436

Appendix III

Review Exercise Solutions

Appendix III

ASPE vs IFRS

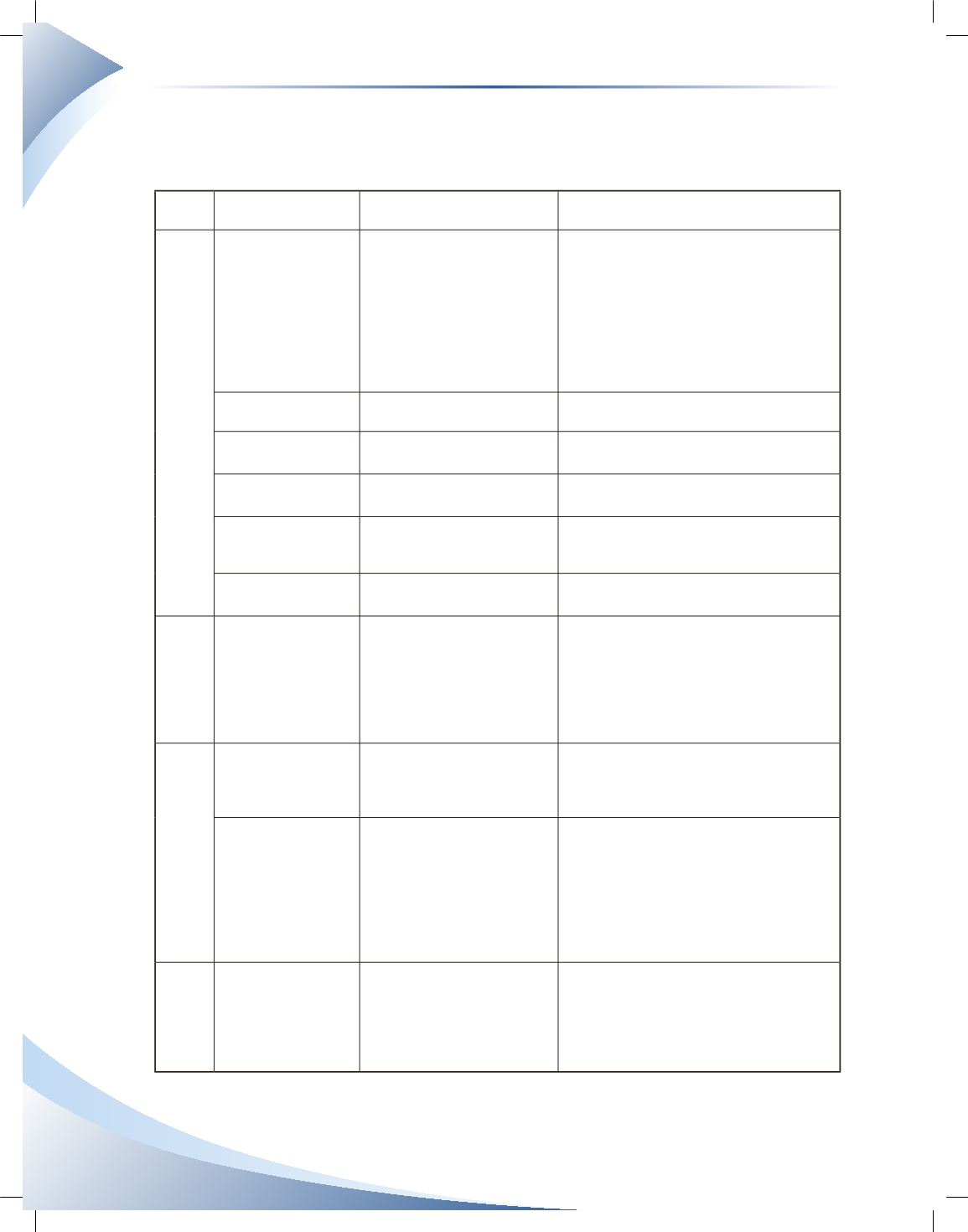

Chapter

Topic

Accounting Standards for

Private Enterprises (ASPE)

International Financial Reporting

Standards (IFRS)

3

When to use

• Private organization (sole

proprietorship, partnership,

private corporations)

