Chapter 1

Financial Statements: Personal Accounting

4

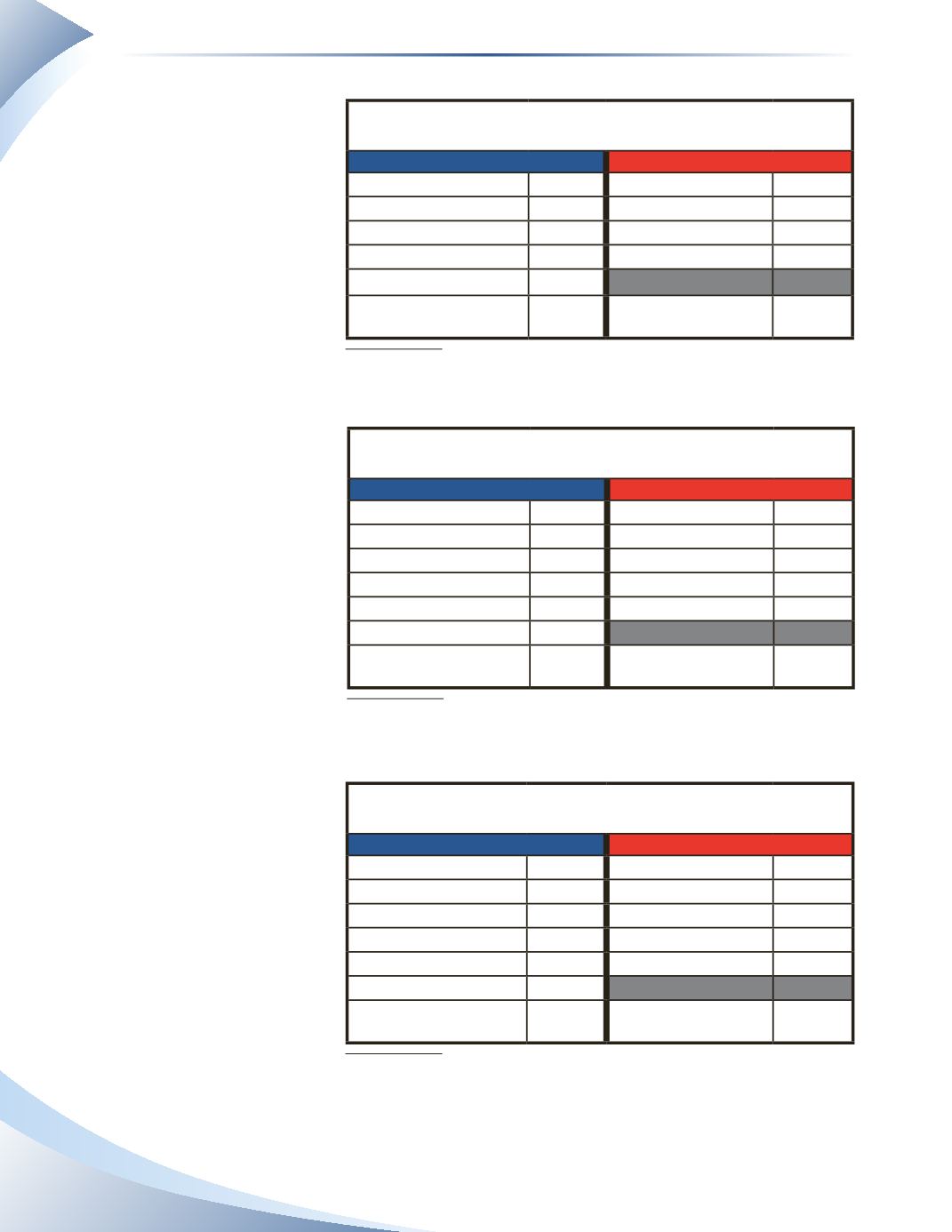

Note that net worth is

equal to assets minus

liabilities. We will discuss

this relationship later in

the chapter.

In Figure 1.4, despite

the fact that your cash

balance is lower, your net

worth is higher.

