Appendix I

Review Exercise Solutions

430

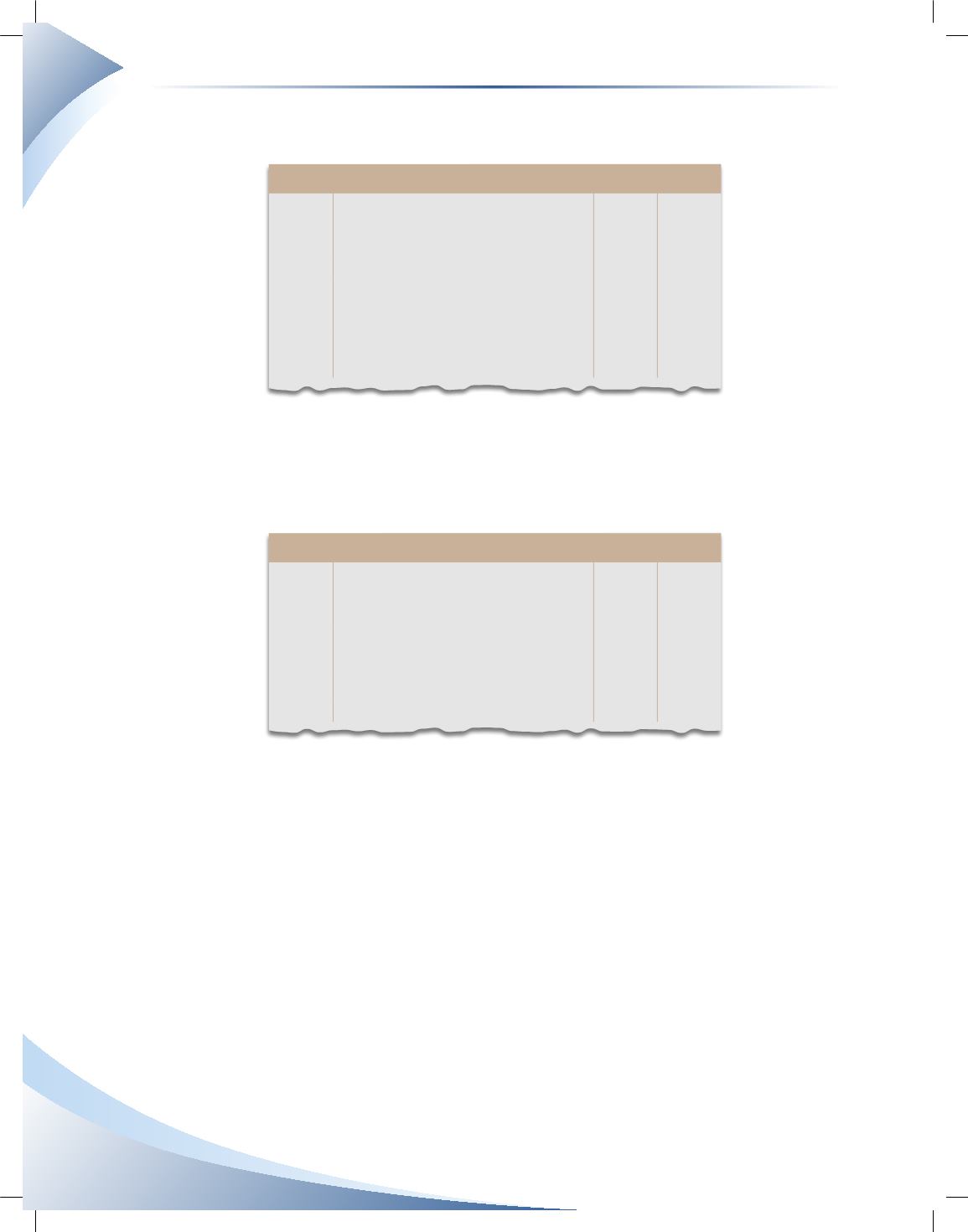

d) Employer expenses

JOURNAL Page 1

Date

2015

Account Title and Explanation

Debit Credit

Jun 19 Employee Benefits Expense

342.81

CPP Payable

154.12

EI Payable

92.58

Health Plan Payable

75.00

Workers' Compensation Payable

21.11

Record business expense

Employer portion of EI = $66.13 × 1.4

