262

Chapter 9

Accounting Information Systems

To help with the posting to the general ledger as we discuss the special journals, we will use the

following selected accounts from Jill Hanlon Retailer. You will notice these account numbers being

used as we progress through the special journal examples.

Account Description

Account # Account Description Account #

Cash

101

Hanlon, Capital

300

Accounts Receivable

110

Hanlon, Drawings

310

Inventory

120

Sales Revenue

400

Accounts Payable

200

Sales Discount

405

Bank Loan

220

Cost of Goods Sold

500

Maintenance Expense

525

The Sales Journal

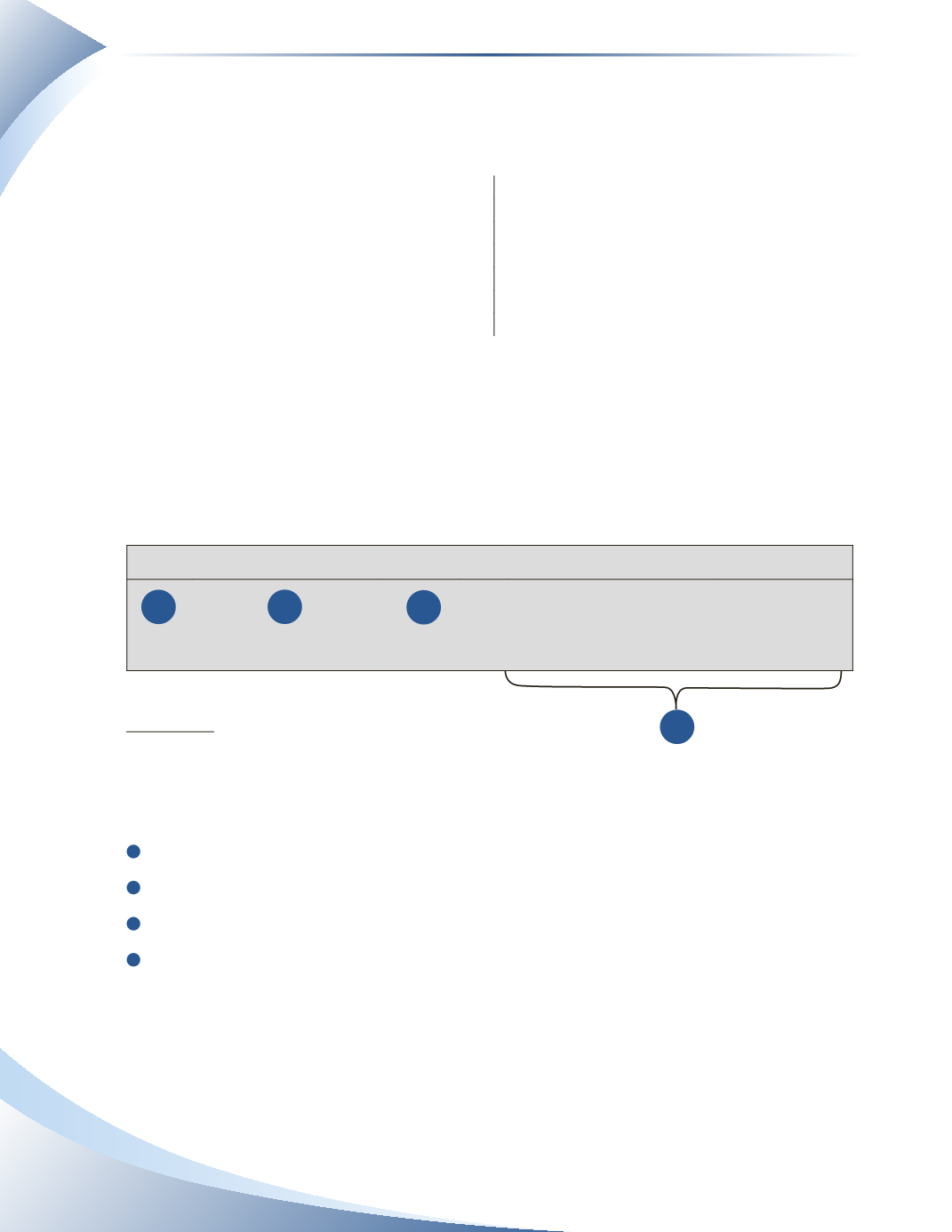

The sales journal records all the details of sales on account. Cash sales are not included in this

journal. They will appear in the cash receipts journal which records all cash received. The sales

journal includes 1) the date of the sale, 2) the name of the customer, 3) the invoice number and 4)

the value of the sale and inventory.These items are shown in Figure 9.4.

Sales Journal

Page 1

Date

Account

Invoice # PR

Accounts Receivable/Sales

(DR/CR)

COGS/Inventory

(DR/CR)

figure 9.4

When a sale is made, as shown on January 5 in Figure 9.5, the customer subledger account must be

updated immediately. Updating the subledger account follows these steps.

1

Transfer the date from the sales journal to the date column in the subledger account.

2

Make a note of the journal and page number in the PR column of the subledger.

3

Transfer the amount of the accounts receivable column to the debit column in the subledger.

4

Indicate the posting is complete by entering a check mark in the PR column in the sales

journal.

1

2

3

4