Chapter 6

The Accounting Cycle: Statements and Closing Entries

151

Property, plant and equipment are long-term physical assets used to help run the business. This

category contains several types of long-term assets such as land, building, equipment and furniture.

Each of these items must be presented

separately along with any accumulated

depreciation to show its net book value.

Long-term investments are investments

by the business by buying debt (e.g. bonds)

or equity (e.g. shares) of another company.

These are assets because the business owns

the investment and expects to receive

benefits from owning them. Benefits are

usually cash receipts of interest or divi-

dends.

Intangible assets are long-term assets that

lack a physical body. They provide legal

rights and include items such as patents,

trademarks or copyrights. Some intan-

gible assets such as patents have their cost allocated across their useful life, similar to how depre-

ciation is accounted for property, plant and equipment.These intangibles must show their net book

value. Different types of intangible assets may require different methods of recording depreciation

or reductions in their value.

Goodwill is a special type of intangible asset. It only arises when a business buys another company

and pays more than the fair value of the company’s net assets.

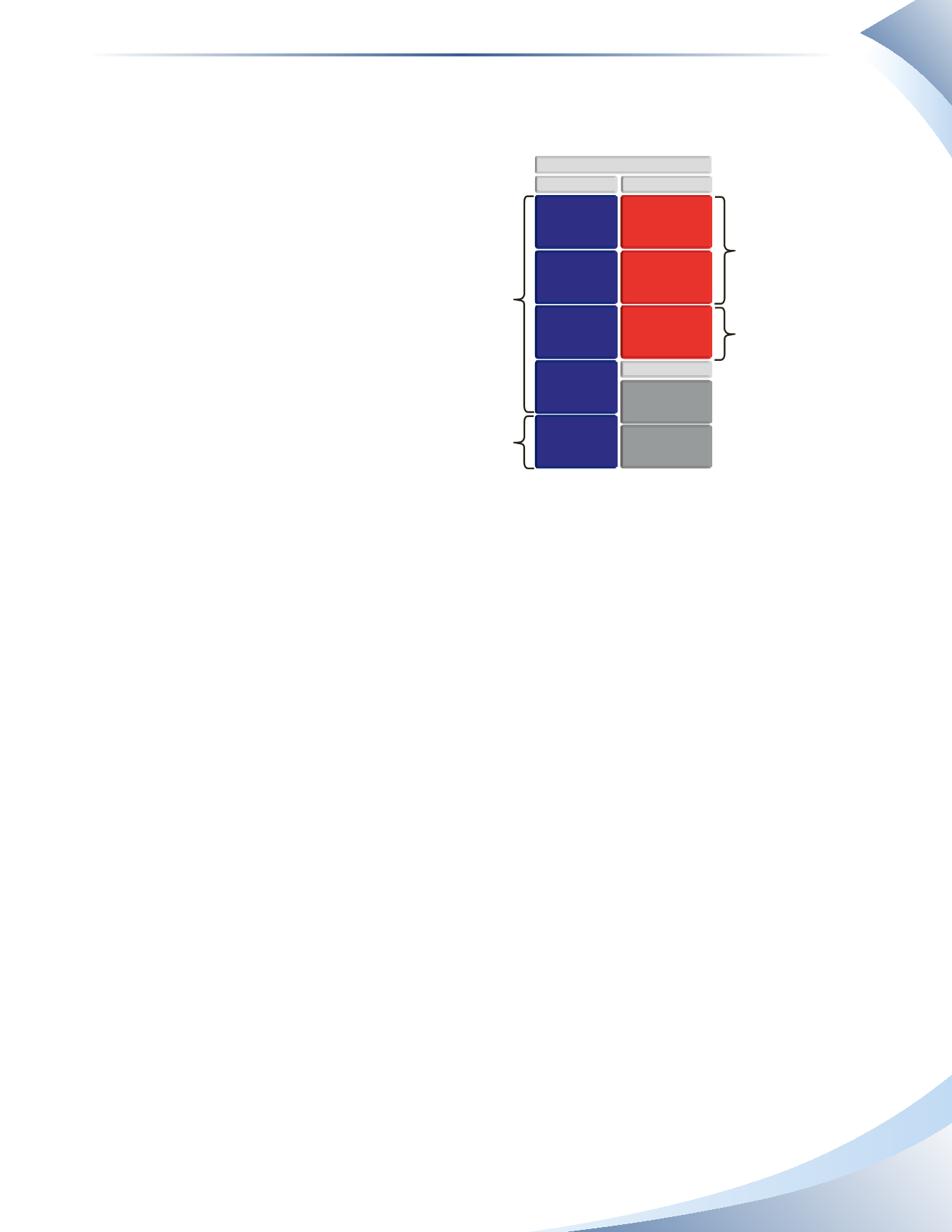

