Appendix I

Review Exercise Solutions

429

Chapter 11 Review Exercise—Solutions

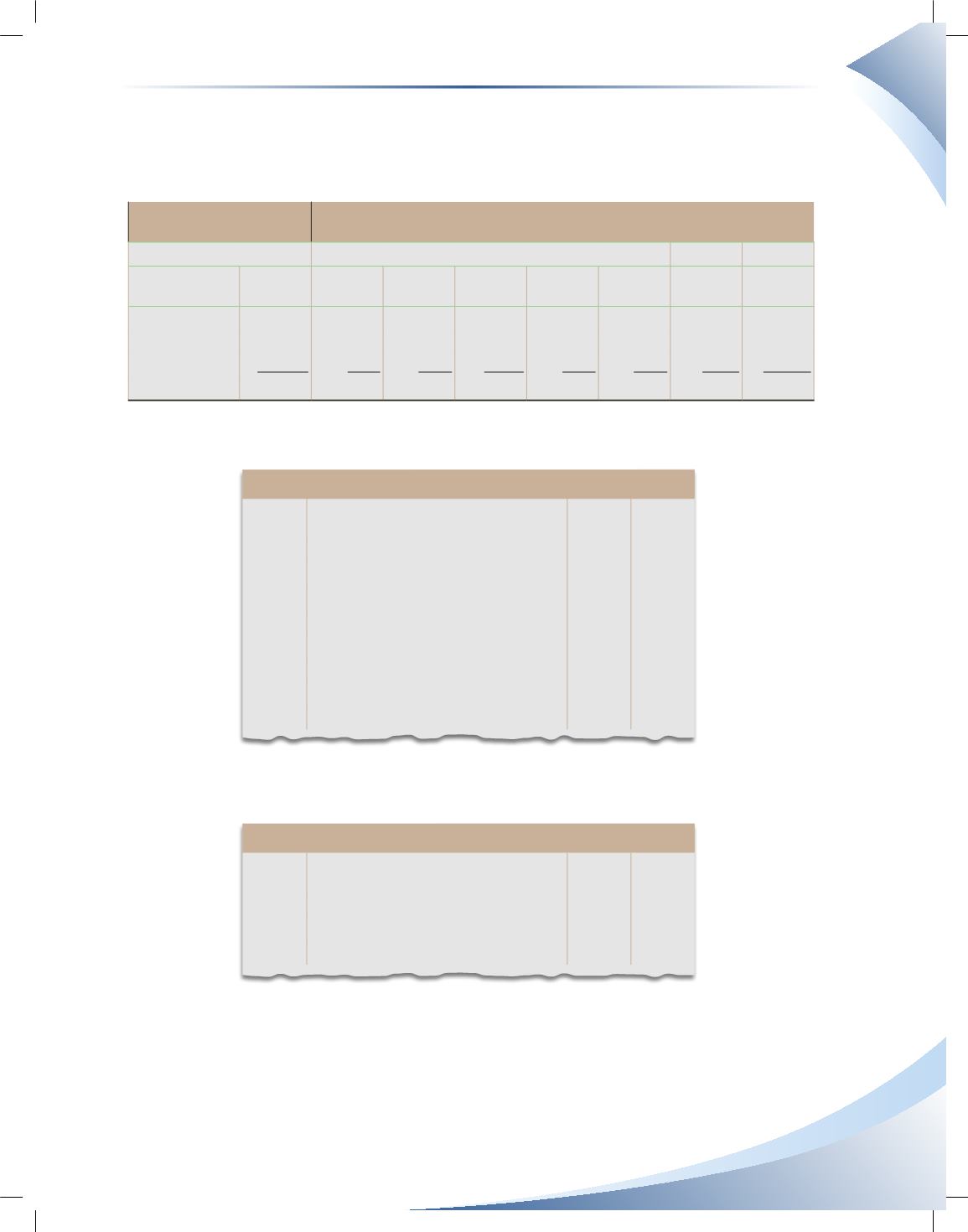

a) Payroll register

Payroll Period

June 8 to June 19, 2015

Payroll Register

Deductions

Name

Gross

Earnings

CPP

EI

Income Tax Charitable

Donations

Health

Plan

Total

Deductions Net Pay

Flower, Blossom 1,288.00

57.09

24.21 231.84

10.00

25.00 348.14 $939.86

Painter, Rob

1,026.00

44.12

19.29 184.68

10.00

25.00 283.09 $742.91

Scrap, Brook

1,203.50

52.91

22.63 216.63

10.00

25.00 327.17 $876.33

Totals

$3,517.50 $154.12 $66.13 $633.15 $30.00 $75.00 $958.40 $2,559.10

