Chapter 2

Linking Personal Accounting to Business Accounting

50

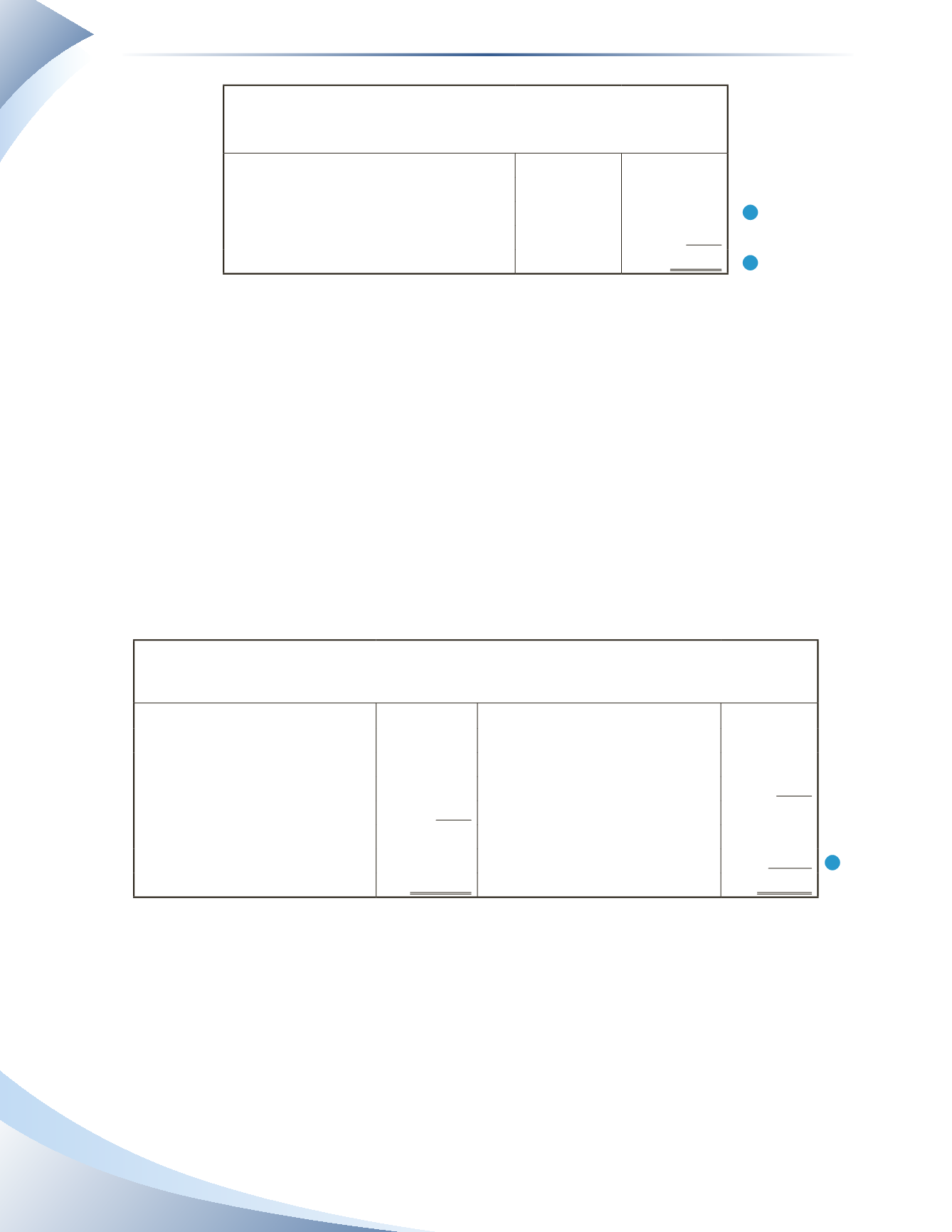

Ace Bookkeepers

Statement of Owner’s Equity

For the Month Ended March 31, 2016

Smith, Capital, March 1, 2016

$0

Add: Investment

30,000

Net Income

9,400

Less: Smith, Drawings

2,000

Smith, Capital, March 31, 2016

$37,400

______________

FIGURE 2.32

1

2

Since the business was started this month, the balance of the owner’s capital account was $0 at the

beginning of the month.The investment made in the first transaction is added, as is the net income

we calculated from the income statement (indicated by the number 1). The amount of drawings

by the owner is subtracted to give us a final balance of the owner’s capital of $37,400.The closing

balance for March will be the opening balance shown on April’s statement of owner’s equity.

