Chapter 1

Financial Statements: Personal Accounting

6

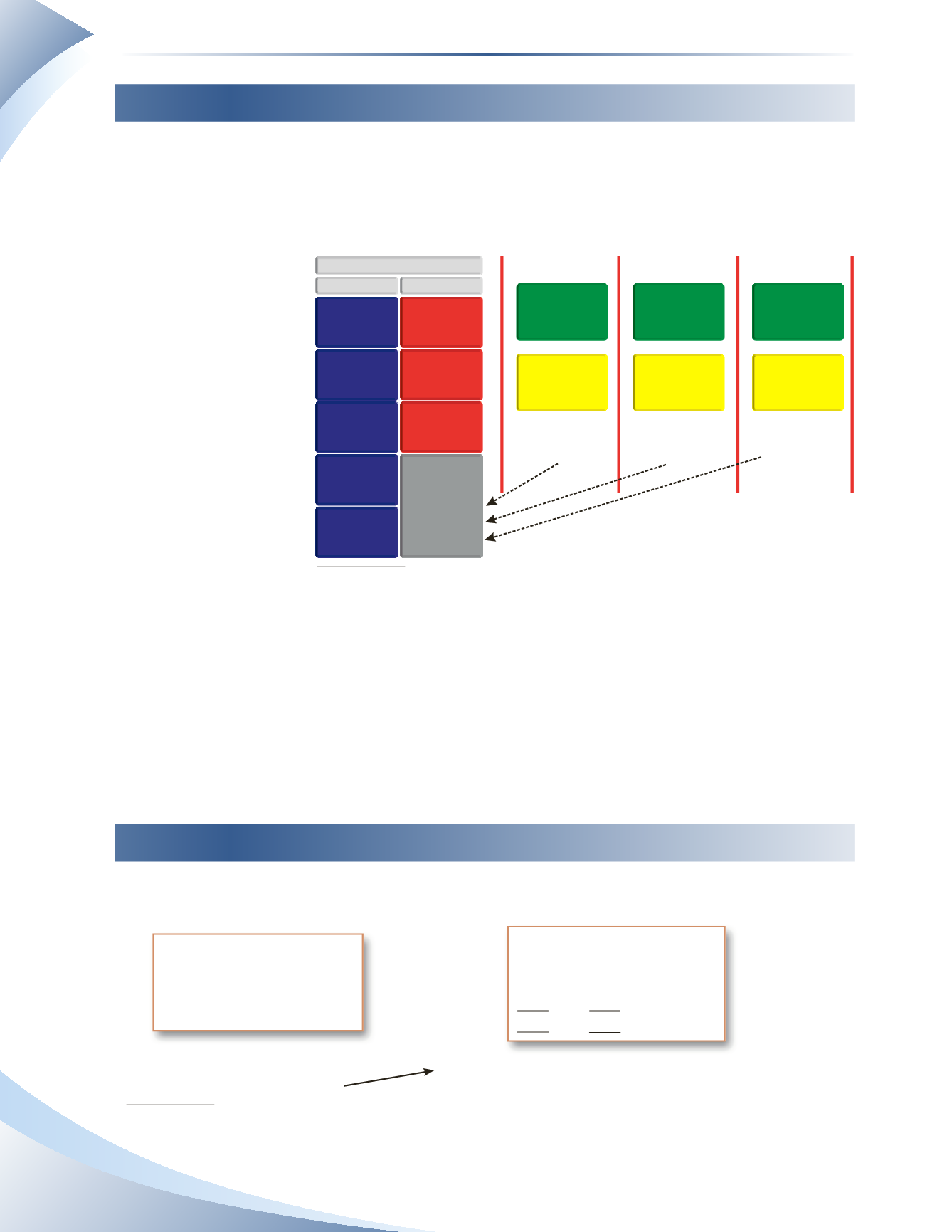

Accounting Periods

You can keep changing net worth continuously; however, for accounting purposes, it is more conve-

nient to record changes to net worth in separate periods. You can use any period you choose as an

accounting period. An

accounting period

is the time frame in which the financial statements are

prepared and can be

one year, six months

or one month, as

shown in Figure 1.8.

If you use a month

as your accounting

period, you can look

back at previous

months (periods) and

estimate what your

expenses and income

will be in the coming

months. You can also

estimate the surplus

or deficit you will

generate each month. If you are saving for a major purchase such as a car, a new computer or an

expensive entertainment system, you will be able to determine when you will have enough money

to buy the desired item or at least provide a down payment.

