Chapter 2

Linking Personal Accounting to Business Accounting

49

Financial Statements

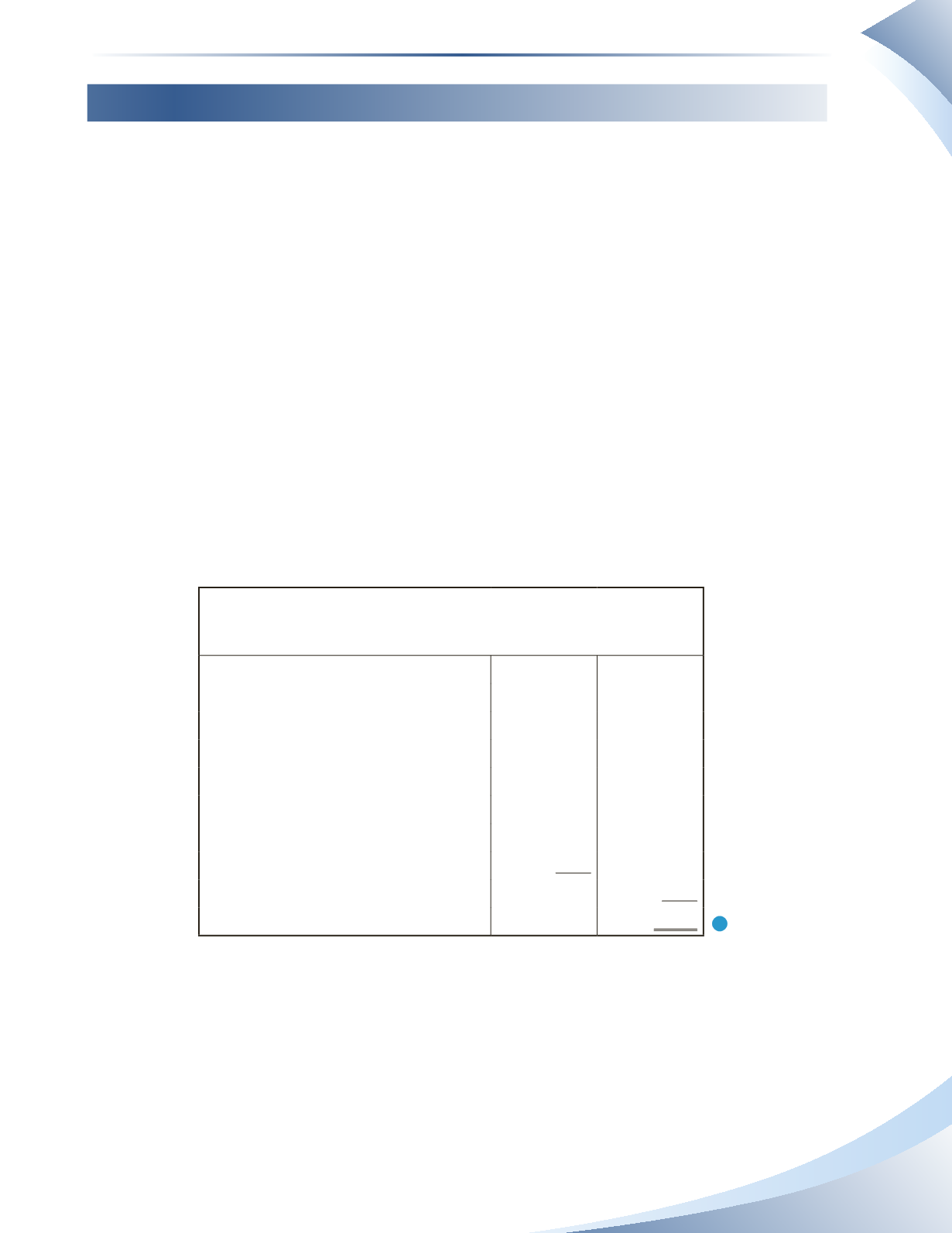

Now that the T-account worksheet is complete, we can prepare formal financial statements. All

financial statements follow certain formatting standards when being created.

•

Each statement will have three lines at the top to identify the company (e.g. Ace Book-

keepers), the statement (e.g. Income Statement) and the time period or date the statement

covers (e.g. For the Month Ended March 31, 2016).

•

The first number in each column will have a dollar sign to indicate the currency of values

presented in the statement.

•

The last number in a calculated column will have a single underline to indicate a total or

subtotal is being calculated.

•

The final number on the financial statement, or in the case of the balance sheet the total

assets and the total liabilities and owner’s equity figures, will have a dollar sign and be double

underlined.

The first statement to complete is the income statement shown in Figure 2.31. Recall that this

reports on the revenue earned and expenses incurred during the period. For Ace Bookkeepers, this

income statement is for the month ended March 31, 2016 and shows a net income of $9,400.

Ace Bookkeepers

Income Statement

For the Month Ended March 31, 2016

Revenue

Service Revenue

$19,000

Expenses

Interest Expense

$200

Rent Expense

1,100

Salaries Expense

6,000

Telephone Expense

300

Travel Expense

2,000

Total Expenses

9,600

Net Income

$9,400

______________

FIGURE 2.31

1

The

Statement of Owner’s Equity

is the formal statement to show how owner’s equity changed

during the month. It will cover the same reporting period as the income statement, so Ace Book-

keepers will prepare the statement of owner’s equity for the month ended March 31, 2016. The

basic calculation for the change in equity was shown at the bottom of the T-account worksheet in

Figure 2.30. The statement of owner’s equity is the formal presentation of this calculation and is

shown in Figure 2.32.