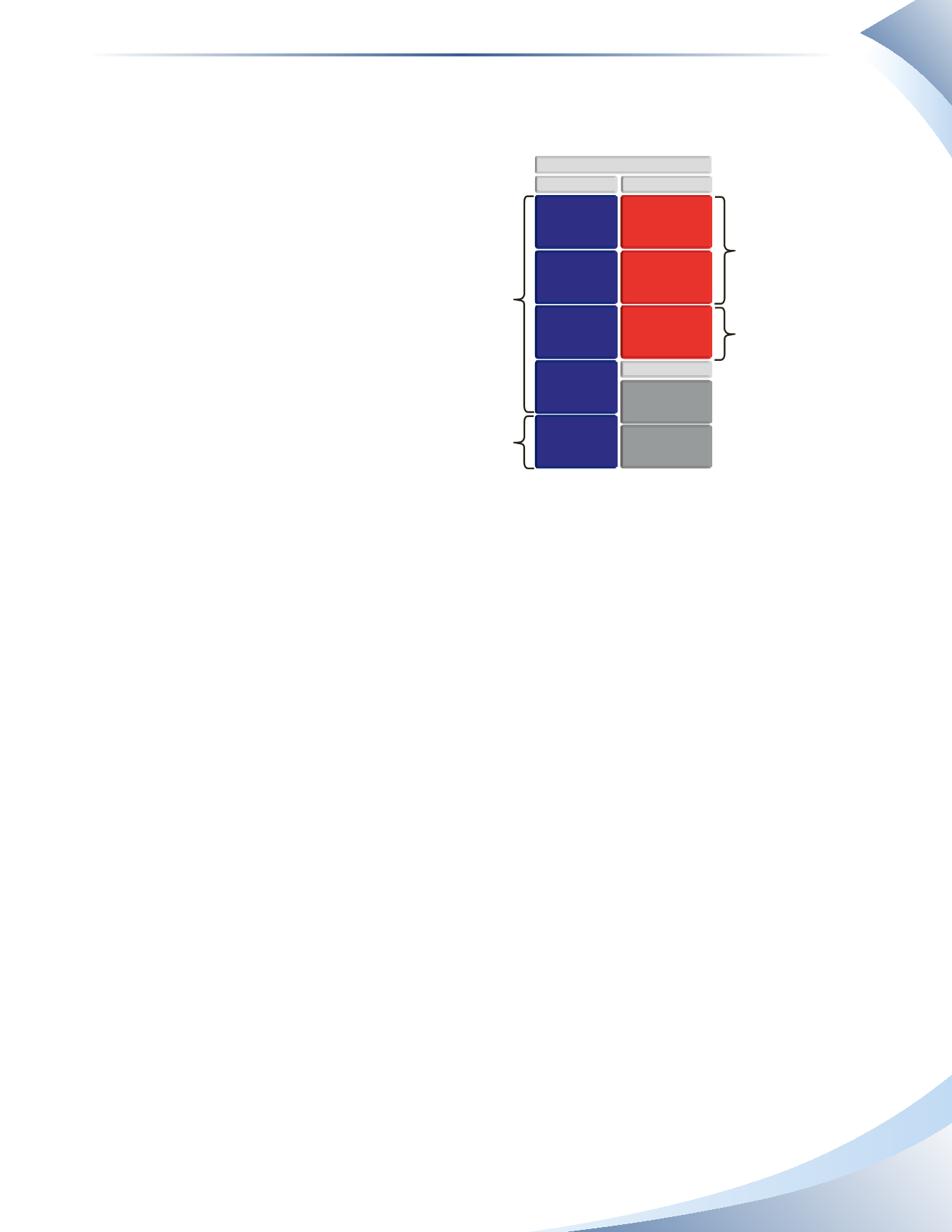

Current Liabilities vs. Long-Term Liabilities

Liabilities are divided into two categories

1.

Current liabilities

are amounts due to be paid within the next 12 months. Examples of current

liabilities include accounts payable, interest payable and unearned revenue. (assuming the

related revenue will be earned within the next 12 months).

2.

Long-term liabilities

are amounts due to be paid after 12 months. Examples of long-term

liabilities include bank loans and mortgages.

Long-term liabilities usually have a portion that is considered current. That is, a portion must

be repaid within the next 12 months. To properly plan for cash payments in the upcoming year,

accountants will separate the current portion from the long-term portion on the classified balance

sheet.

For example, if a company had a $50,000 bank loan that was supposed to be paid off in five equal

installments, $10,000 ($50,000 ÷ 5 years) would be considered current and the rest ($40,000)

ASSETS

BALANCE SHEET

LIABILITIES

CASH

OFFICE

SUPPLIES

PREPAID

EXPENSES

PROPERTY, PLANT &

EQUIPMENT

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

ACCOUNTS

RECEIVABLE

BANK LOAN

OWNER’S EQUITY

OWNER’S CAPITAL

OWNER’S DRAWINGS

Current assets

Current liabilities

Long-term assets

Long-term liabilities

________________

figure 6.21