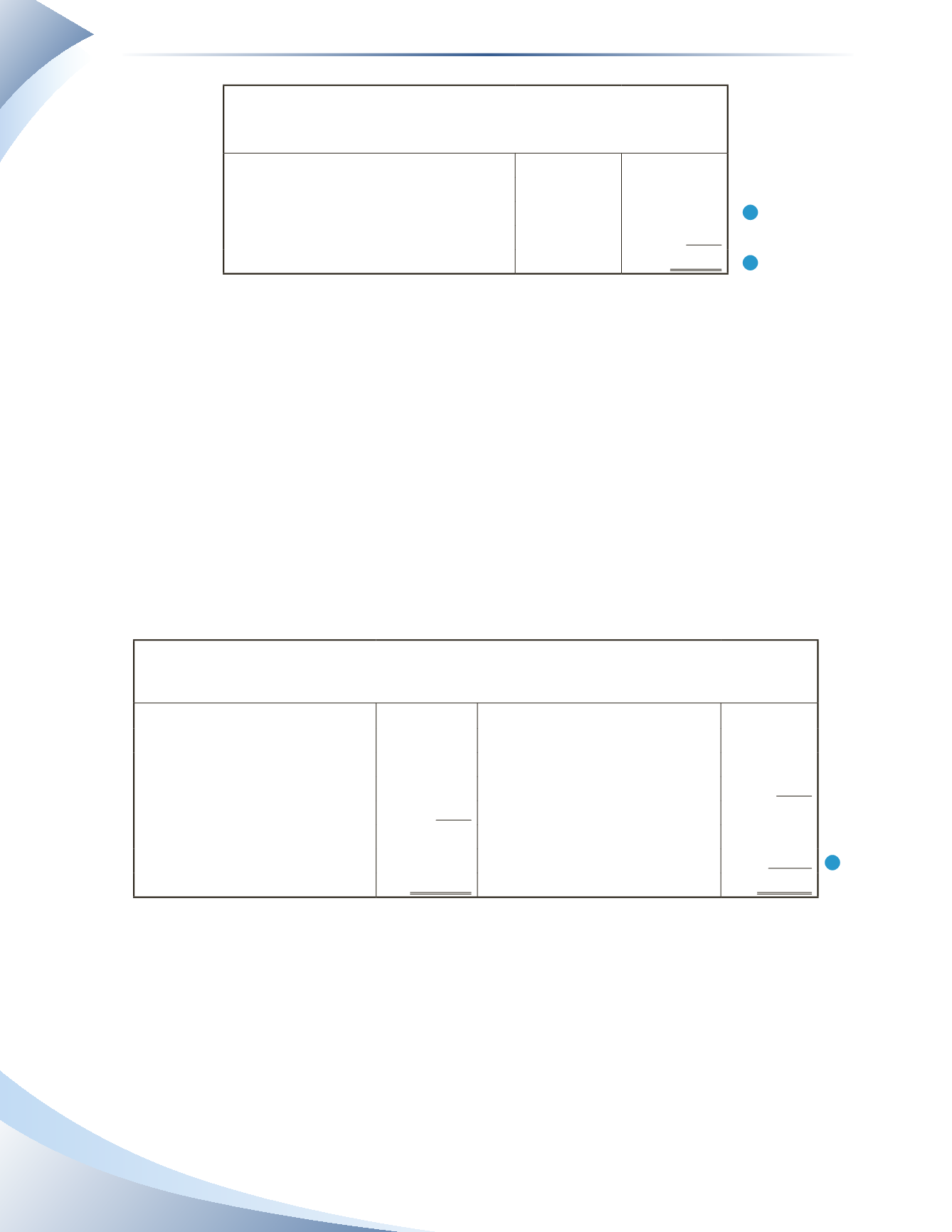

Lastly, the balance sheet can be created to report on the balances of assets, liabilities and owner’s

equity on March 31, 2016.The balance sheet is shown in Figure 2.33. Notice how the value of the

owner’s capital is taken from the statement of owner’s equity (indicated by the number 2). Also

the total of the assets is equal to the total of liabilities plus owner’s equity.These totals must be the

same, otherwise the accounting equation is not balanced and there is an error either in recording

the transactions in the T-accounts or in the calculation of the financial statements.

Ace Bookkeepers

Balance Sheet

As at March 31, 2016

Assets

Liabilities

Cash

$ 29,900 Accounts Payable

$ 2,000

Accounts Receivable

3,500 Unearned Revenue

2,000

Prepaid Insurance

6,000 Bank Loan

7,000

Furniture

8,000

Total Liabilities

11,000

Owner’s Equity

Smith, Capital

37,400

Total Assets

$ 48,400

Total Liabilities & Owner’s Equity

$ 48,400

______________

FIGURE 2.33

2