Some advantages of using monthly accounting periods for your personal financial statements include

•

tracking regular monthly living expenses (e.g. rent, cell phone)

•

frequently assessing realistic expectations

•

controlling errors effectively

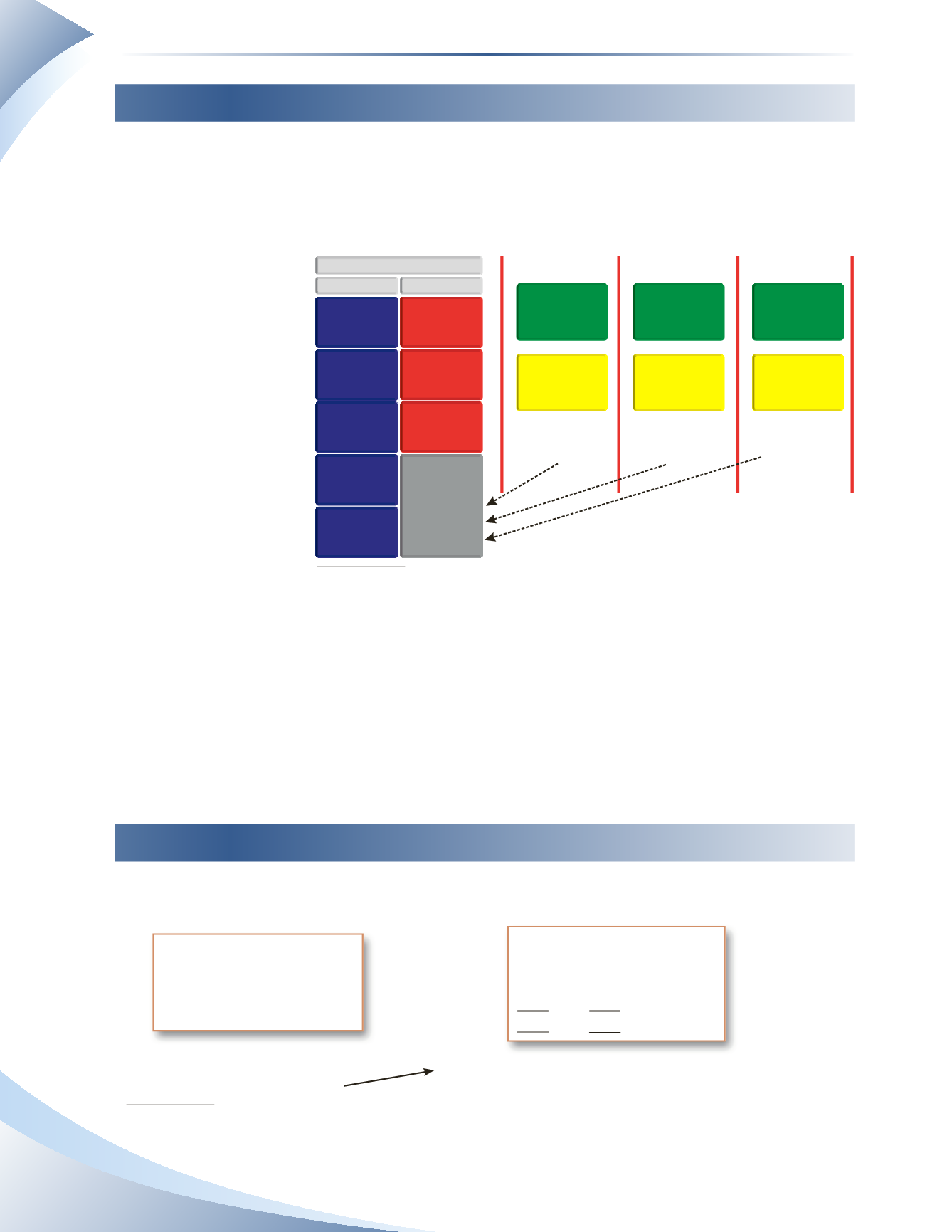

The Accounting Equation

The accounting equation is shown in Figure 1.9.

FIGURE 1.9

Assets

Liabilities

$100

– $70

= 30

Net Worth

Assets

Liabilities

$100

$70

+ 30

Net Worth

$100

$100

If assets minus liabilities = net worth,

assets must equal liabilities plus net worth

then mathematically…

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID

EXPENSES

CONTENTS OF

HOME

AUTOMOBILE

HOUSE

UNPAID

ACCOUNTS

MORTGAGE

LOANS

NETWORTH

January

February

PERSONAL INCOME STATEMENT

March

Surplus

(Deficit)

Surplus

(Deficit)

Surplus

(Deficit)

REVENUE

REVENUE

REVENUE

EXPENSES

EXPENSES

EXPENSES

–

–

–

=

=

=

increase or decrease in net worth

FIGURE 1.8