Chapter 12

Using Accounting Information

354

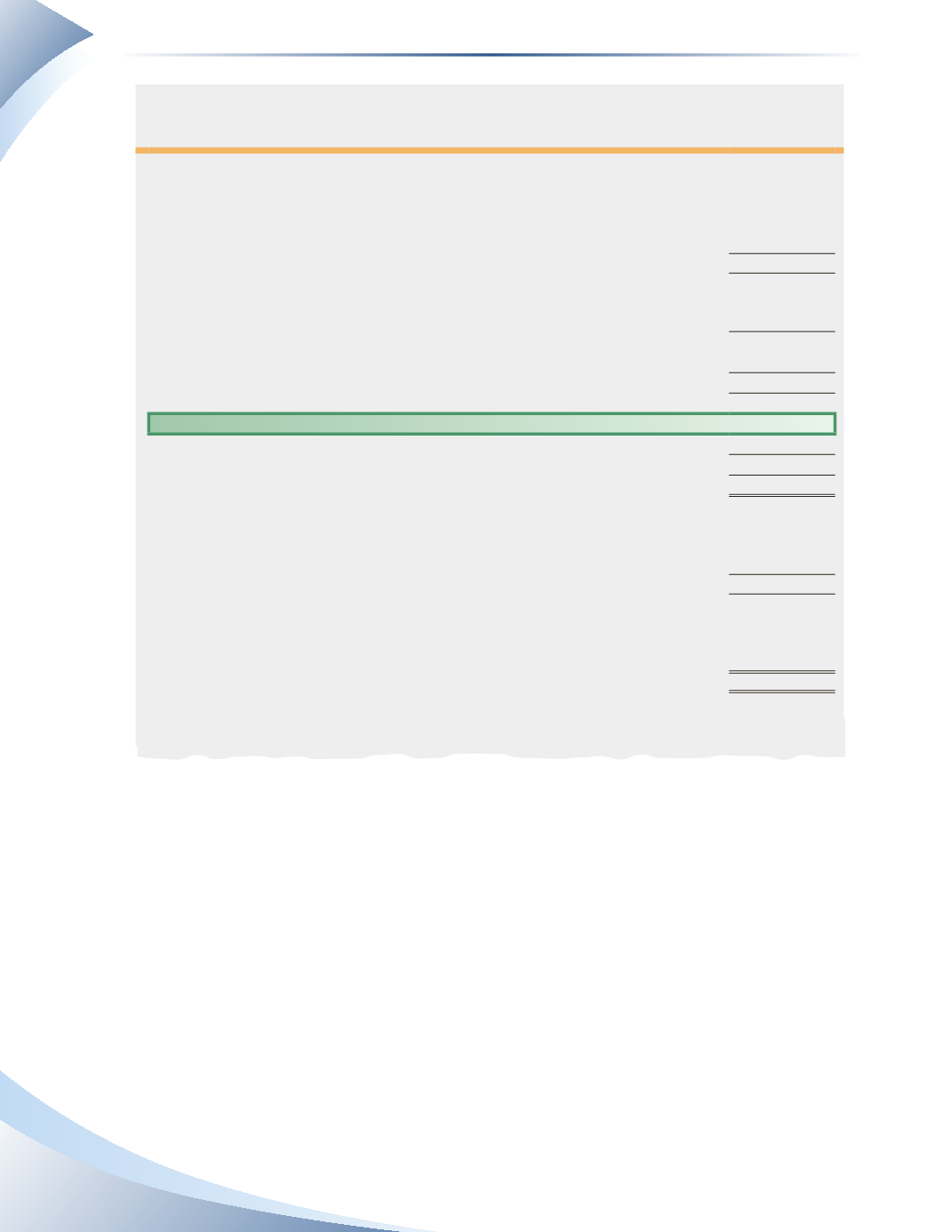

the Procter & gamble company

consolidated statement of earnings

amounts in millions except per share amounts; Year ended June 29, 2014

2014

net sales

$83,062

Cost of products sold

42,460

Selling, general and administrative expense

25,314

goodwill and indefinite lived intangibles impairment charges

–

oPerating income

15,288

Interest expense

709

Interest Income

100

Other non-operating income/(expense), net

206

eArNINgS FrOM CONTINUINg OPerATIONS BeFOre INCOMe TAXeS

14,885

Income taxes on continuing operations

3,178

NeT eArNINgS FrOM CONTINUINg OPerATIONS

11,707

net earnings from DiscountinueD oPerations

78

net earnings

11,785

Less: Net earnings attributable to noncontrolling interests

142

net earnings attriButaBle to Procter & gamBle

$11,643

Basic net earnings Per common sHare:

earnings from continuing operations

$4.16

earnings from discontinued operations

0.03

Basic net earnings Per common sHare

4.19

DiluteD net earnings Per common sHare

earnings from continuing operations

$3.98

earnings from discontinued operations

0.03

DiluteD net earnings Per common sHare

4.01

DiViDenDs Per common sHare

$2.45

(1) Basic net earnings per common share and diluted net earnings per

common share are calculated on net earnings attributable to Procter & gamble

_______________

FIgUre 12.3

Discontinued operation

A

discontinued operation

is a segment of a business that is no longer part of regular operating

activities. However, other business segments are still operational. There are a variety of reasons that

a corporation may want to discontinue a business segment. For example, the segment may no longer

be profitable, so the corporation is shutting it down or selling it. Or management has shifted the

corporate mission and the segment no longer fits the company’s focus.

Normally, sole proprietorships have a single business segment, meaning the business only has one

type of operation (e.g. providing a service or operating as a retailer).Because corporations are usually

larger in nature, they tend to be divided into more than one business segment.These segments may

operate independently and contribute to the revenues and expenses of the corporation as a whole.

Discontinued operations are accounted for and presented in the financial statements in the

following manner. The corporation liquidates the net assets of the discontinued business segment.

The revenues and expenses generated by discontinued operations, as well as any gains or losses