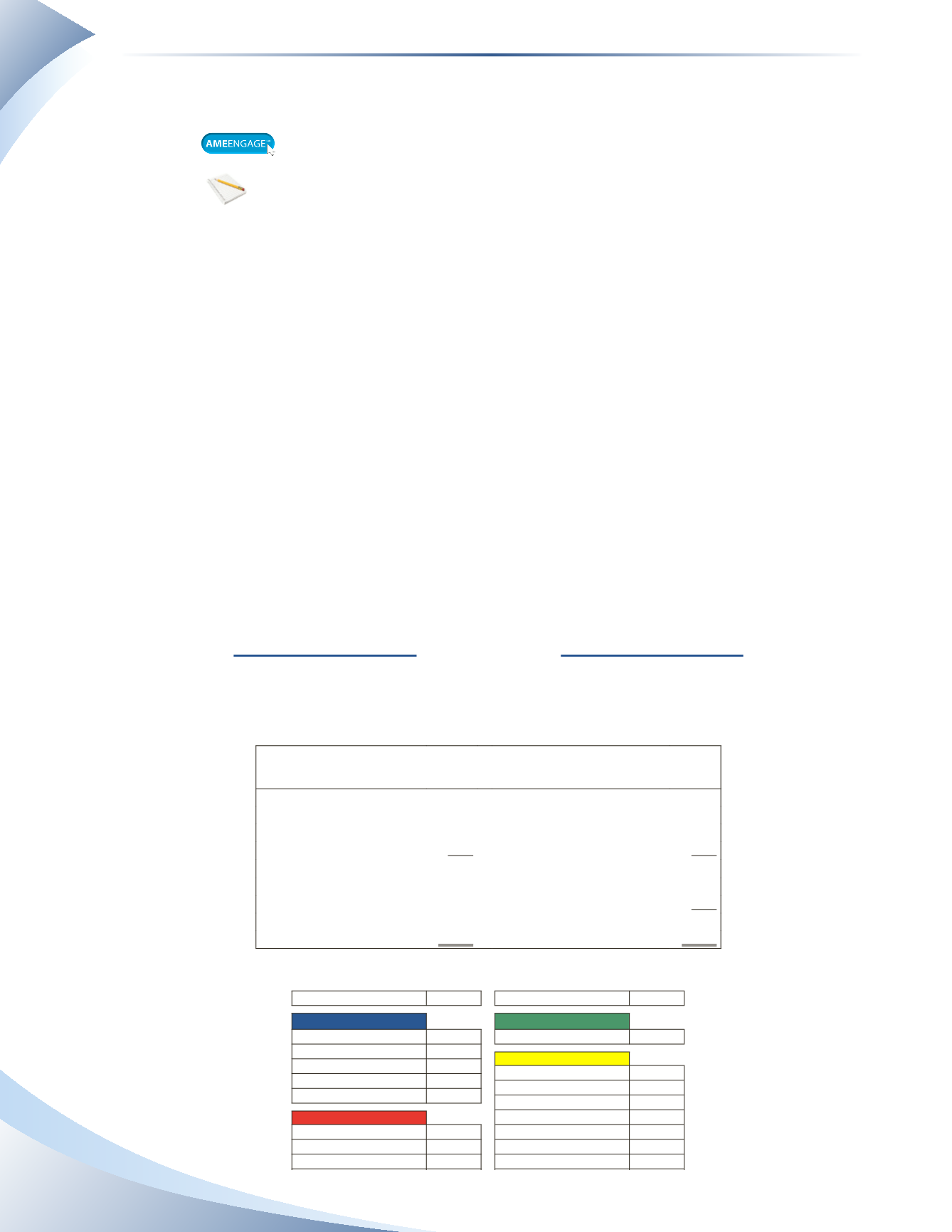

Catherine Gordon is running her own proprietary business called CGAccounting.CGAccounting

provides bookkeeping services to small and mid-sized companies.The company prepares financial

statements on a monthly basis and had the following closing balances at the end of May 2016.

Cg Accounting

Balance sheet

As at may 31, 2016

Assets

liabilities

Cash

$4,200 Accounts Payable

$2,300

Accounts receivable

3,100 unearned revenue

600

equipment

6,000 Bank Loan

4,000

Total Liabilities

6,900

owner's equity

gordon, Capital

6,400

Total liabilities & owner's equity

$13,300

Total Assets

$13,300

CG Accounting uses a variety of accounts and account numbers in its accounting records.

Account description

Account #

AsseTs

Cash

101

Accounts receivable

105

Prepaid Insurance

110

equipment

120

Accumulated Depreciation

125

liABiliTies

Accounts Payable

200

Interest Payable

205

unearned revenue

210

Bank Loan

215

oWner’s eQuiTy

gordon, Capital

300

Account description

Account #

reVenue

Service revenue

400

eXPenses

Advertising expense

500

Bad Debt expense

505

Depreciation expense

510

Insurance expense

515

Interest expense

520

Maintenance expense

525

Office Supplies expense

530

Professional Fees expense

535

rent expense

540

Salaries expense

545

Telephone expense

550