Chapter 11

Payroll

340

Review Exercise

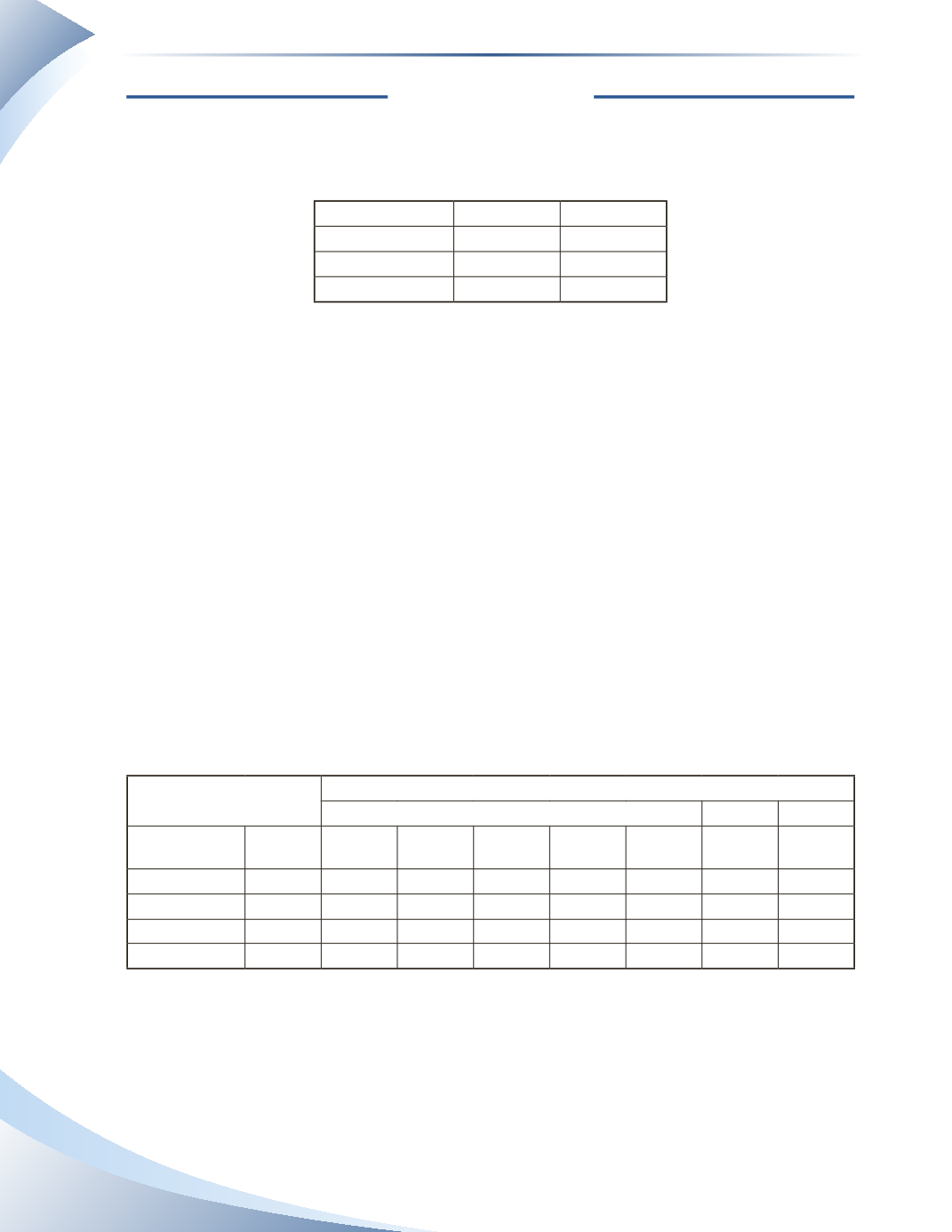

Michelle’s Crafts has three employees.They get paid bi-weekly (every two weeks).The following

table lists the employees, the hours they worked over the last two weeks and their pay rate.

Name

HourlyWage Hours

Flower, Blossom $14.00

88

Painter, Rob

$13.50

76

Scrap, Brook

$14.50

82

Any hours over 40 per week (or 80 in two weeks) is overtime and paid at 1.5 times the regular

rate. Each employee donates $10 to a charity and contributes $25 to a health plan.The company

matches the employees’ health plan deduction. Deductions for CPP and EI are already provided.

