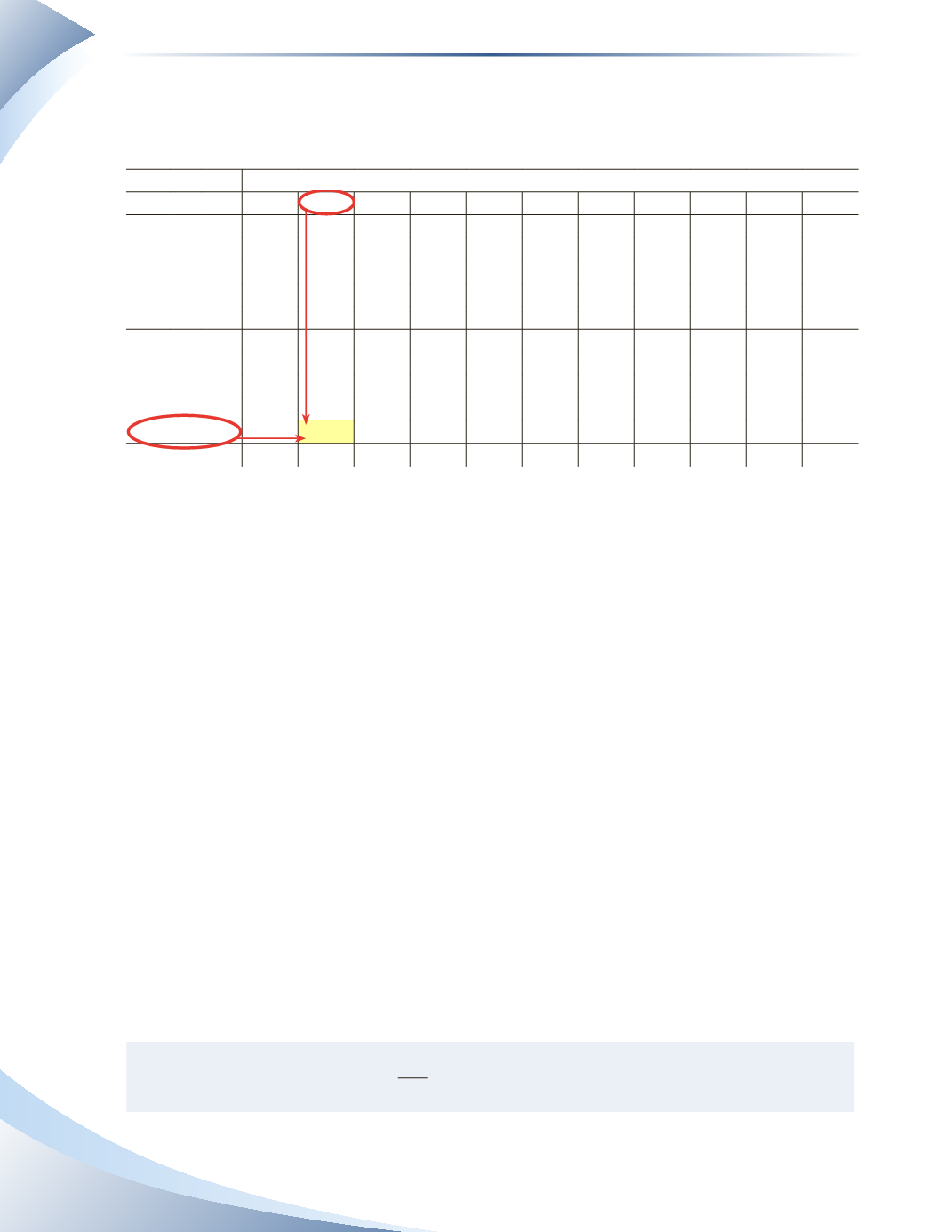

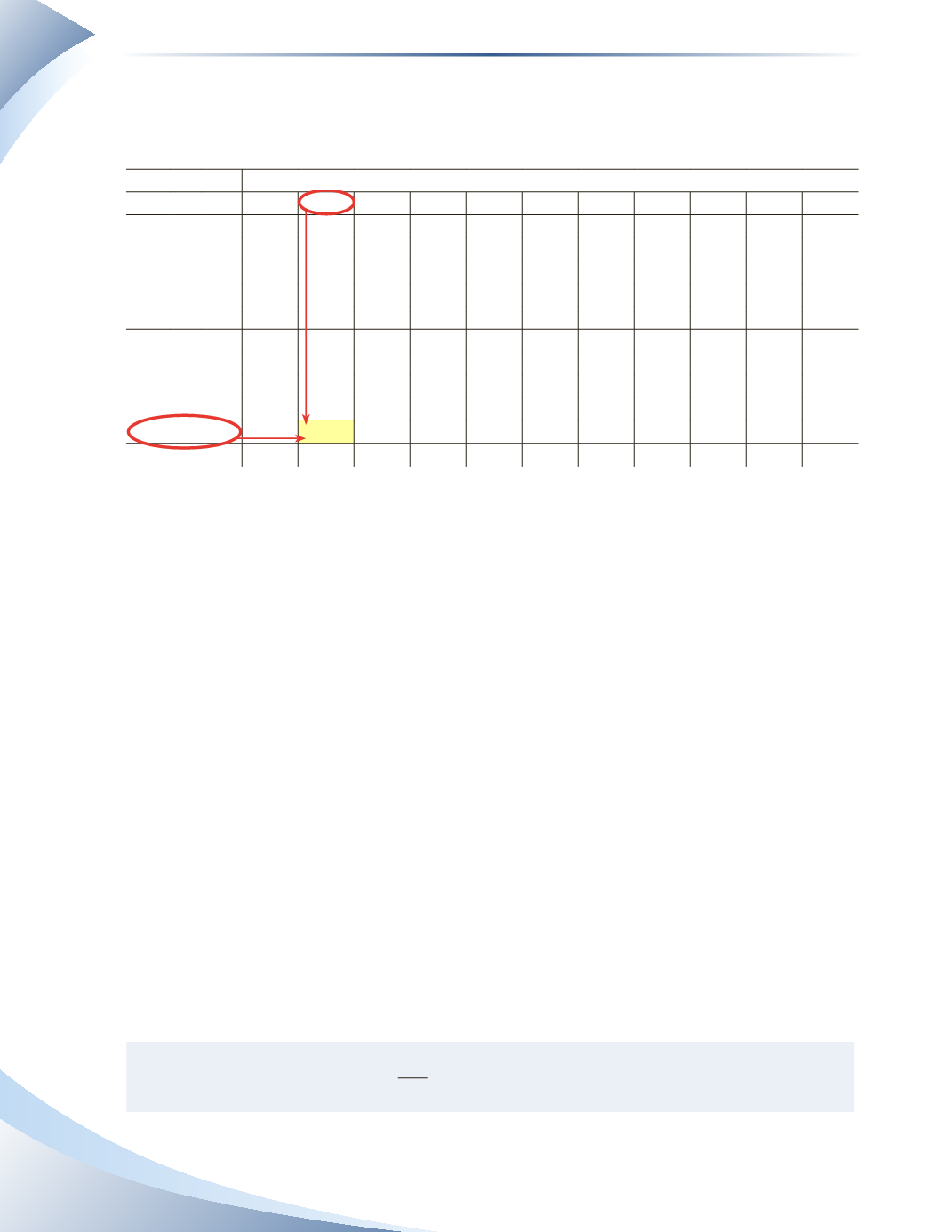

346

Federal tax deductions

Effective January 1, 2015

Monthly (12 pay periods a year)

Also look up the tax deductions in the provincial table

Pay

FromLess than CC0 CC1 CC2 CC3 CC4 CC5 CC6 CC7 CC8 CC9 CC10

1533 - 1551 203.35 61.75 48.25 21.20

1551 - 1569 205.85 64.25 50.75 23.70

1569 - 1587 208.35 66.80 53.25 26.20

1587 - 1605 210.90 69.30 55.80 28.75 1.70

1605 - 1623 213.40 71.80 58.30 31.25 4.20

1623 - 1641 215.90 74.35 60.80 33.75 6.70

1641 - 1659 218.45 76.85 63.30 36.25 9.20

1659 - 1677 220.95 79.35 65.85 38.80 11.75

1677 - 1695 223.45 81.90 68.35 41.30 14.25

1695 - 1713 226.00 84.40 70.85 43.80 16.75

1713 - 1731 228.50 86.90 73.40 46.35 19.30

______________

FIGURE 11A.1

Workers’ Compensation

Workers' compensation is calculated on gross pay for most employees in a business.There are two

items that must be known to calculate the workers’ compensation premium

1. Maximum insurable earnings ceiling

2. Rate assigned

Each provincial workers’ compensation board will determine the maximum insurable earnings

ceiling and assign rates for each broad industry category.The maximum insurable earnings ceiling

indicates that the employer must pay workers’ compensation on gross pay up to the maximum

specified. In Ontario, the maximum insurable earnings ceiling is $85,200 for 2015.

The rates are assigned as a dollar amount per $100 of gross payroll.The rates are different for each

broad industry category the workers’ compensation board has defined and can change each year.

In Ontario for 2015, the lowest rate is for businesses classified as legal and financial services.They

pay $0.21 per $100 of gross payroll.The highest rate is for businesses classified as form work and

demolition.They pay $18.31 per $100 of gross payroll. Each individual business can lower its rate

if it meets certain criteria, such as having a very safe work record. Conversely, having many work-

related injuries can cause the rate to increase.

The calculation for the workers’ compensation payment is shown below.

Gross Pay × Rate

100 =Workers’ Compensation Payment

Chapter 11 Appendix

Payroll