Chapter 6

The Accounting Cycle: Statements and Closing Entries

160

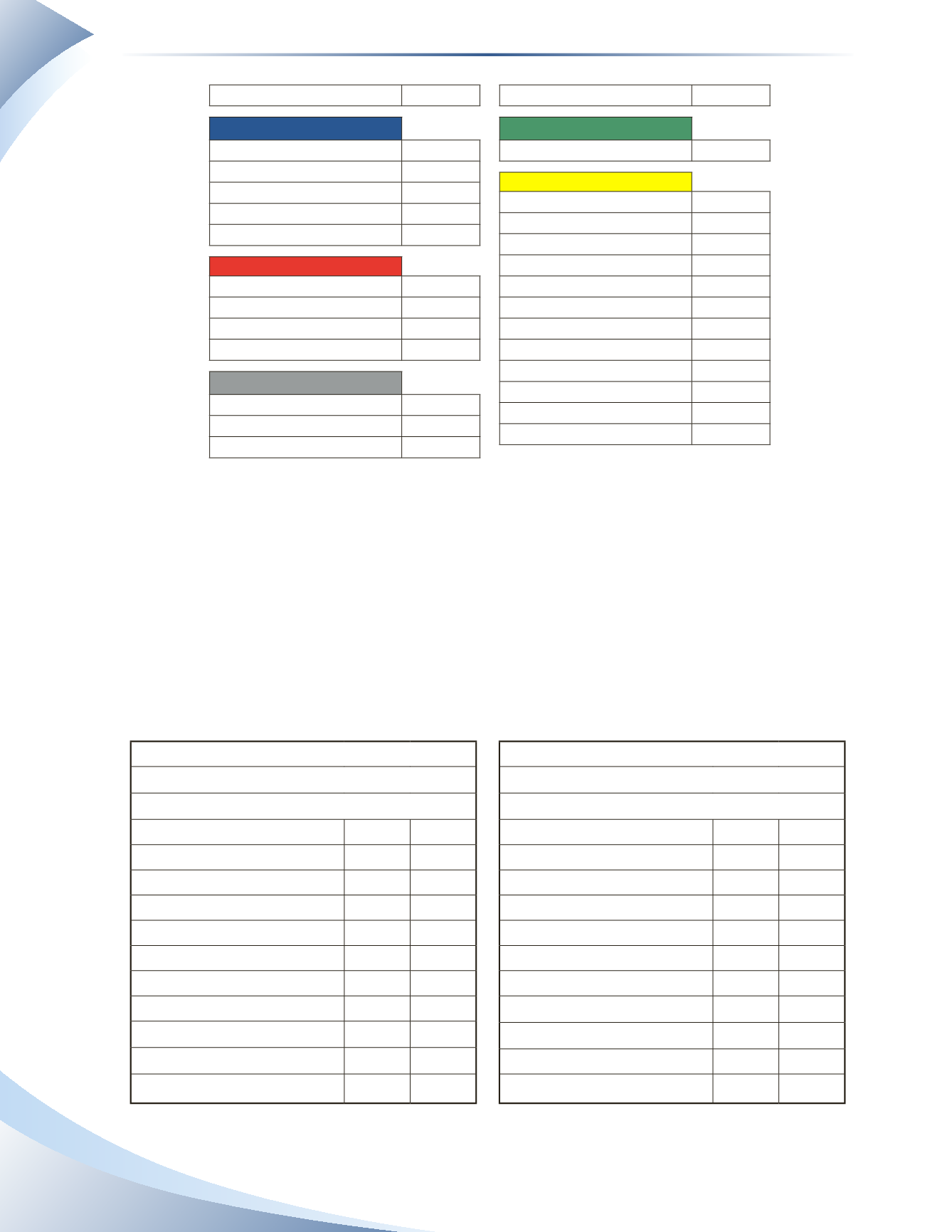

Account Description

Account #

ASSETS

Cash

101

Accounts Receivable

105

Prepaid Insurance

110

Equipment

120

Accumulated Depreciation

125

LIABILITIES

Accounts Payable

200

Interest Payable

205

Unearned Revenue

210

Bank Loan

215

OWNER’S EQUITY

Gordon, Capital

300

Gordon, Drawings

310

Income Summary

315

Account Description

Account #

REVENUE

Service Revenue

400

EXPENSES

Advertising Expense

500

Bad Debt Expense

505

Depreciation Expense

510

Insurance Expense

515

