Chapter 1

Financial Statements: Personal Accounting

12

Cash-Based vs. Accrual-Based Accounting

If a cash-based method of accounting

is used, then revenue and expenses are

recorded only when the cash is received

or paid.

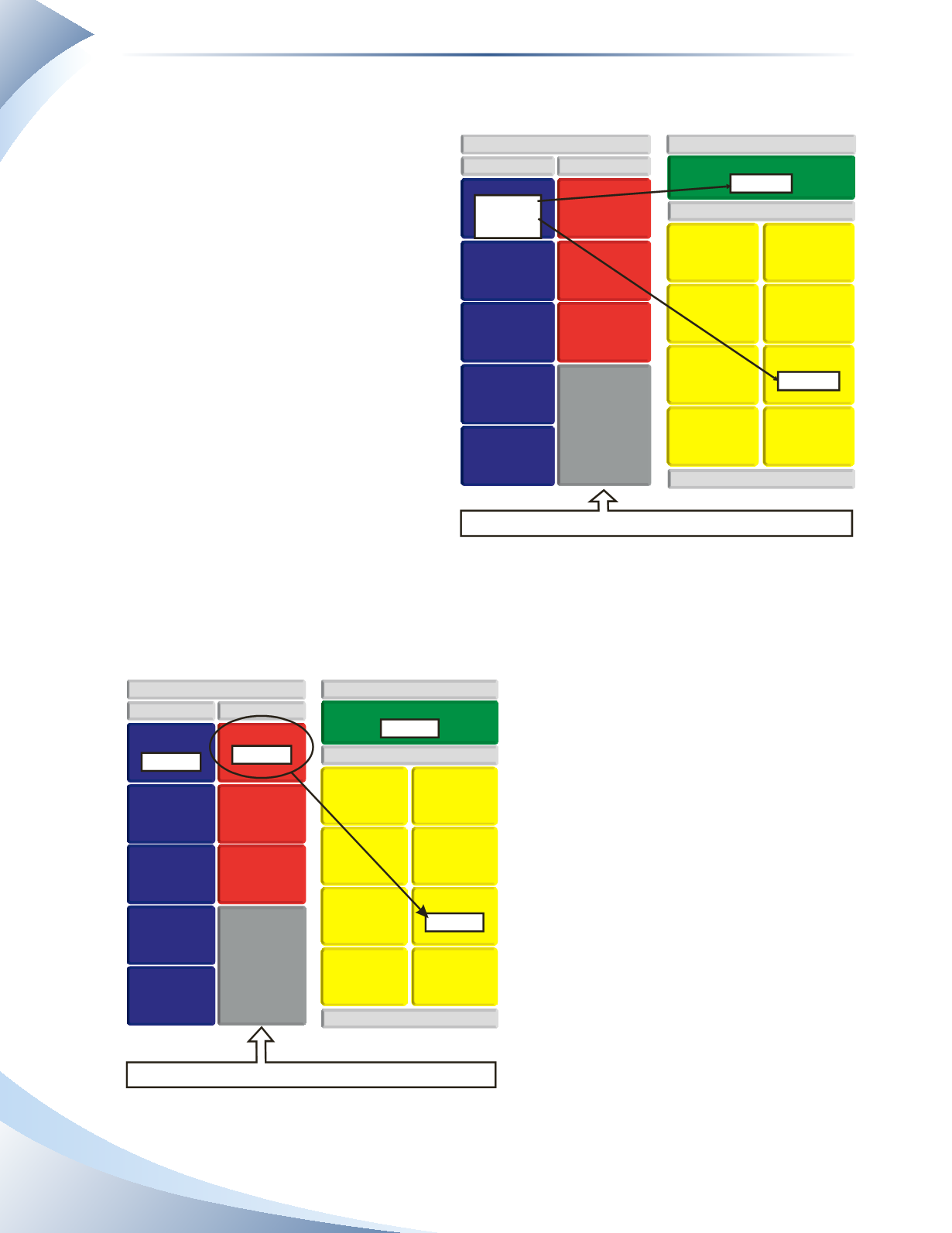

As illustrated in Figure 1.21, at the end of

January you deposit $3,000 salary earned

that month and you pay expenses of

$2,000 using cash from the bank. The

difference between revenue and expenses

results in an increase in net worth of

$1,000, which happens to be the same as

the increase in cash.

Suppose that you deposit salary of $3,000

in January, but choose to charge all $2,000

worth of expenses to your credit card, which

is to be paid in February. When you use

cash-based accounting,

your net worth

appears to be $3,000 in January, since no

cash is used to pay your expenses.