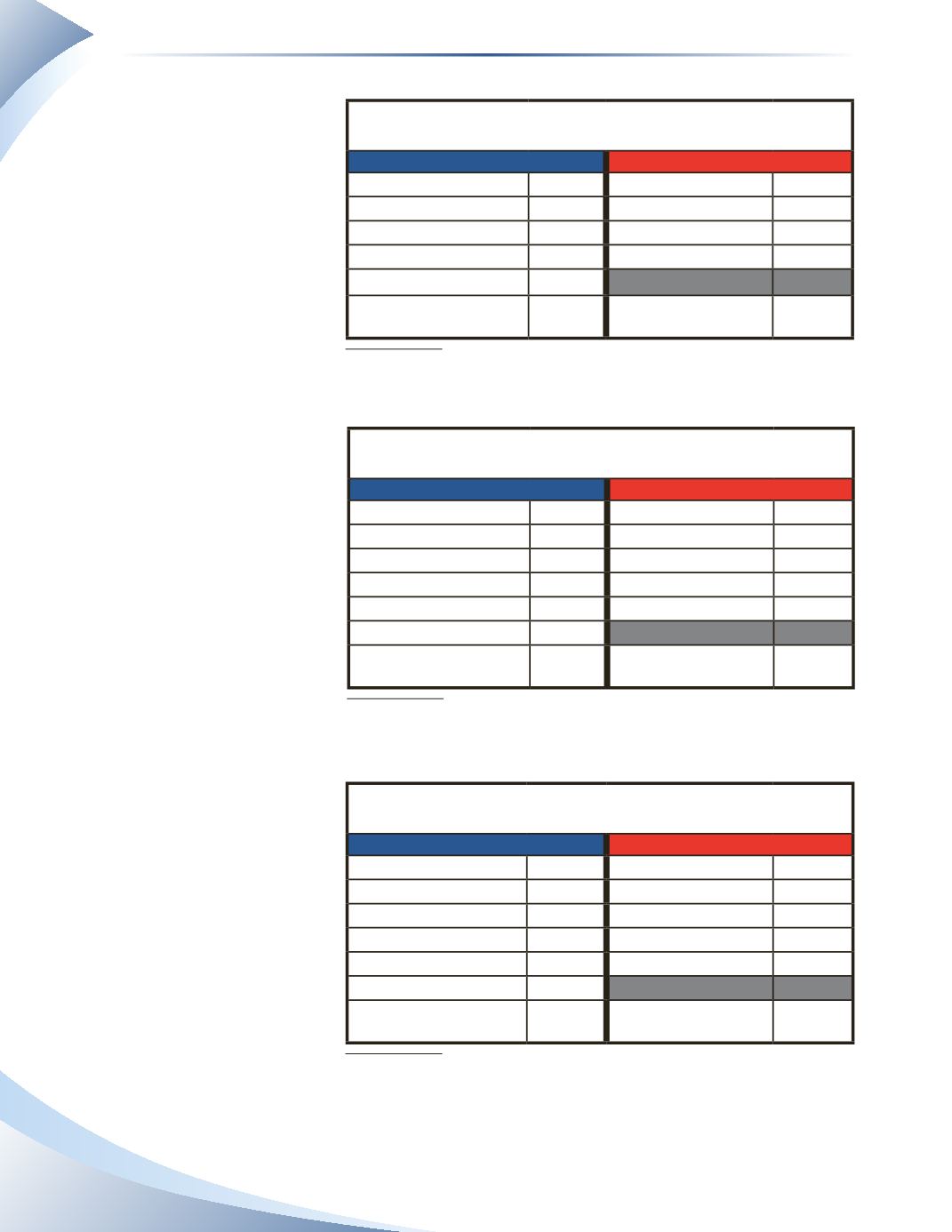

In Figure 1.5, you have a

negative bank balance,

meaning that you have a

bank overdraft. However,

your net worth is signifi-

cantly higher than in

Figures 1.3 and 1.4.

Note that in accounting,

negative numbers are

expressed in parentheses.

For example, –$2,000 is

shown as ($2,000).

In Figure 1.6, you have

a large amount of cash,

a valuable home and an

expensive car. However,

your net worth is lower

than the previous three

scenarios. This is because

you borrowed a large

amount from the bank

for your house and car.

The net worth reflected

in Figure 1.5 (with the

negative cash balance) is

actually greater than that

in the other figures.

Personal Balance Sheet

As at December 31, 2016

Assets

Liabilities

Cash

$1,000 Unpaid Accounts

$5,000

Investments

18,000 Mortgage

100,000

Contents of Home

4,500

Automobile

10,000

Total Liabilities

105,000

House

120,000

Net Worth

48,500

Total Assets

$153,500 Total Liabilities +

Net Worth

$153,500

FIGURE 1.4

Personal Balance Sheet

As at December 31, 2016

Assets

Liabilities

Cash

($2,000) Unpaid Accounts

$10,000

Investments

30,000 Mortgage

80,000

Contents of Home

5,000 Bank Loan

7,000

Automobile

10,000 Car Loan

6,000

House

180,000

Total Liabilities

103,000

Net Worth

120,000

Total Assets

$223,000 Total Liabilities +

Net Worth

$223,000

FIGURE 1.5

Personal Balance Sheet

As at December 31, 2016

Assets

Liabilities

Cash

$50,000 Unpaid Accounts

$15,000

Investments

8,000 Mortgage

220,000

Contents of Home

12,000 Bank Loan

60,000

Automobile

50,000 Car Loan

40,000

House

250,000

Total Liabilities

335,000

Net Worth

35,000

Total Assets

$370,000 Total Liabilities +

Net Worth

$370,000

FIGURE 1.6