Chapter 6

The Accounting Cycle: Statements and Closing Entries

152

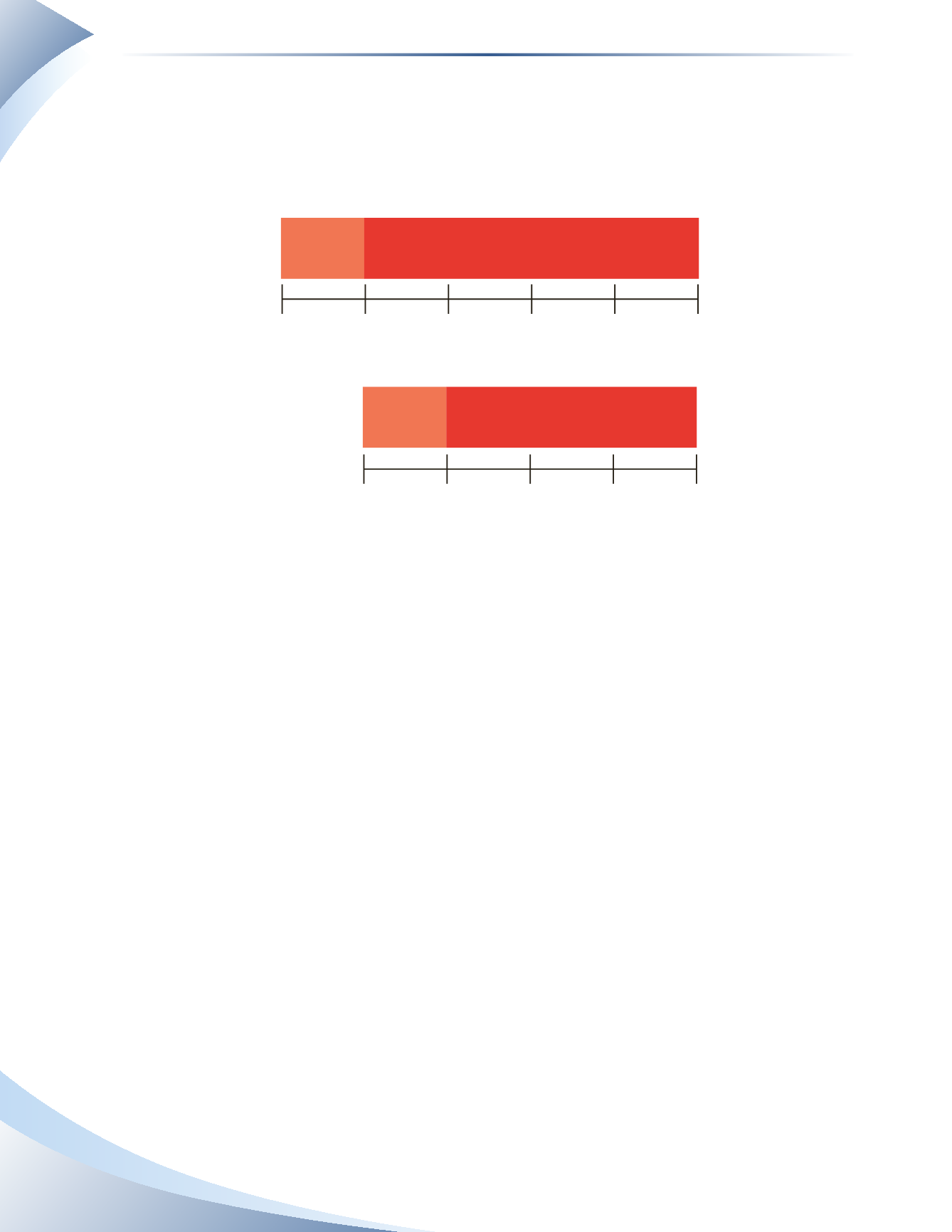

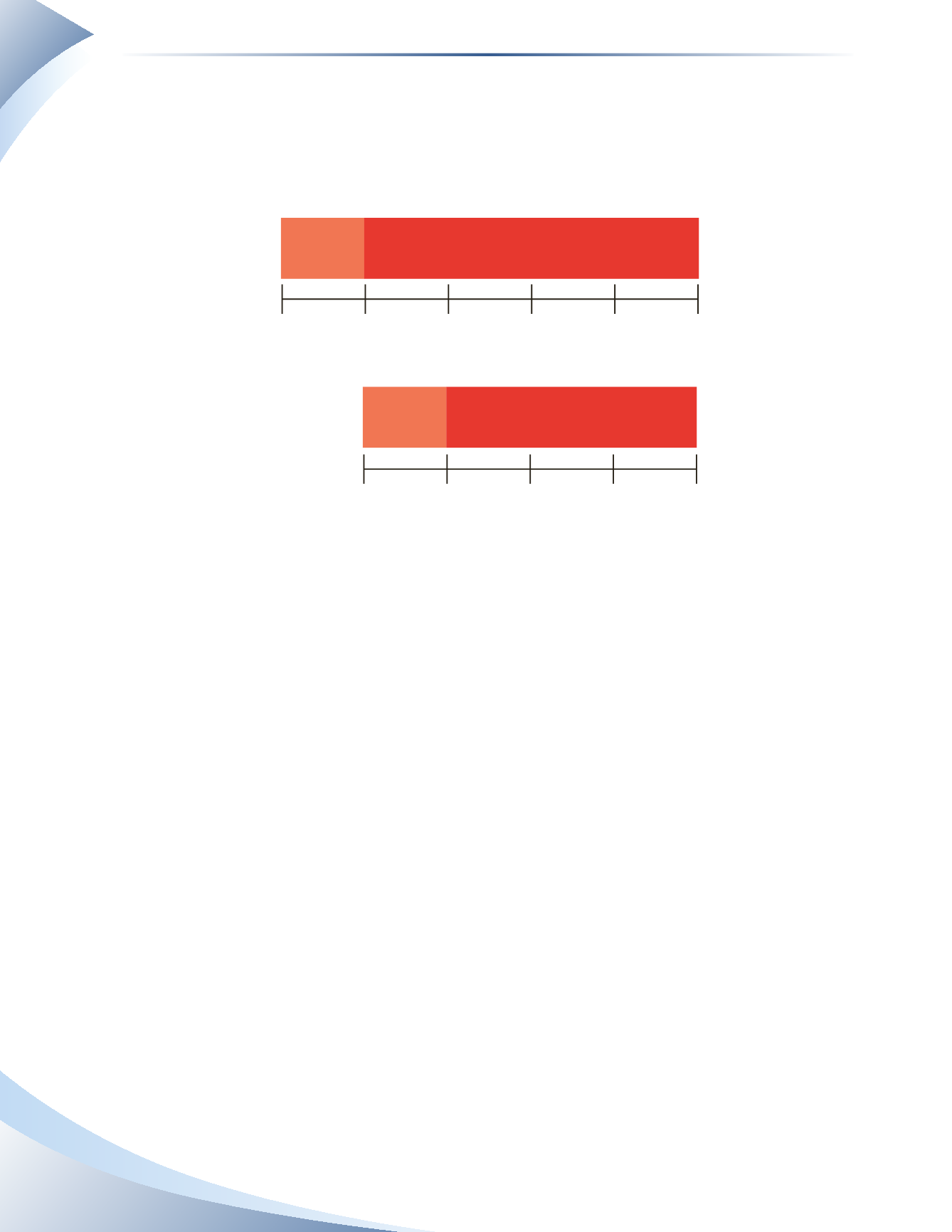

would be considered long-term. In other words, $10,000 is due within one year and $40,000 is

due after one year.This separation of current debt from long-term debt is done on the date of the

balance sheet. Each year, the amount of long-term debt would decrease because a portion is classi-

fied as current debt.This is illustrated in Figure 6.22.

$10,000

Current

$10,000

Current

Dec 31

2015

Dec 31

2016

Dec 31

2017

Dec 31

2018

Dec 31

2019

Dec 31

2020

Dec 31

2016

Dec 31

2017

Dec 31

2018

Dec 31

2019

Dec 31

2020

$40,000

Long-term

$30,000

Long-Term

Balance Sheet as at December 31, 2015

Balance Sheet as at December 31, 2016

$10,000

Current

$10,000

Current

Dec 31

2015

Dec 31

2016

Dec 31

2017

Dec 31

2018

Dec 31

2019

Dec 31

2020

Dec 31

2016

Dec 31

2017

Dec 31

2018

Dec 31

2019

Dec 31

2020

$40,000

Long-term

$30,000

Long-Term

Balance Sheet as at December 31, 2015

Balance Sheet as at December 31, 2016

________________

Figure 6.22

What is the reason for splitting the balance sheet assets and liabilities between current and long-

term items? Readers of the financial statements are interested in the ability of the business to pay

the upcoming debt, and where they will get the money to do so. Current liabilities indicate the

upcoming debt and current assets indicate where the money will come from.The classified balance

sheet also indicates how much the company has invested in itself by means of long-term assets.The

amount of long-term liabilities and equity also provide a snapshot of how the company finances

its operations.

Now that we have defined current and long-term assets, as well as current and long-term liabilities,

we can demonstrate the difference between the balance sheet that we have been using so far and a

classified balance sheet.

The classified balance sheet for a sample company is illustrated in Figure 6.23. It illustrates the

categories used to classify the various assets and liabilities of the business.The order of presentation

for the current assets is shown as most liquid (cash) to least liquid (prepaid insurance) followed by

various long-term assets in order of liquidity. Liabilities are also shown in order of when they are

due, with the debts due earlier listed first.

Both ASPE and IFRS do not prescribe the listing order of items on the balance sheet. Most

companies that adopt ASPE list the items from most liquid to least liquid, as stated above. Inter-

estingly, most companies that adopt IFRS, particularly European companies, take an opposite

approach by listing least liquid assets first. On the other side of the balance sheet, those companies

also tend to present equity first, followed by long-term liabilities and current liabilities.