Chapter 1

Financial Statements: Personal Accounting

10

Revenue increases net worth and expenses decrease net worth. The more revenue earned, the

more should be added to net worth. Therefore the revenue T-account increases on the right

side and decreases on the left side.The more expenses incurred, the more should be subtracted

from net worth.Therefore the expense T-accounts increase on the left side and decrease on the

right side.

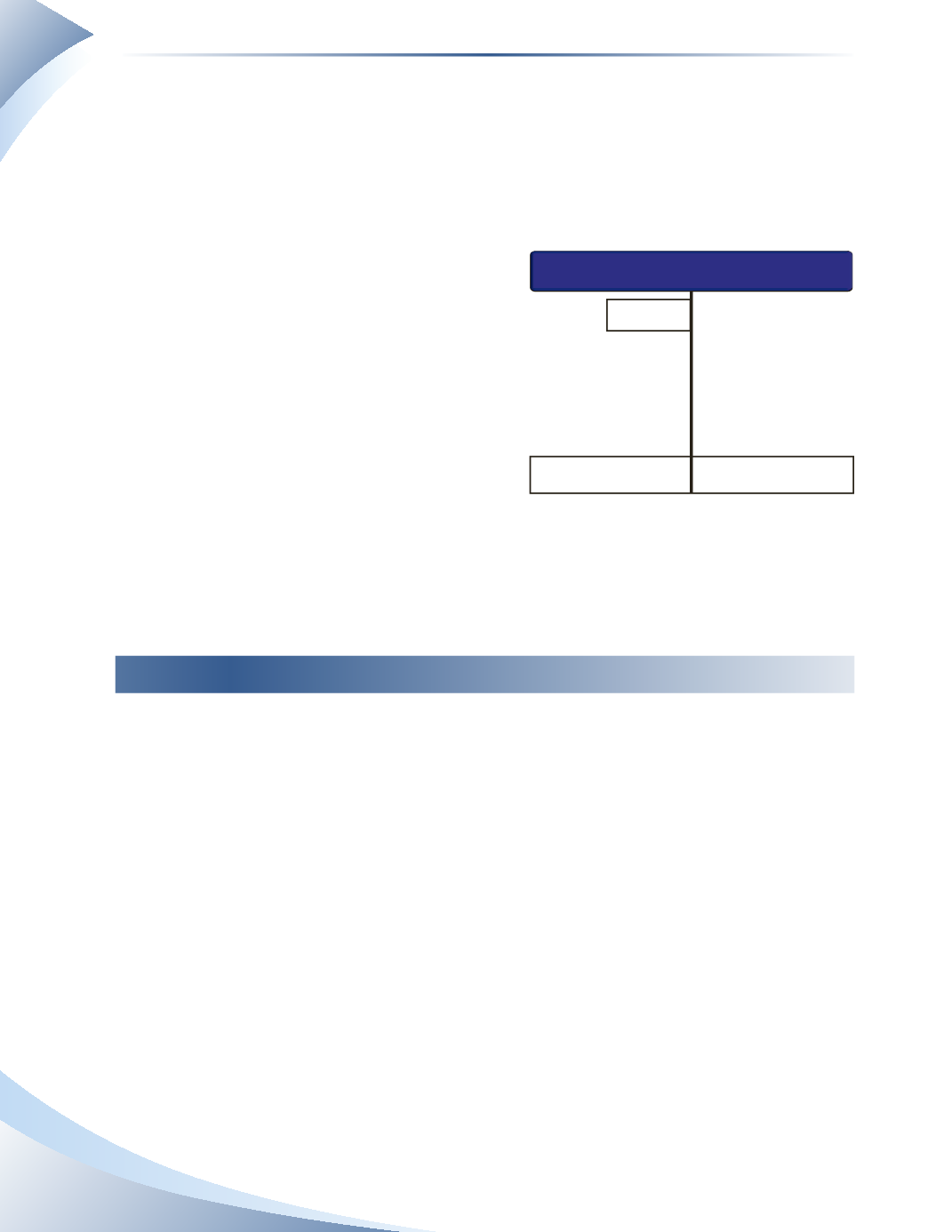

The balance of a T-account at the end of the

period is simply the difference between all the

increases and decreases. Figure 1.17 shows

an example of the cash account. Since cash is

an asset, the left side of the T-account is for

increases and the right side is for decreases.

Cash has an opening balance of $1,000, which

is shown at the top of the increase side of the

T-account. After all transactions have been

recorded, we total both sides of the T-account,

which is shown in red in the figure. The increase

side will include the opening balance in addition

to the transactions. The difference between the

increase and decrease sides is $4,400, which is

the closing balance of cash. The difference is placed on the side which had the larger subtotal,

which is the increase side in this example.

Accrual-Based Accounting

A typical reason for personal financial failure (and small business failure) is not understanding

accruals. People tend to think intuitively that an increase in cash represents an increase in wealth,

and vice versa.The notion of the accrual is recognizing how much you are worth at a point in time.

Accrual-based accounting

means that revenue (an increase to net worth) and expenses (a decrease

to net worth) are recorded in the period in which they occur, regardless of when cash payment is

received or paid.

So far we have assumed that every expense is paid when it is incurred. In reality, many expenses

are not paid until a later date. The examples in Figures 1.18 and 1.19 illustrate how expenses are

recorded as they occur.

Assume that you have $1,000 of cash and net worth of $1,000. If you pay for a $300 expense with

cash, your cash and your net worth will decrease by $300 (see Figure 1.18).

If instead you receive a phone bill for $300 to be paid next month, there would be no change in

cash in the current month. However, the phone debt (or unpaid accounts) would increase by $300

and net worth would decrease by $300 (see Figure 1.19). In other words, you would recognize

the

expense which decreases net worth.

______________

FIGURE 1.17

CASH

+

-

$1,000

1. 2,000

4. 4,000

5. 500

Subtotal

7,500

$4,400

Closing

Balance

2. 1,500

3. 1,000

6. 600

3,100

Opening

Balance

INCREASE

DECREASE