Interest Expense

520

Maintenance Expense

525

Office Supplies Expense

530

Professional Fees Expense

535

Rent Expense

540

Salaries Expense

545

Telephone Expense

550

Travel Expense

555

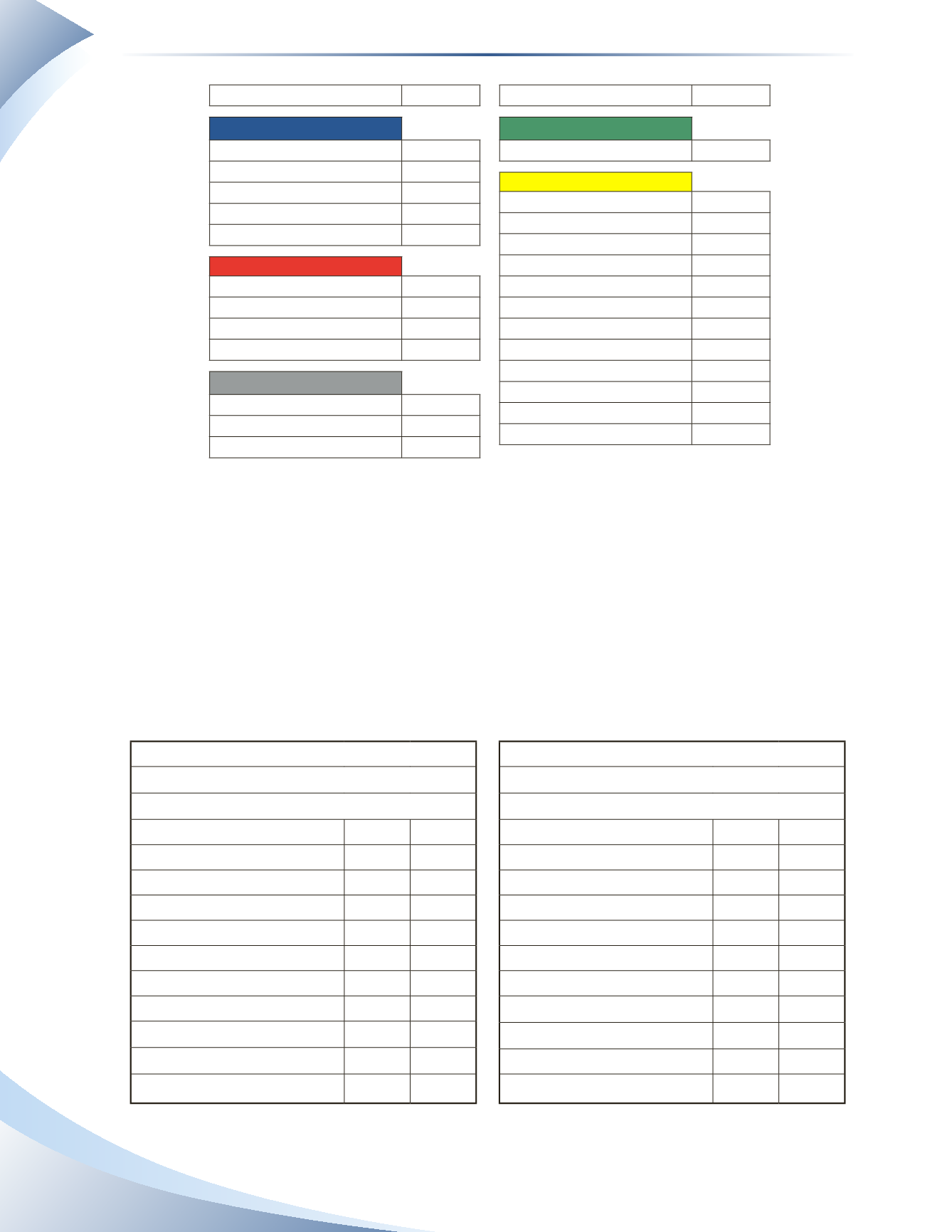

Required

a) Prepare the income statement, statement of owner’s equity and the classified balance sheet.

b) Complete the closing entries using the income summary account and post them to the general

ledger.

c) Prepare the post-closing trial balance.

See Appendix I for solutions.

a) Prepare the income statement, statement of owner’s equity and the classified balance sheet.