Chapter 6

The Accounting Cycle: Statements and Closing Entries

154

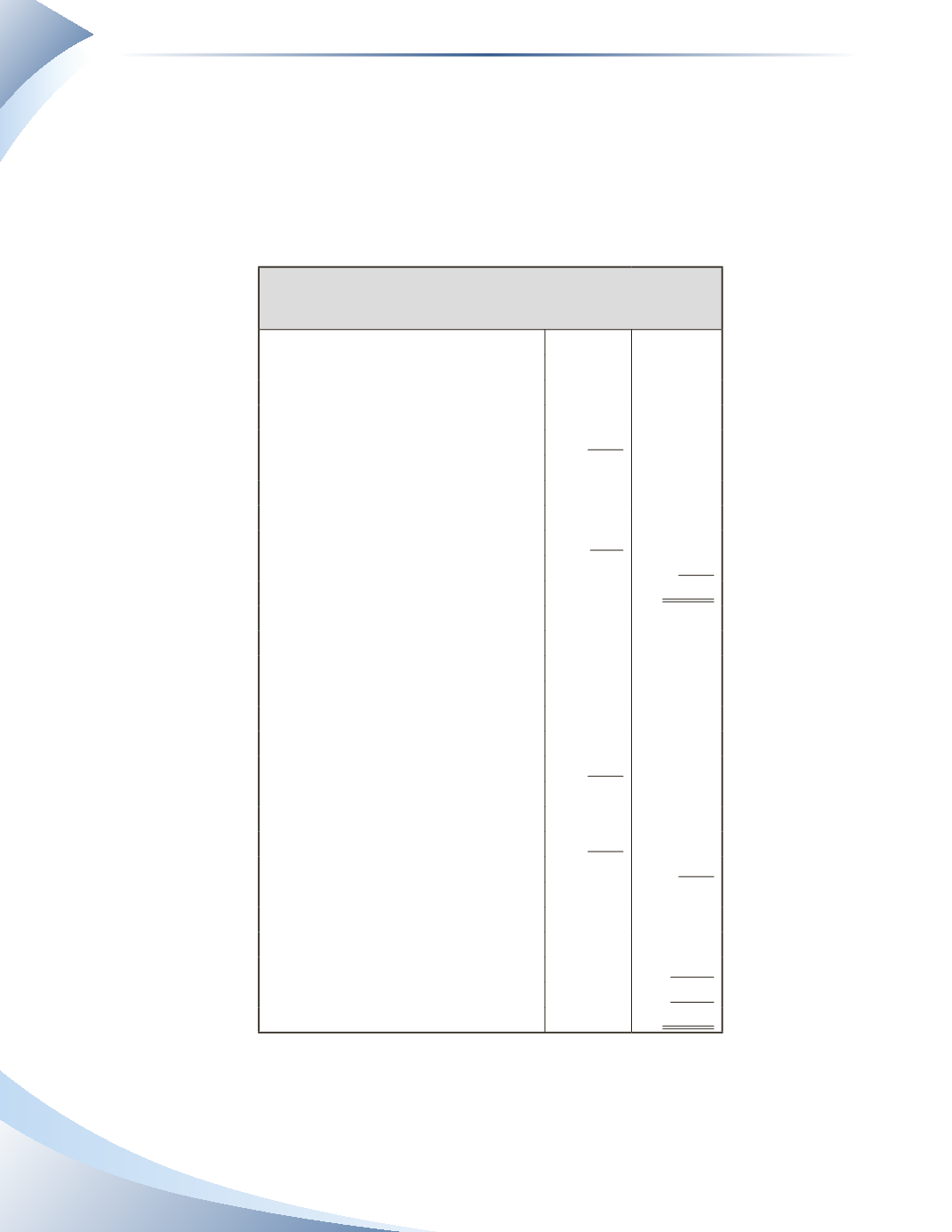

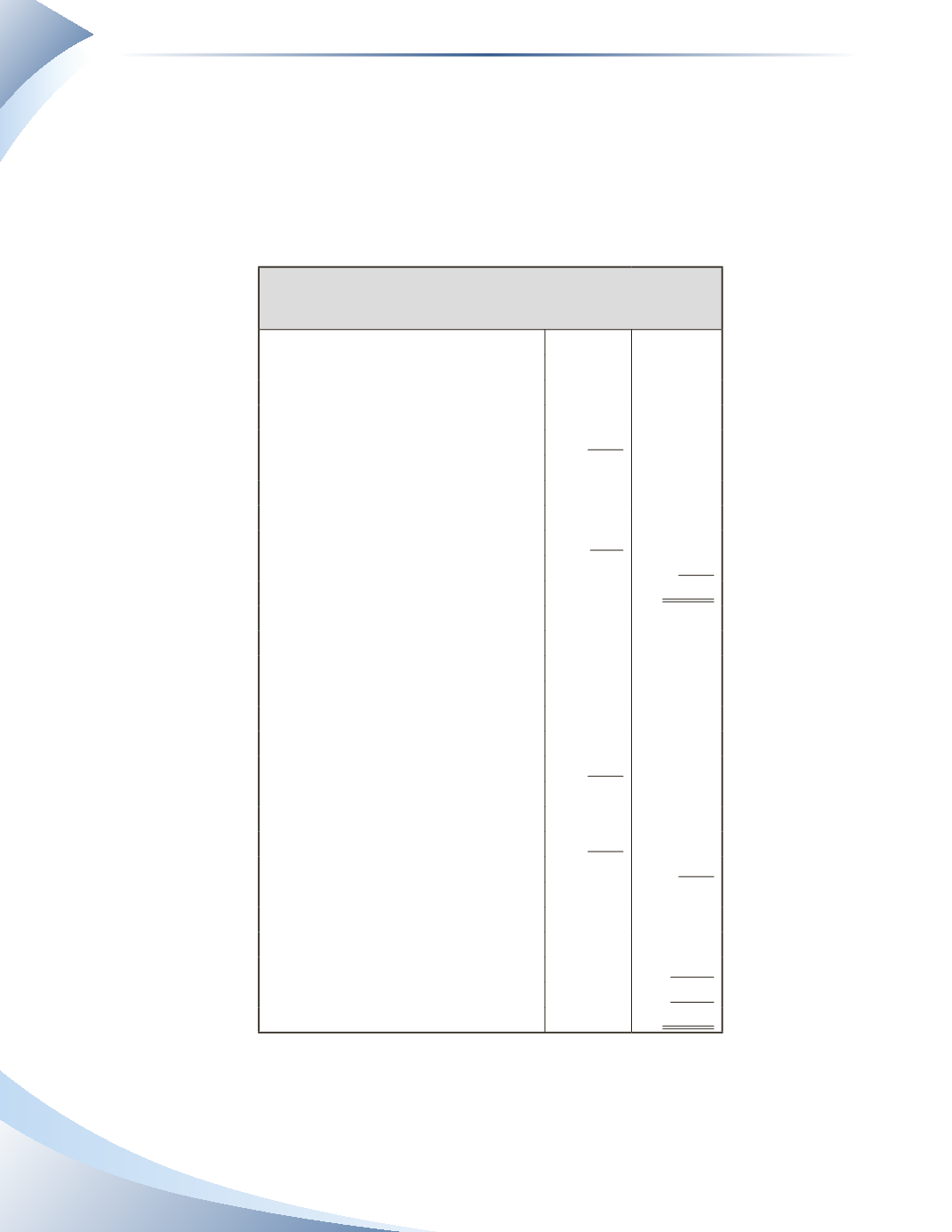

Let us see how the sample company used in this chapter would prepare the classified balance sheet.

The balance sheet for MP Consulting was shown in Figure 6.6. It was not a classified balance sheet,

so all assets and liabilities were grouped as one. The company has a $2,500 bank loan, of which

$1,000 will be paid off by January 31, 2017 (one year from the balance sheet date).

The classified balance sheet is shown in Figure 6.24. Notice that $1,000 of the bank loan is classi-

fied as current because it will be paid within the next one-year period.

MP Consulting

Classified Balance Sheet

As at January 31, 2016

Assets

Current Assets

Cash

$3,800

Accounts Receivable

4,000

Prepaid Insurance

1,100

Total Current Assets

$8,900

Property, Plant and Equipment

Equipment

8,300

Less Accumulated Depreciation

(173)

Total Property, Plant and Equipment

8,127

Total Assets

$17,027

Liabilities

Current Liabilities

Accounts Payable

$1,250

Interest Payable

25

Unearned Revenue

1,800

Current Portion of Bank Loan

1,000

Total Current Liabilities

$4,075

Long-Term Liabilities

Long-Term Portion of Bank Loan

1,500

Total Long-Term Liabilities

1,500

Total Liabilities

5,575

Owner's Equity

Parish, Capital

11,452

Total Owner's Equity

11,452

Total Liabilities and Owner's Equity

$17,027

________________

Figure 6.24