Workers’ compensation = $3,517.50 × 0.6%

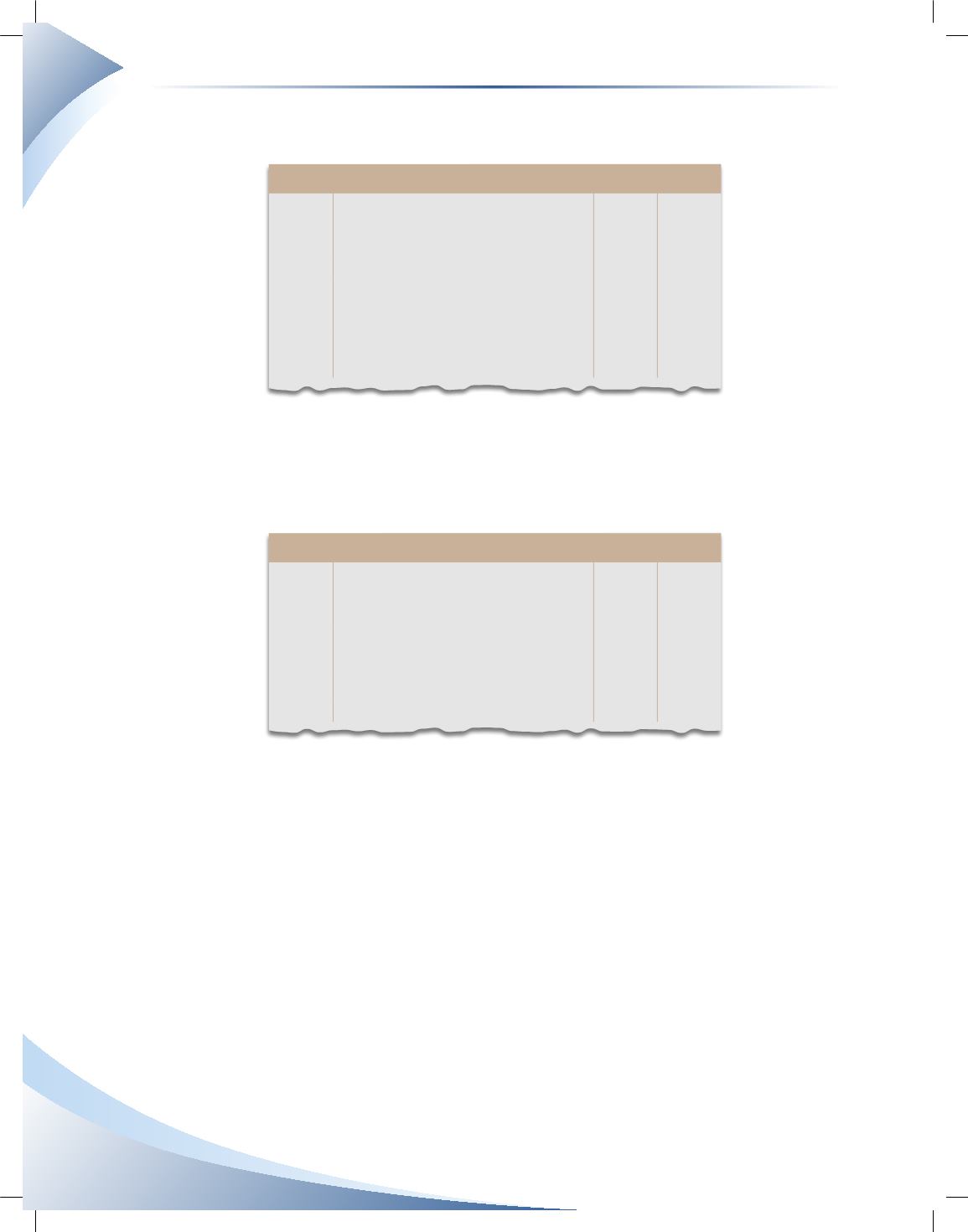

e) Government remittance

JOURNAL Page 1

Date

2015

Account Title and Explanation

Debit Credit

Jul 15 CPP Payable

308.24

EI Payable

158.71

Income Tax Payable

633.15

Cash

1,100.10

Payment to the government

CPP Payable = $154.12 + $154.12

EI Payable = $66.13 + $92.58