Chapter 11

Payroll

336

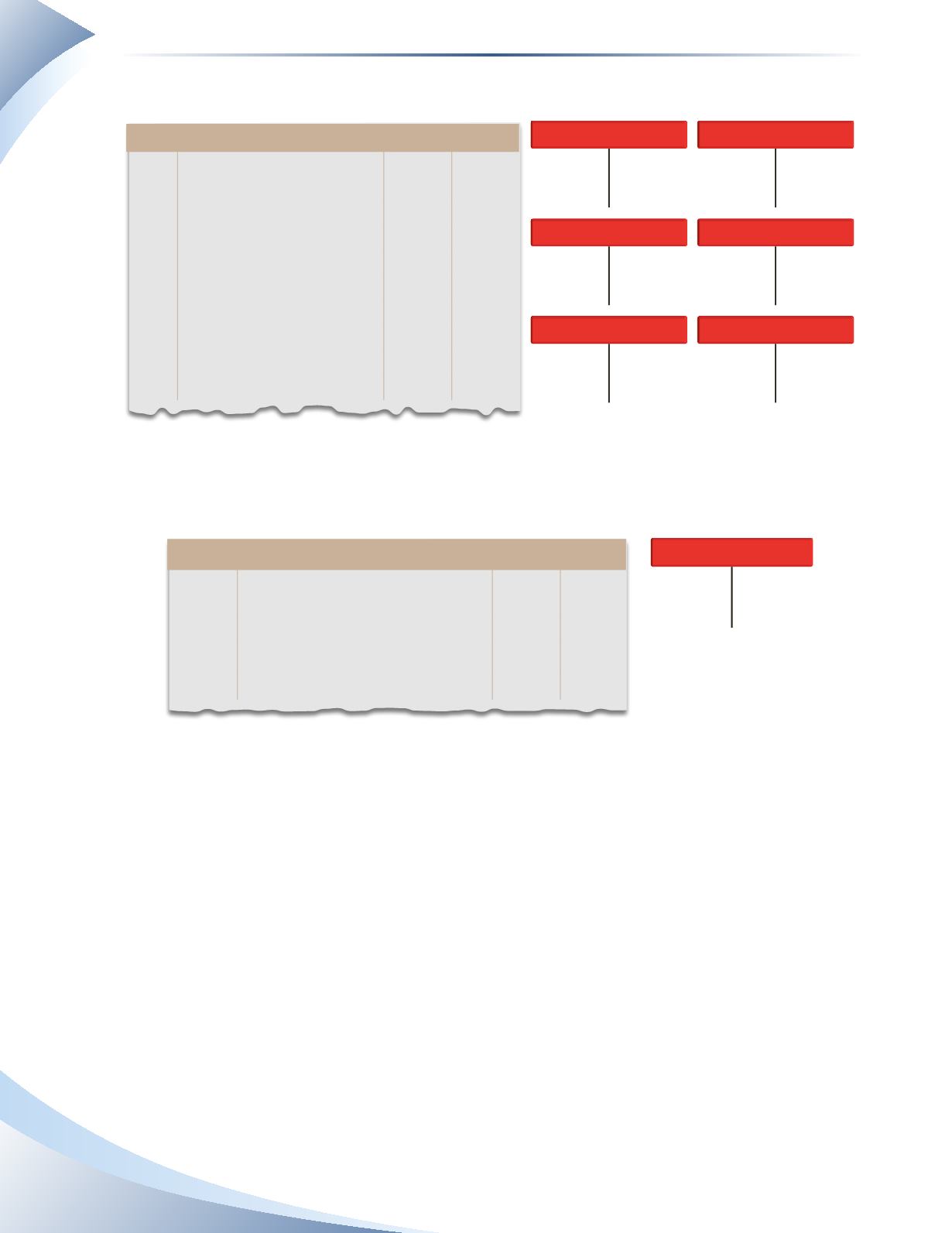

The journal entry to be prepared from the payroll register is shown in Figure 11.10.

