Chapter 2

Linking Personal Accounting to Business Accounting

44

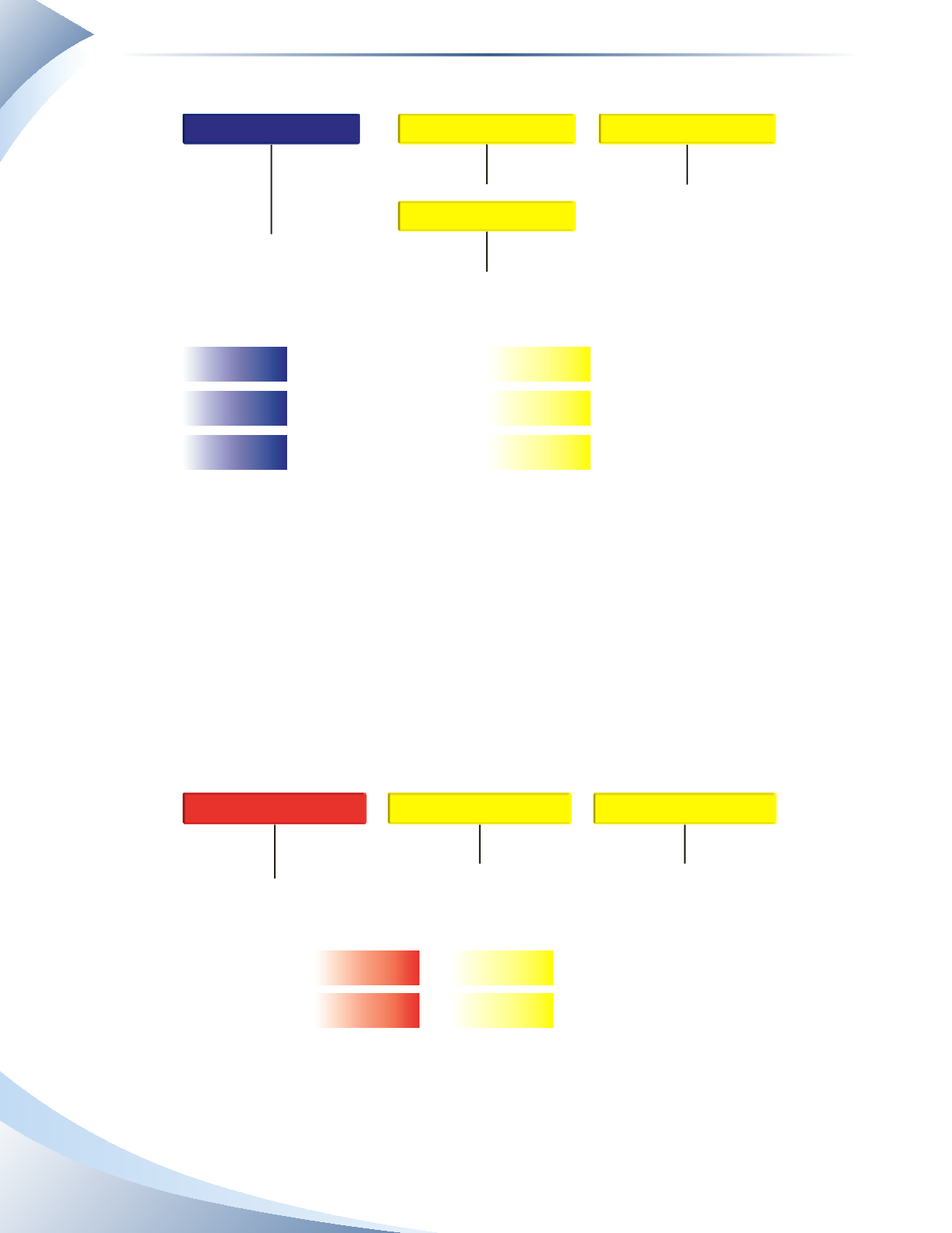

Record the transaction in the T-accounts

CASH

RENT EXPENSE

INTEREST EXPENSE

SALARIES EXPENSE

+

+

+

+

-

-

-

-

1,100

6,000

200

1,100

200

6,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

- 1,100

- 6,000

- 200

- 1,100

- 6,000

- 200

*Explanation of changes to Owner’s Equity

Rent expense

Salaries expense

Interest expense

Explanation*

______________

FIGURE 2.24

Transactions 11 and 12: Incurred expenses to be paid later

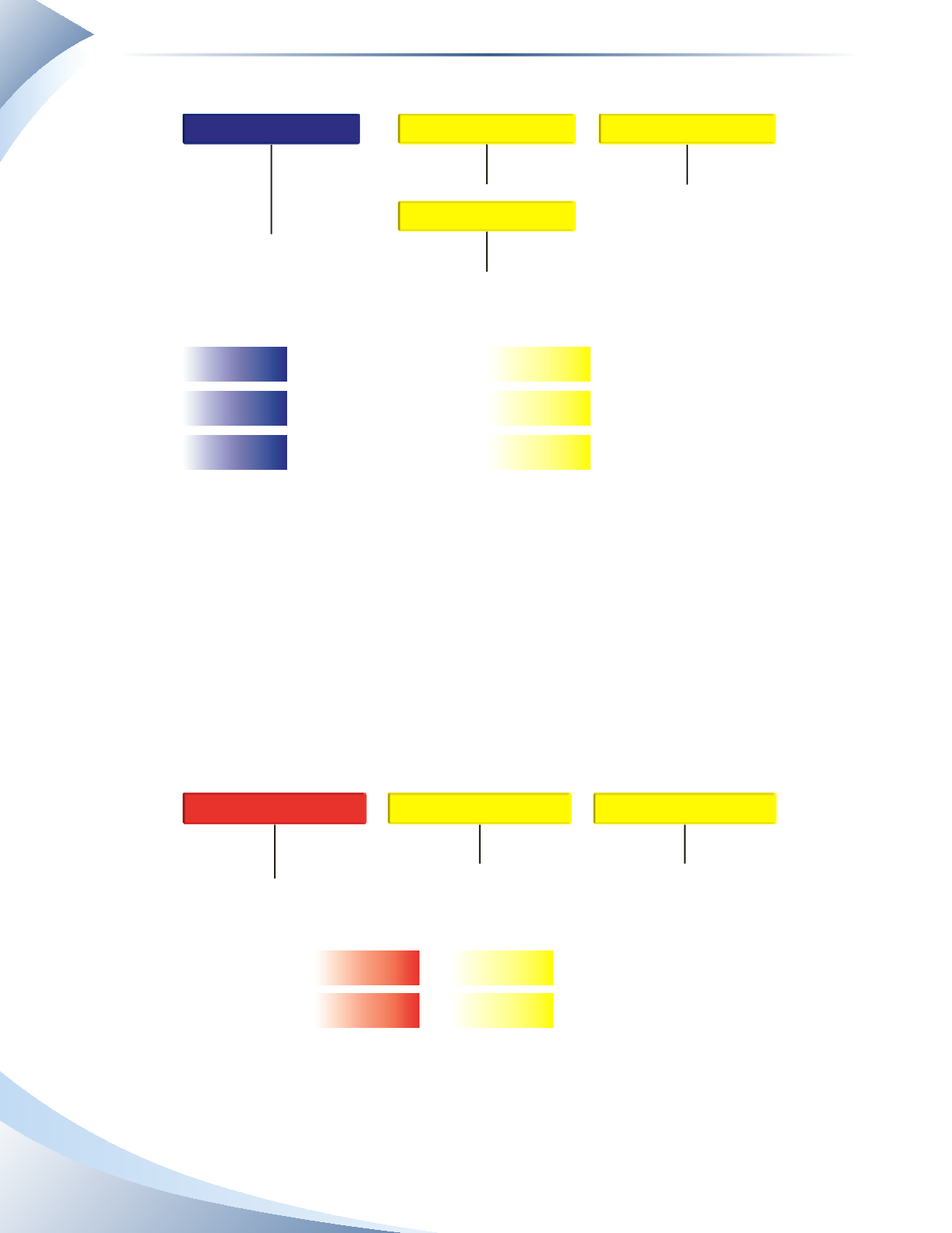

The telephone expense is due to be paid next month and travel expenses were billed to a credit card

that is also to be paid next month.These expenses must be recorded this month because they were

incurred and used to generate sales this month. In other words, expenses incurred are matched to

revenue earned in the same period.This transaction is recorded by increasing accounts payable and

increasing the appropriate expense account, as illustrated in Figure 2.25. Remember, the equity in

the business decreases and is recorded as an increase to expenses.

Record the transaction in the T-accounts

ACCOUNTS PAYABLE

TELEPHONE EXPENSE

TRAVEL EXPENSE

-

+

+

+

-

-

300

2,000

300

2,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

- 300

- 2,000

+ 300

+ 2,000

*Explanation of changes to Owner’s Equity

Telephone expense

Travel expense

Explanation*

______________

FIGURE 2.25