• No plans to become public in

the near future

• ASPE also used by most

competitors

• Public corporation or owned by a public

company

• Private organization intending to become

public in the near future

• IFRS already adopted by most competitors

• Private enterprises adopting IFRS by choice

for other reasons, such as, in anticipation

of a bank's requirement for IFRS-based

financial statements in loan application

Cost

Less costly and simpler to

implement

Can be costly to implement

Number of disclosure

requirements

Fewer disclosures are required More disclosures are required

Comparability

Less comparable on a global

scale

More relevant, reliable and comparable on a

global scale

Development status ASPE may eventually evolve

into IFRS in the future

IFRS is positioned to be the global

accounting standards for the foreseeable

future

Level of judgments

required

More specific rules; fewer

judgments required

Fewer hard-and-fast rules; more judgments

required

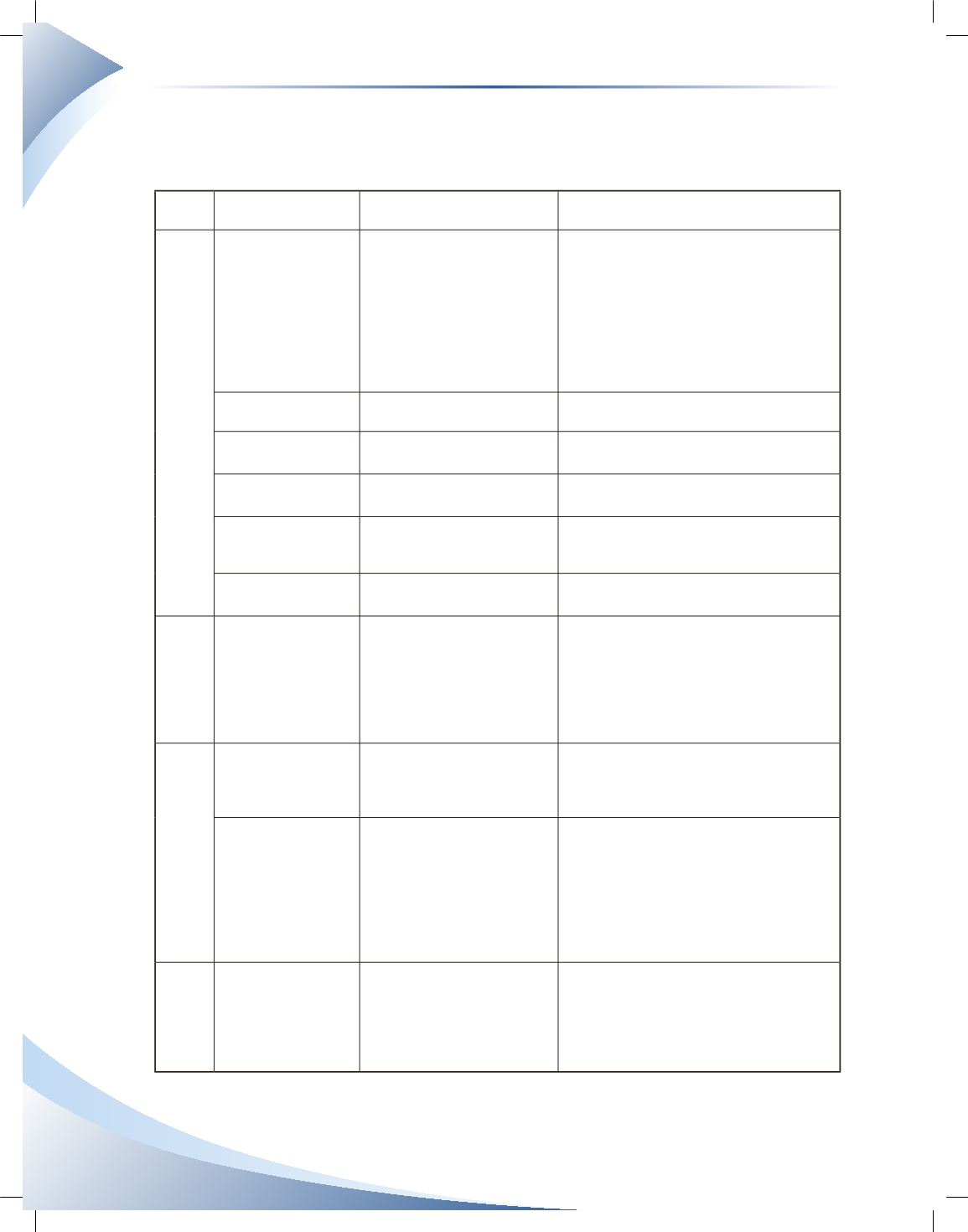

5

Frequency of financial

statement issuance

Companies are required to

prepare financial statements

at least once a year. This

implies that the end-of-period

adjustments process must also

be completed at least once a

year.

Companies are required to prepare financial

statements at least once per quarter. This

implies that the end-of-period adjustments

process must be completed at least four

times a year.

6

Balance Sheet

or Statement of

Financial Position

terminology

The term "Balance Sheet" is

more often used, although the

term "Statement of Financial

Position" is also allowed.

The term "Statement of Financial Position"

is more often used, although the term

"Balance Sheet" is also allowed.

Order of items listed

on the balance sheet

or statement of

financial position

The listing order of items on a

balance sheet is not specified,

although ordering items from

most liquid to least liquid

on the balance sheet is a

common practice among the

companies adopting ASPE.

IFRS also does not prescribe the listing order

of items on a statement of financial position.

However, a common practice among the

companies adopting IFRS, particularly

European companies, is ordering assets

from least liquid to most liquid. Additionally,

equity is commonly presented before long-

term liabilities, followed by current liabilities.

7

Expense classification

on income statement

A company can choose to

present its expenses on an

income statement by nature,

or by function, or even by

using a mixture of nature and

function.

Expenses can be classified either by nature

or by function on an income statement.

Using a mixture of nature and function is

prohibited.