Chapter 6

The Accounting Cycle: Statements and Closing Entries

159

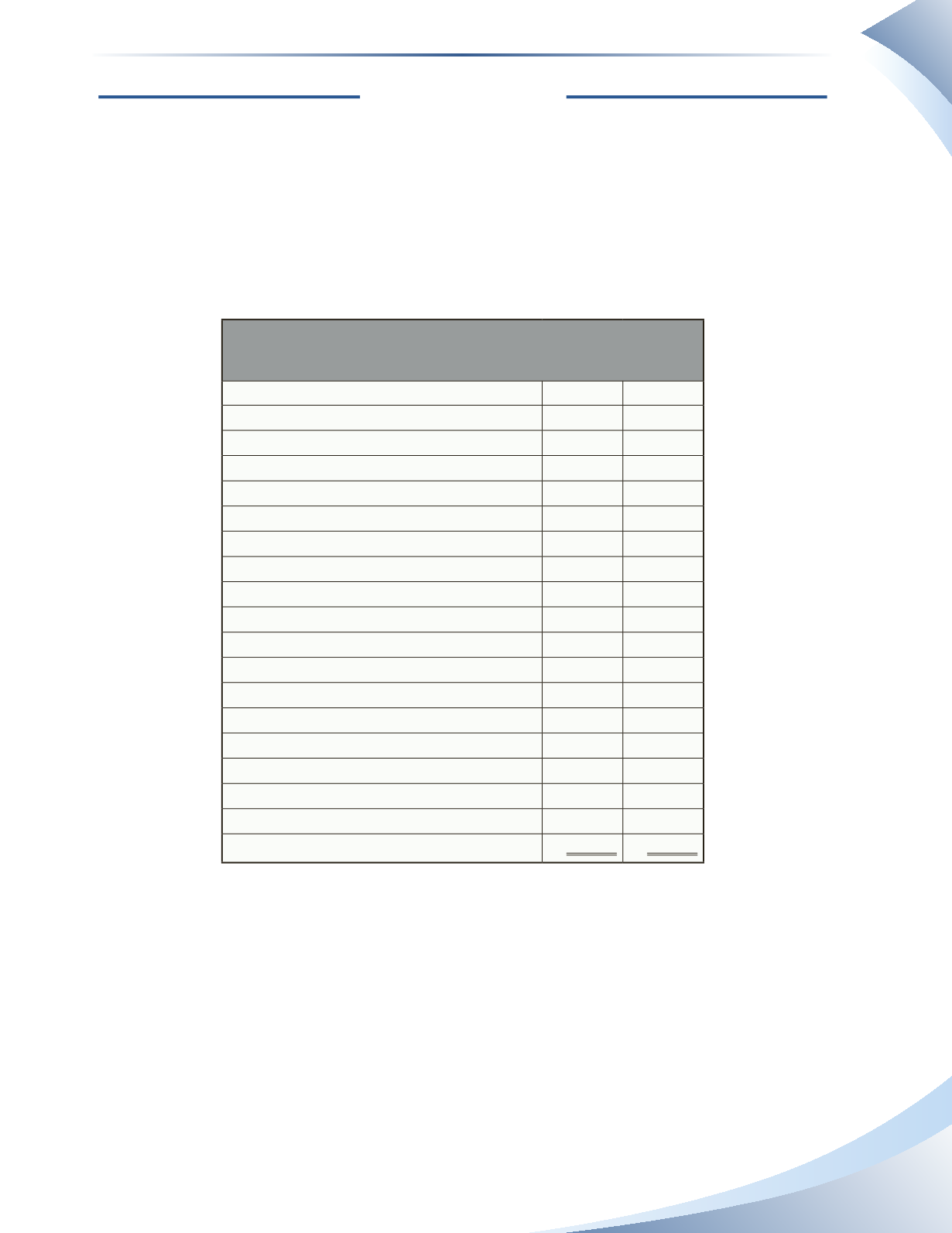

Review Exercise

Catherine Gordon is running her own proprietary business called CG Accounting. CG

Accounting provides bookkeeping services to small and mid-sized companies.The company

was introduced in the review exercises from chapter 4 and 5. Before you begin this exercise,

familiarize yourself with the review exercise in chapter 5 because this is a continuation.

Journal entries for the month have already been completed, as have the adjustments at month

end.The adjusted trial balance is presented below.

CG Accounting

Trial Balance

June 30, 2016

Account Titles

DR

CR

Cash

$5,550

Accounts Receivable

5,500

Prepaid Insurance

1,100

Equipment

6,000

Accumulated Depreciation

$100

Accounts Payable

2,750

Interest Payable

25

Unearned Revenue

450

Bank Loan

3,050

Gordon, Capital

9,400

Gordon, Drawings

1,000

Service Revenue

4,950

Advertising Expense

450

Depreciation Expense

100

Insurance Expense

100

Interest Expense

25

Rent Expense

900

Total

$20,725 $20,725

The balance of owner’s equity as at May 31, 2016 was $6,400. Also recall from the chapter 4

review exercise that during June the owner contributed $3,000 cash to the business and withdrew

$1,000 cash for personal use. Assume that $800 of the bank loan must be paid by June 30, 2017.

CG Accounting uses the following accounts and accounting numbers in its accounting records.