Chapter 12

Using Accounting Information

356

clearer idea of how the company’s financial situation would be affected if the assets were sold at

the end of the accounting period. While such gains and losses are not part of the daily operating

activities, they still affect the company’s comprehensive income. This means they must be presented

on the statement of comprehensive income.

We have reviewed the balance sheet and income statement from the perspectives of both a sole

proprietorship and a corporation. Now, the financial statements can be analyzed and we can learn

more about how accounting information can be used for decision making.

Horizontal and Vertical Analysis

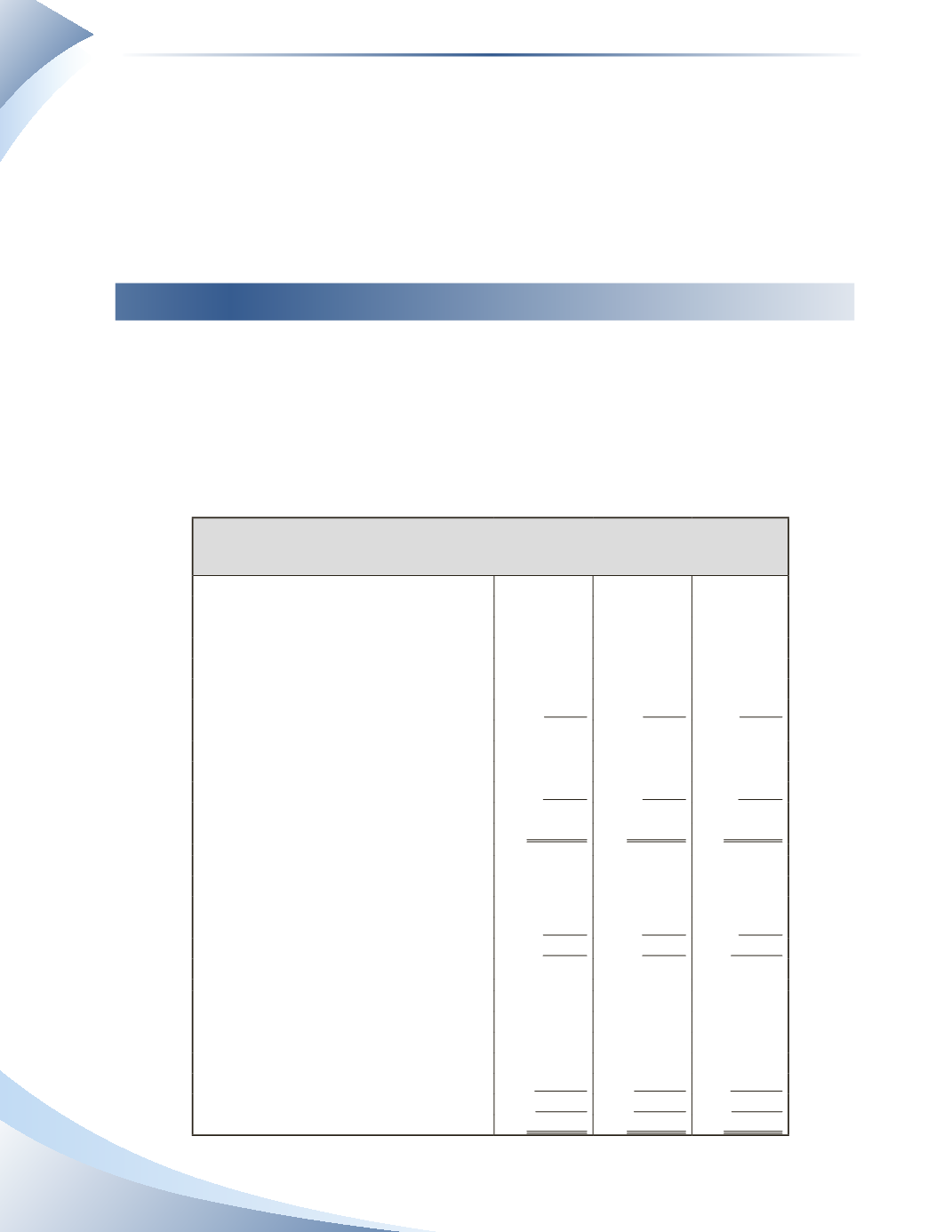

We will inspect the balance sheet of Star Hotel, a Canadian hotel corporation. Suppose this

company is planning to renovate to offer more rooms and services. It has contacted the bank to

secure a bank loan, but the bank must determine whether the company is profitable and will be able

to afford the loan and interest payments.The bank has asked for Star Hotel’s financial statements

for the last three years. Star Hotel’s comparative balance sheet is presented in Figure 12.5. A

comparative balance sheet

is simply a balance sheet that shows the balances for multiple years for

easy comparison. For readability, a single column is used for each year.

Star Hotel

Balance Sheet

As at December 31, 2014 - 2016

2016

2015

2014

Assets

Current Assets

Cash

$8,000

$20,000

$32,000

Accounts Receivable

100,000

70,000

40,000

Food Inventory

40,000

28,000

16,000

Prepaid Expenses

12,000

12,000

12,000

Total Current Assets

160,000

130,000

100,000

Property, Plant & Equipment

Building, Net

390,000

400,000

410,000

Equipment, Net

50,000

55,000

60,000

Total Property, Plant & Equipment

440,000

455,000

470,000

Total Assets

$600,000

$585,000 $570,000

Liabilities

Current Liabilities

Accounts Payable

$50,000

$60,000

$80,000

Unearned Revenue

30,000

25,000

20,000

Total Current Liabilities

80,000

85,000

100,000

Total Liabilities

80,000

85,000

100,000

Shareholders’ Equity

Share Capital

Common Shares—10,000 outstanding

100,000

100,000

100,000

Preferred Shares—5,000 outstanding

20,000

10,000

10,000

Retained Earnings

400,000

390,000

360,000

Total Shareholders’ Equity

520,000

500,000

470,000

Total Liabilities and Shareholders’ Equity

$600,000

$585,000 $570,000

_______________

Figure 12.5