Chapter 1

Financial Statements: Personal Accounting

5

The Income Statement

The

income statement

is primarily used as a temporary record to record transactions relating to

revenue and expenses.

Revenue

is an increase to net worth caused by providing goods or services

in exchange for an asset, usually cash. In your personal life, revenue is usually earned by working

and earning a salary.

Expenses

are costs and a decrease to net worth caused by day-to-day activities.

These costs are incurred and will be paid later or use up an asset, usually cash. In your personal life,

expenses can include items such as rent or food.

The purpose of the income statement is to determine the change in net worth over a specific period

of time.The date of the income statement is presented as “For the Period Ended ...” since the state-

ment covers a period of time. For example, an income statement prepared on December 31, 2016

covering a year would have the date “For the Year Ended December 31, 2016.”

If you did not want to use a formal income statement, you could merely record every transaction in

the net worth section on the balance sheet. Since revenue increases net worth and expenses decrease

net worth, you could record every revenue and expense amount directly into net worth on the balance

sheet. However, this method would not keep track of the details of the type of revenue or expense

you had.

Instead, you could note revenue and expenses on a separate document (the income statement).

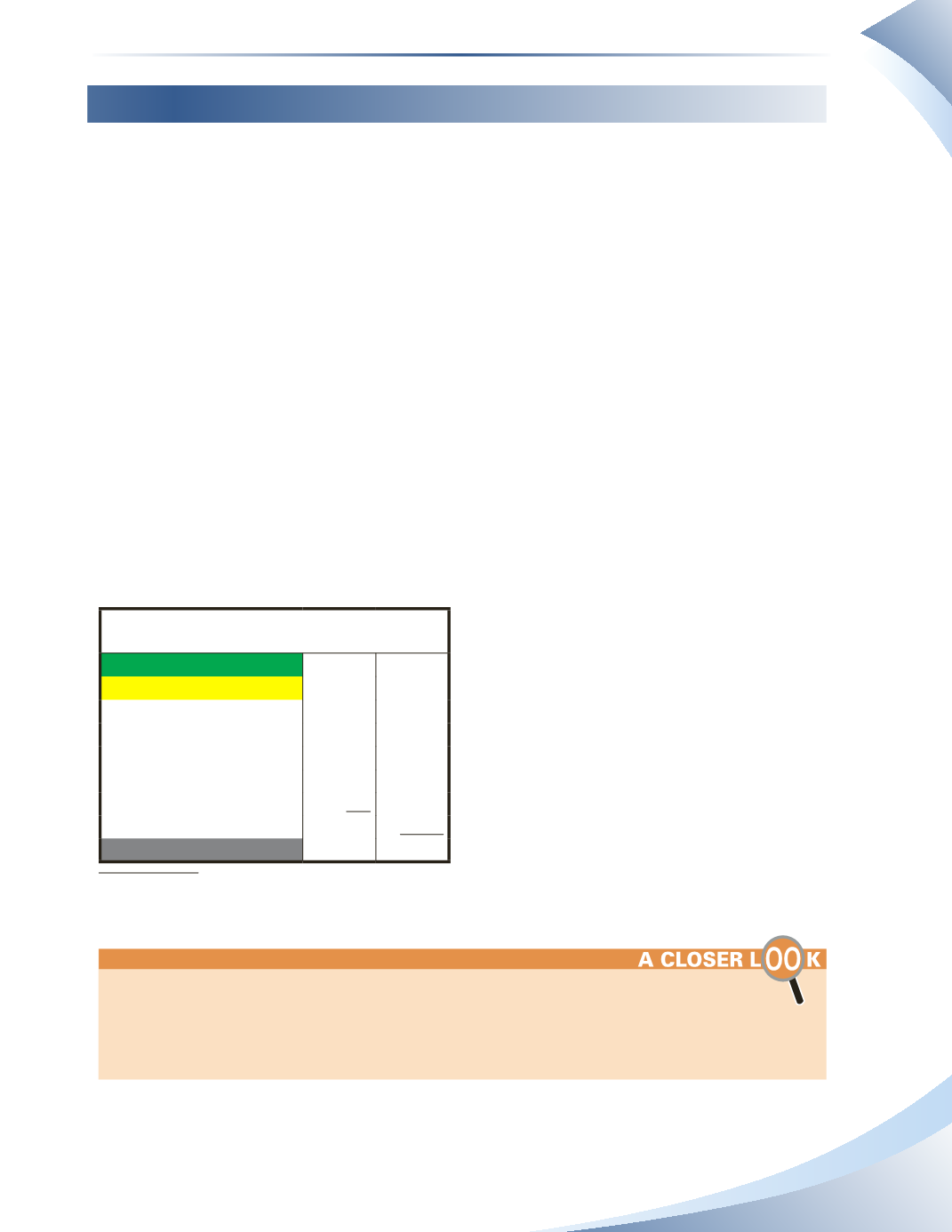

Figure 1.7 illustrates a sample personal income

statement. This shows that $36,000 was earned

during the year and expenses amounted to

$29,500. The difference between revenue and

expenses is a surplus of $6,500, which will be

added to the person’s net worth. If expenses are

more than revenue, then a deficit is recorded

and this deficit would be subtracted from the

person’s net worth.

Imagine playing a sport without a scorecard. It would be difficult to play the game effectively

without knowing the score while the game is played. Your economic life is no different. It is crucial to

monitor how your day-to-day activities impact your net worth on a monthly basis to allow sufficient time

to change spending behaviours to fit within your income. Remember that there is a difference between

cash and your net worth.

Personal Income Statement

For the Year Ended December 31, 2016

Revenue

$36,000

Expenses

Food Expense

$12,000

Insurance Expense

1,000

Maintenance Expense

800

Rent Expense

15,000

Utilities Expense

700

Total Expenses

29,500

Surplus (Deficit)

$6,500

FIGURE 1.7