Chapter 2

Linking Personal Accounting to Business Accounting

41

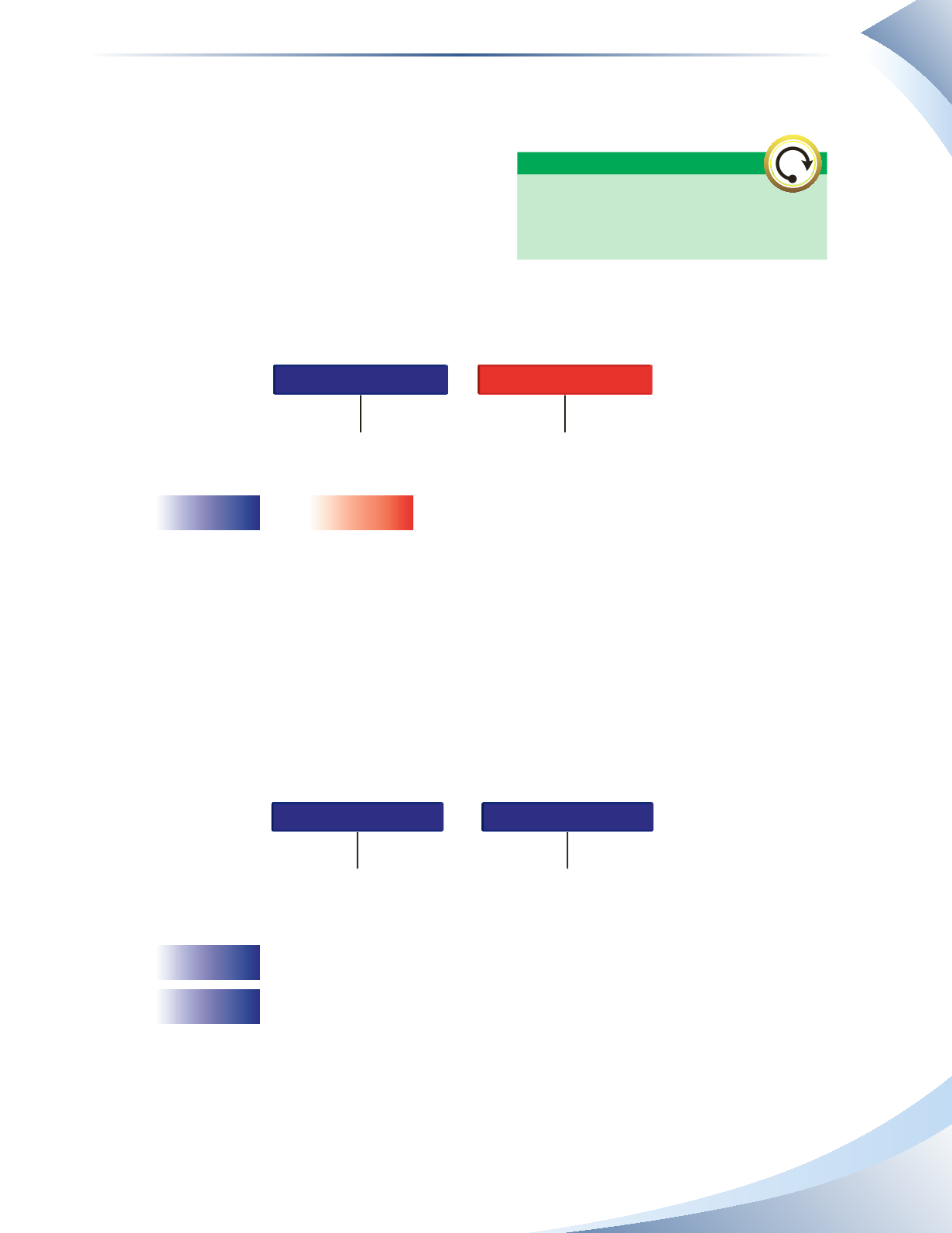

Transaction 2: Borrowed cash from the bank

The business has increased its debt by getting a

loan from the bank. This transaction is recorded by

increasing cash (an asset) and increasing the value of

bank loan (a liability). The transaction has no impact

on owner’s equity; therefore nothing is recorded on the

income statement. Again, the accounting equation will

remain in balance.