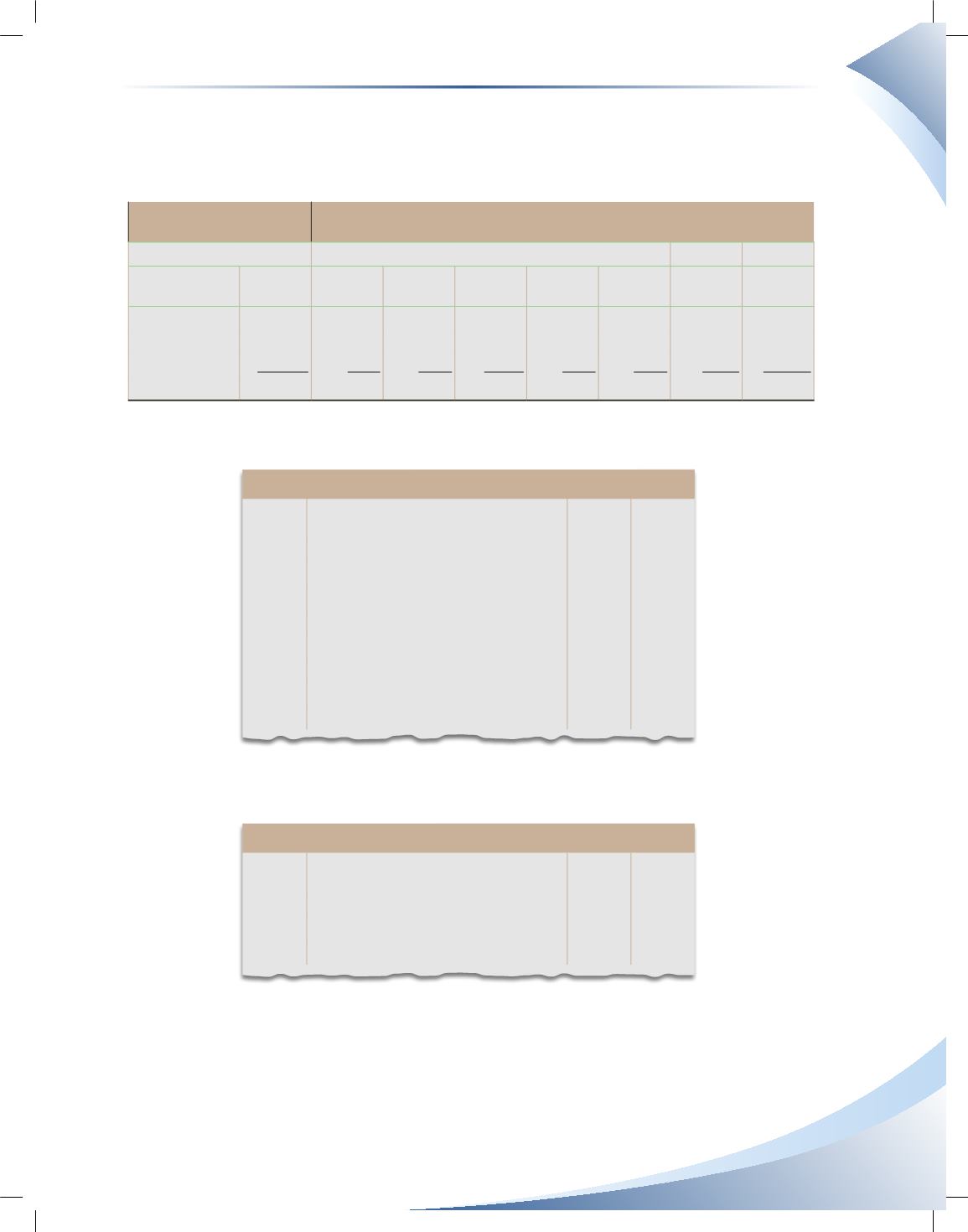

b) Pay employees

JOURNAL Page 1

Date

2015

Account Title and Explanation

Debit Credit

Jun 19 Salaries Expense

3,517.50

CPP Payable

154.12

EI Payable

66.13

Income Tax Payable

633.15

Charitable Donations Payable

30.00

Health Plan Payable

75.00

Cash

2,559.10

Record salaries and deductions

c) Accrue vacation pay

JOURNAL Page 1

Date

2015

Account Title and Explanation

Debit Credit

Jun 19 Vacation Pay Expense

140.70

Vacation Pay Payable

140.70

To accrue vacation play

Vacation pay = $3,517.50 × 4%