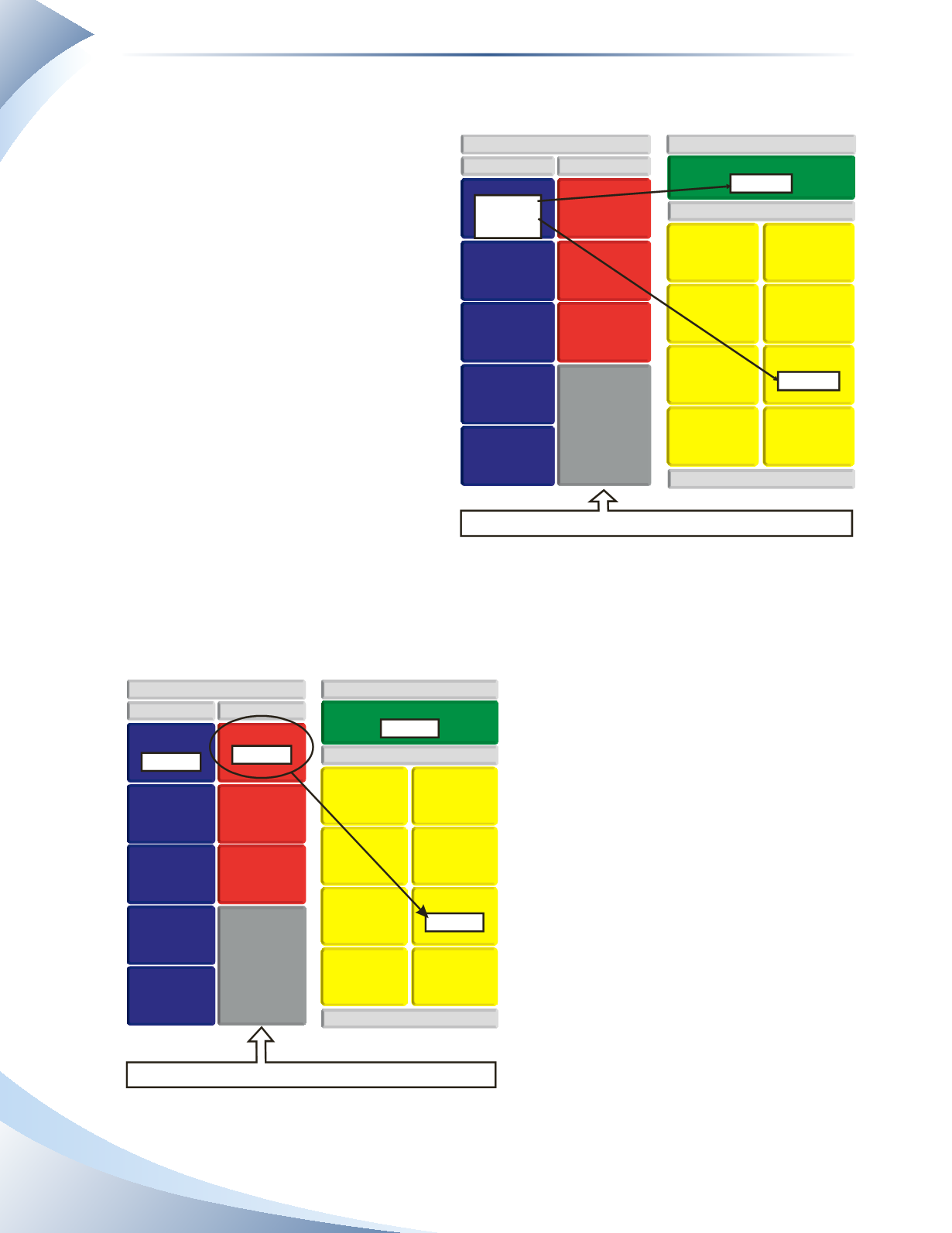

If you are using accrual-based accounting,

you need to recognize the expense in January,

the month in which it was actually incurred.

In Figure 1.22, the income statement for

the month of January shows that you have

matched the revenue of $3,000 (an increase

in net worth) to the expenses in January of

$2,000 (a decrease in net worth), resulting

in an overall increase in net worth of $1,000.

Cash remains at $3,000 because you have not

spent any of it yet.

The accrual system of accounting recognizes

the change in net worth even though payment

is not necessarily received or paid.

Four transactions that occurred in January are

presented below.Their impact on the balance

sheet and income statement are shown in

Figure 1.23.Keep inmind that the accounting

equation must always stay in balance.

SURPLUS (DEFICIT)

EXPENSES

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID

EXPENSES

AUTOMOBILE

UNPAID

ACCOUNTS

MORTGAGE

LOANS

NETWORTH

+ $3,000

- 2,000

= $1,000

REVENUE

DEPRECIATION

FOOD

ENTERTAINMENT

INTEREST

MAINTENANCE

MISCELLANEOUS

UTILITIES

INSURANCE

+ $2,000

+ $3,000

PERSONAL INCOME STATEMENT

Net worth increases by $3,000, then decreases by $2,000, leaving a balance of $1,000

CONTENTS

OF HOME

HOUSE

January

PERSONAL INCOME STATEMENT

SURPLUS (DEFICIT)

EXPENSES

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID

EXPENSES

HOUSE

AUTOMOBILE

CONTENTS

OF HOME

UNPAID ACCOUNTS

MORTGAGE

LOANS

NETWORTH

+ $3,000

+ $2,000

REVENUE

DEPRECIATION

FOOD

ENTERTAINMENT

INTEREST

MAINTENANCE

MISCELLANEOUS

UTILITIES

INSURANCE

+ $2,000

+ $3,000

January

An expense always decreases net worth

Net worth increases by $3,000, then decreases by $2,000, leaving a balance of $1,000

______________

FIGURE 1.22

______________

FIGURE 1.21