Appendix I

Review Exercise Solutions

431

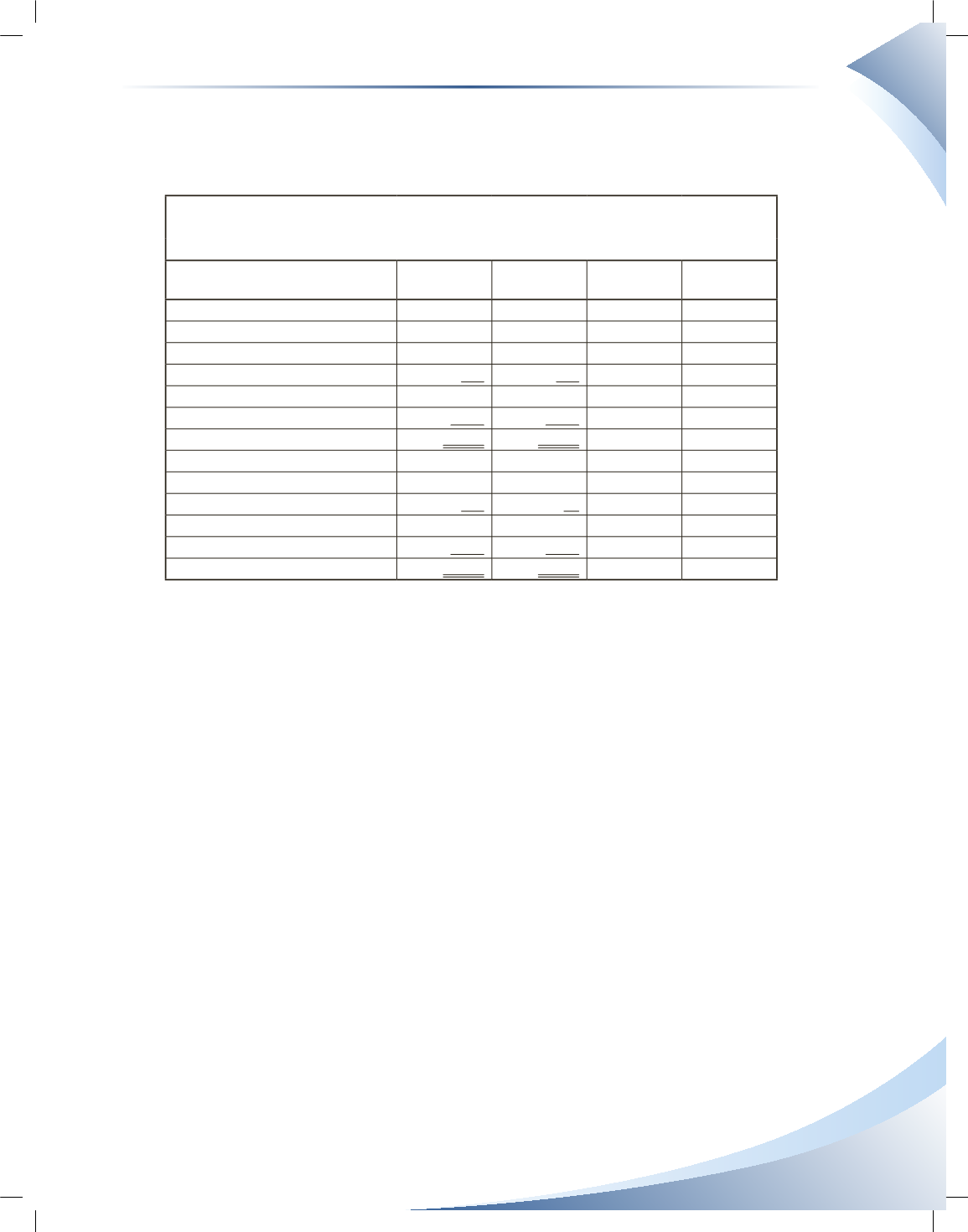

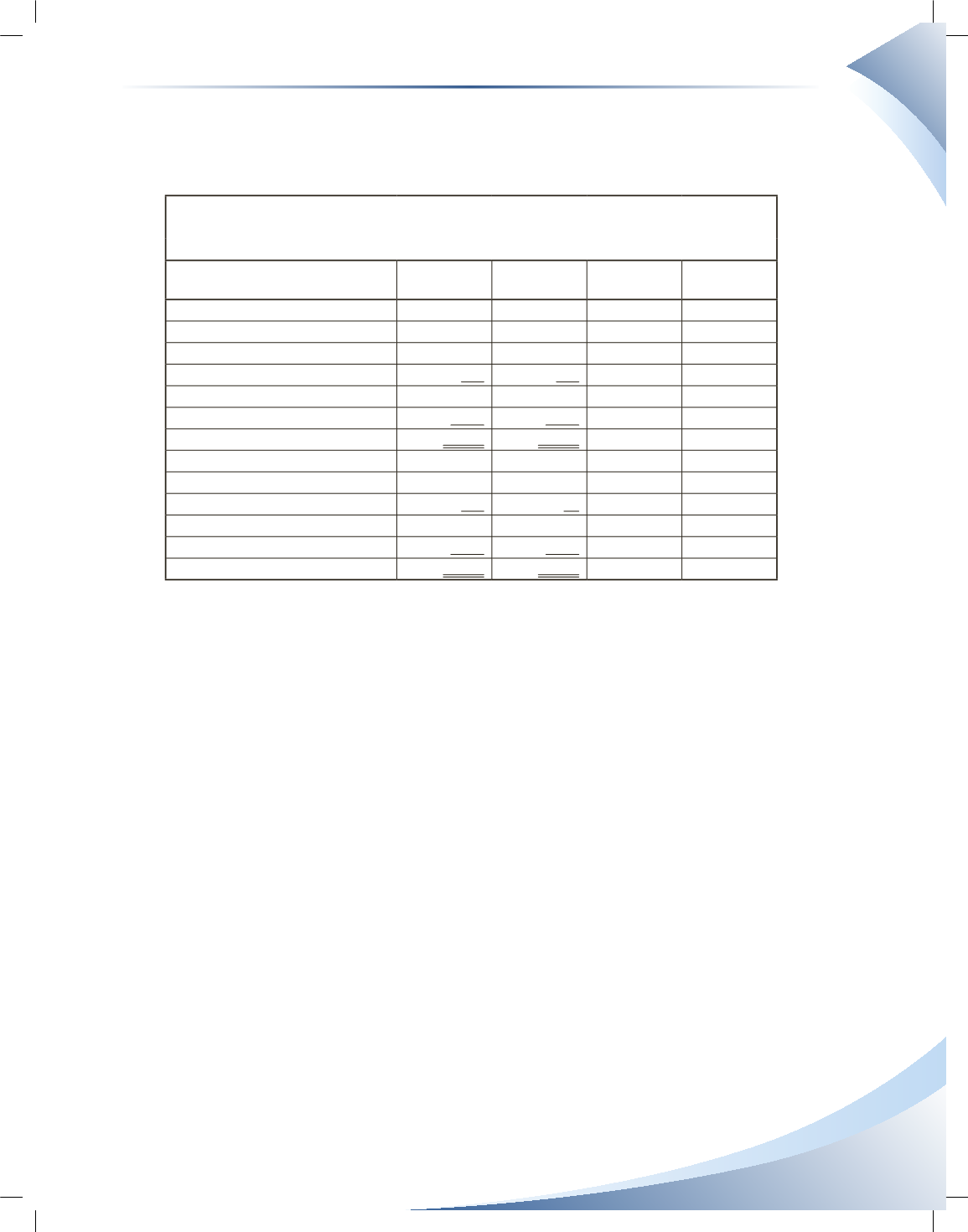

Chapter 12 Review Exercise—Solutions

Review Exercise 1

Basil's Bakery

Percentage Change and Vertical Analysis

As at December 31

2016

2015

% Change

% of Base-

Figure 2016

Cash

$1,650

$987

67.17% 29.70%

Accounts Receivable

1,175

573

105.06% 21.15%

Inventory

396

256

54.69% 7.13%

Other current assets

301

103

192.23% 5.42%

Total Current Assets

3,522

1,919

83.53% 63.39%

Property, plant & equipment

2,034

1,170

73.85% 36.61%

TOTAL ASSETS

$5,556

$3,089

79.86% 100.00%

Current Liabilities

$1,474

$547

169.47% 26.53%

Non-current liabilities

104

58

79.31% 1.87%

TOTAL LIABILITIES

1,578

605

160.83% 28.40%

SHAREHOLDERS' EQUITY

3,978

2,484

60.14% 71.60%

TOTAL LIABILITIES AND EQUITY

$5,556

$3,089

79.86% 100.00%

Basil’s Bakery has grown considerably in 2016 compared to 2015, as witnessed by the positive

percentage changes in all categories. While shareholders’ equity increased 60.14% from 2015, total

liabilities increased even more at 160.83%. This larger percentage increase in liabilities is not neces-

sarily a bad thing, considering that the total liabilities balance is still much lower than shareholders’

equity balance. As shown in the vertical analysis, total liabilities are only 28.40% of total assets,

compared to shareholders’ equity which is 71.60% of total assets. Additionally, liquidity does not

appear to be a problem, considering that Basil’s Bakery has far more current assets (63.39% of total

assets) than current liabilities (26.53% of total assets). Therefore, the company is in a good position

to take advantage of higher leverage provided it can cover the interest expense that comes with

more debt. Another important thing to note from the annual percentage change is the 105.06%

increase in accounts receivable, which is higher than the percentage increases of cash and inventory.

This means that Basil’s Bakery has been growing its business partly by increasing credit sales. The

company may need to put more focus on management and control of accounts receivable, as the

company’s success will increasingly depend on its ability to collect its accounts receivable.