CPP PAYABLE

EI PAYABLE

INCOME TAXES PAYABLE

UNION DUES PAYABLE

HEALTH INSURANCE PAYABLE

SALARIES PAYABLE

-

-

-

-

-

-

+

+

+

+

+

+

630.04

261.23

2,063.60

200

60

10,679.98

Journal Page 1

Date

2015

account title and explanation Debit

credit

Jan 31 Salaries Expense

13,894.85

CPP Payable

630.04

EI Payable

261.23

Income Taxes Payable

2,063.60

Union Dues Payable

200.00

Health Insurance Payable

60.00

Salaries Payable

10,679.98

To record employee payroll

______________

FIGURE 11.10

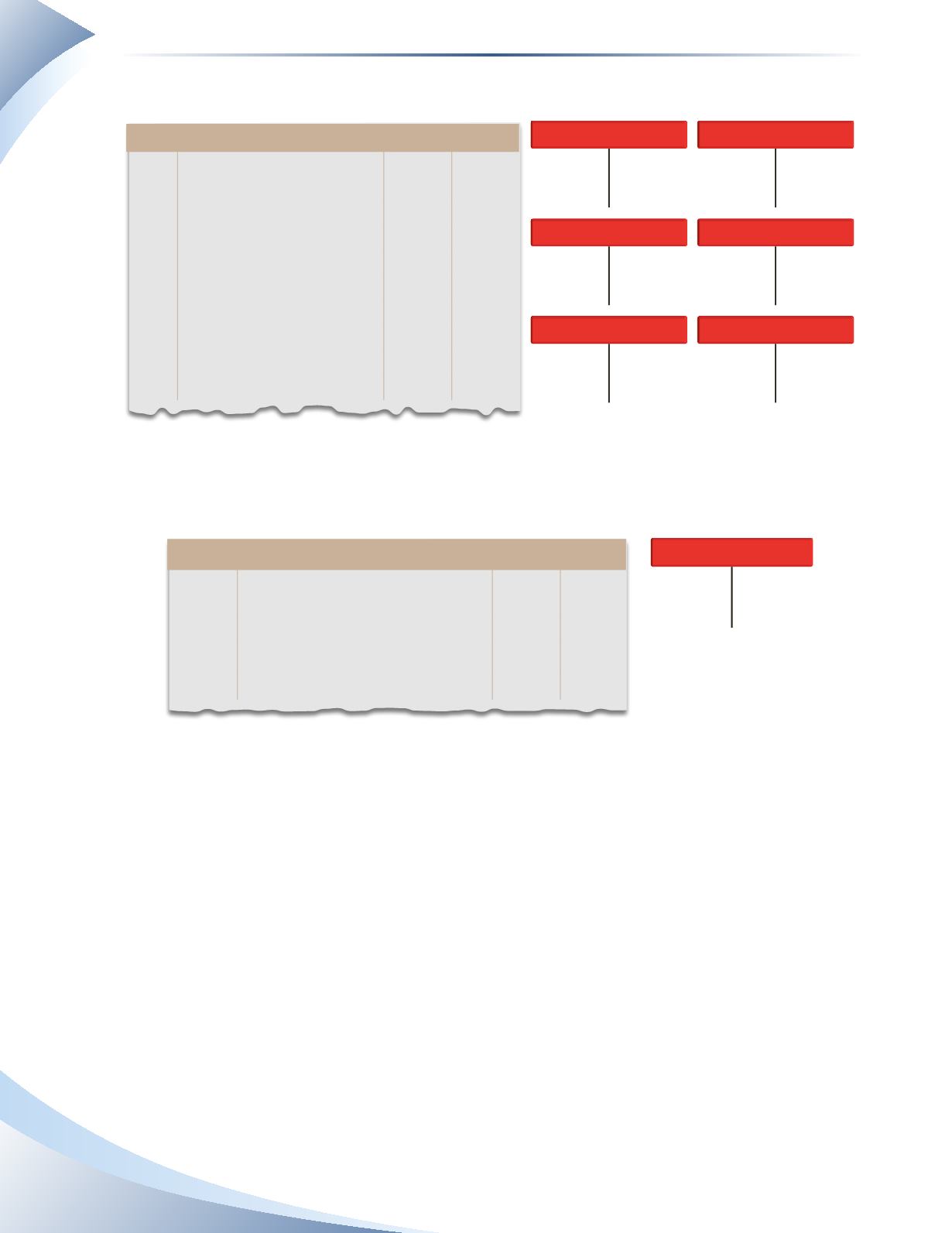

Vacation pay is accrued on the total gross pay for all the employees at 4%. The journal entry is

shown in Figure 11.11.

Journal Page 1

Date

2015

account title and explanation Debit credit

Jan 31 Vacation Pay Expense

555.79

Vacation Pay Payable

555.79

To accrue vacation pay

VACATION PAY PAYABLE

-

+

555.79

______________

FIGURE 11.11

The business also must pay its own payroll contributions relating to the employees. Recall that the

business will match 100% of the CPP deductions and pay 140% of the EI deductions.The business

also pays $15 per employee for health insurance and must pay 0.5% of gross pay for workers’

compensation.