Record the transaction in the T-accounts

CASH

BANK LOAN

+

-

-

+

10,000

10,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

+ 10,000

+ 10,000

Explanation*

*Explanation of changes to Owner’s Equity

*Explanation of changes to Owner’s Equity

______________

FIGURE 2.18

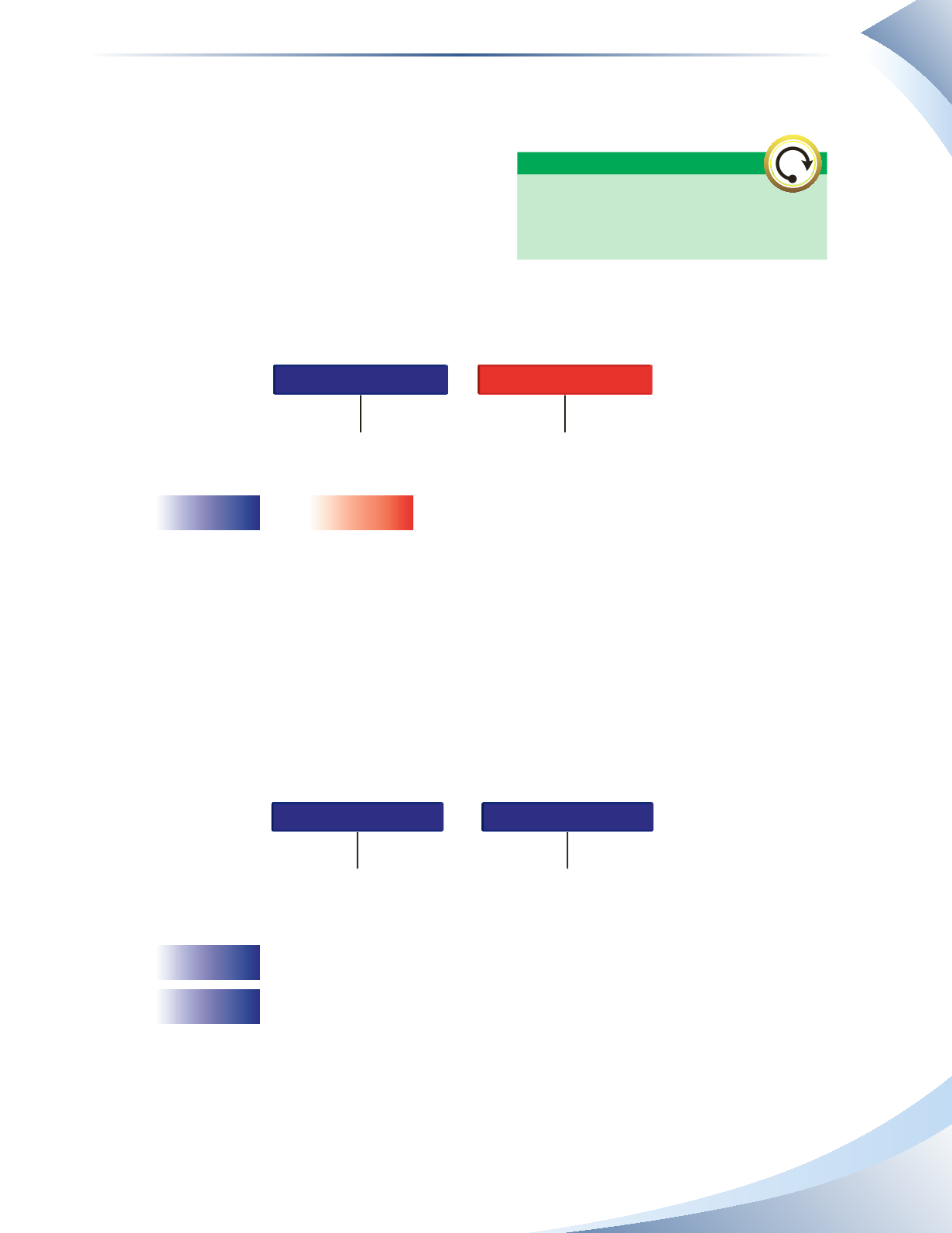

Transaction 3: Bought furniture with cash

Furniture, computers, cars and other similar assets are considered to be property, plant and equipment

and are long-term assets.These assets are used to run the business and generate sales and should not be

sold to customers or sold to raise cash to pay for day-to-day expenses. Each type of property, plant and

equipment is given its own T-account.This transaction is simply an exchange of one asset for another,

and is recorded by increasing furniture and decreasing cash as shown in Figure 2.19.

Record the transaction in the T-accounts

CASH

FURNITURE

+

+

-

-

8,000

8,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

- 8,000

+ 8,000

Explanation*

*Explanation of changes to Owner’s Equity

*Explanation of changes to Owner’s Equity

______________

FIGURE 2.19

A bank loan increases an asset and a

liability without affecting the balance of

owner’s equity.

WORTH REPEATING