Appendix I

Review Exercise Solutions

432

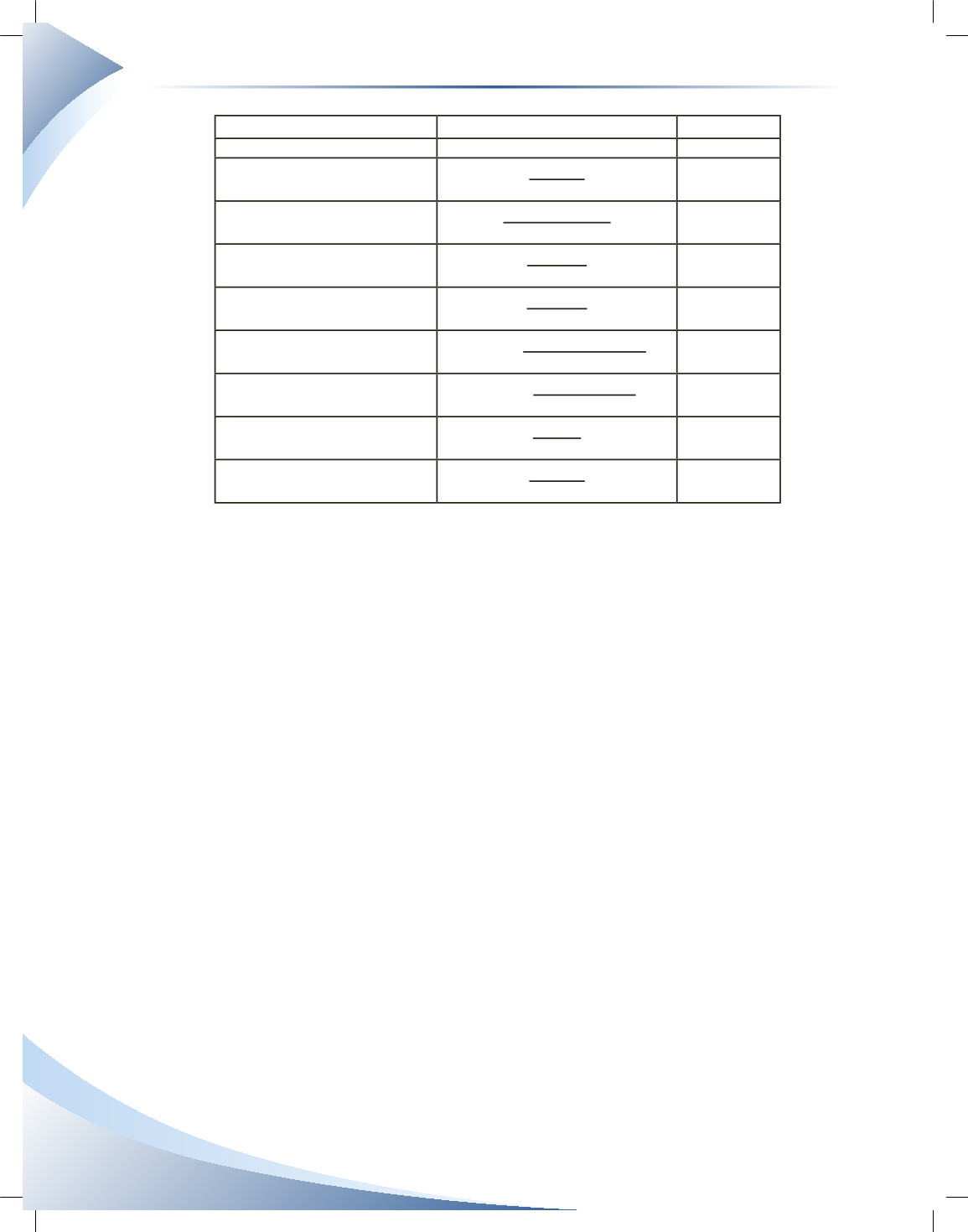

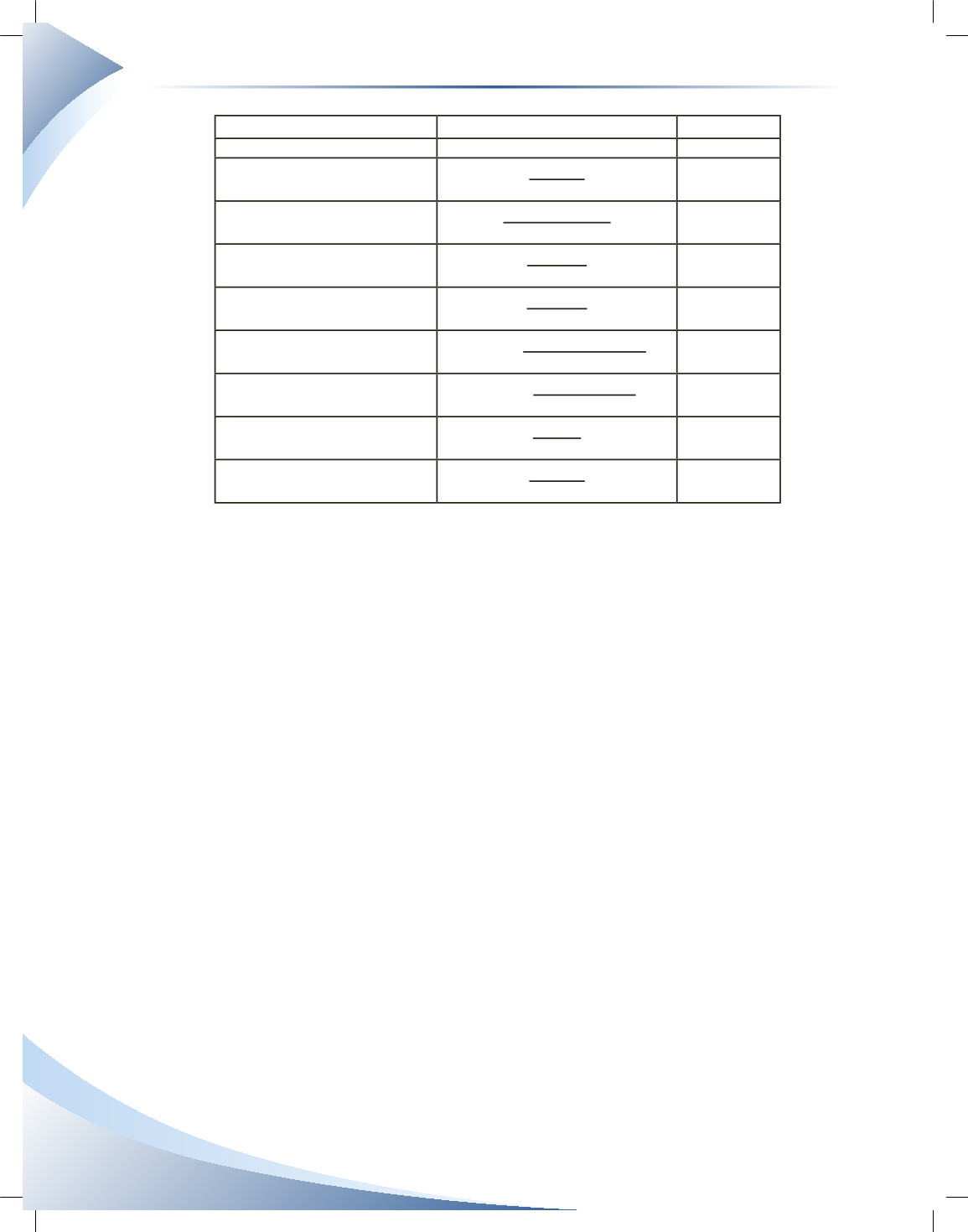

Financial Ratio or Figure

Calculation

Result

Working Capital

$3,477 – $1,474

$2,003

Current Ratio

$3,477

$1,474

2.36

Quick Ratio

$1,605 + $1,175

$1,474

1.89

Gross Profit Margin

$3,081

$6,009

0.5127 or

51.27%

Net Profit Margin

$1,295

$6,009

0.2155 or

21.55%

Return on Equity

$1,295 ÷ ($3,933 + $2,484 )

2

0.4036 or

40.36%

Inventory Turnover Ratio

$2,928 ÷ ($396 + $256 )

2

8.98

Inventory Days on Hand

365

8.98

40.65 days

Debt-to-Equity Ratio

$1,578

$3,933

0.4012 or

40.12%

Basil’s Bakery has a positive

working capital

of $2,003 which indicates that the company has

enough liquid assets to pay off its upcoming short-term debts.

The company has a

current ratio

of 2.36 which indicates that the business has double and a bit of

current assets to pay for its current liabilities. It could be argued that the Bakery has enough of a

cushion that it could afford to have more cash tied up in current assets, such as inventory and accounts

receivable. It could also invest a small portion to earn more investment income.

The Bakery has a

quick ratio

of 1.89 which indicates that the business can meet its most imme-

diate debt obligations without relying on the liquidation of inventory. In terms of liquidity as a

whole, Basil’s Bakery is highly liquid based on the above three financial ratios and figures, indi-

cating a strong financial position in its short-term goals.

The organization has a

gross profit margin

of 51.27% which means that the company has an

easier time covering its expenses and is more likely to be profitable. Compared to 2015, the gross

profit margin declined, indicating that the company is either not generating enough revenue, has

experienced an increase in inventory costs or both. This should be a point of concern, indicating a

downward trend. Comparing 2016’s gross profit margin to the industry average of 49.47% shows

that the bakery is doing better than the average company in the same industry. It must work to

ensure that it remains above this amount by managing costs and expenses.

The business has a

net profit margin

of 21.55% which means that the company is earning 21 cents

of net income for every one dollar of revenue earned. Compared to 2015, the net profit margin

declined, indicating that the company’s costs have increased. This should be a point of concern,

indicating a downward trend. Comparing 2016’s net profit margin to the industry average of

20.36% shows that the bakery is doing better than the average company in the same industry. It

must work to ensure that it remains above this amount by managing costs and expenses.