Assume income tax is calculated at 18% of their gross pay. Michelle's Crafts also accrues 4%

vacation pay for all employees and pays workers' compensation at 0.6% of the gross pay.

Required

a) Complete a payroll register for the bi-weekly pay.

b) Prepare a journal entry to pay the employees.

c) Prepare a journal entry to accrue vacation pay.

d) Prepare a journal entry to record the additional employer expense.

e) Prepare a journal entry to make a government remittance on July 15, 2015 using just the

numbers from this pay period.

See Appendix I for solutions.

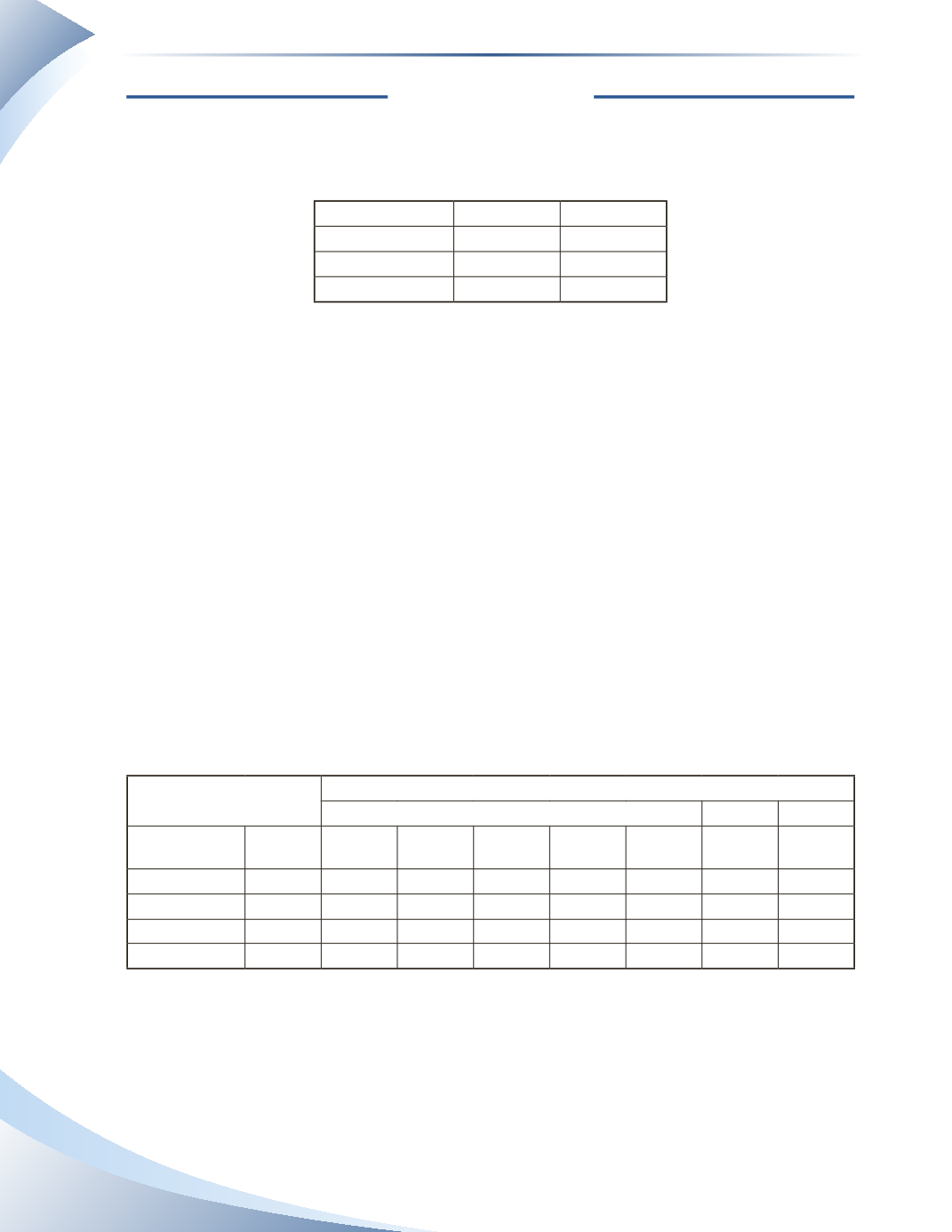

a) Payroll register

Payroll Period

June 8 to June 19, 2015

Payroll Register

Deductions

Name

Gross

Earnings

CPP

EI

Income Tax Charitable

Donations

Health

Plan

Total

Deductions Net Pay