Chapter 2

Linking Personal Accounting to Business Accounting

43

that accounts receivable is the amount owing to the business from its customers. Since accounts

receivable will eventually be collected and become cash, it is regarded as an asset. Since services

were provided at this time, the equity in the business increases and is recorded as an increase to

service revenue. A customer payment for this service will be shown in transaction 15.

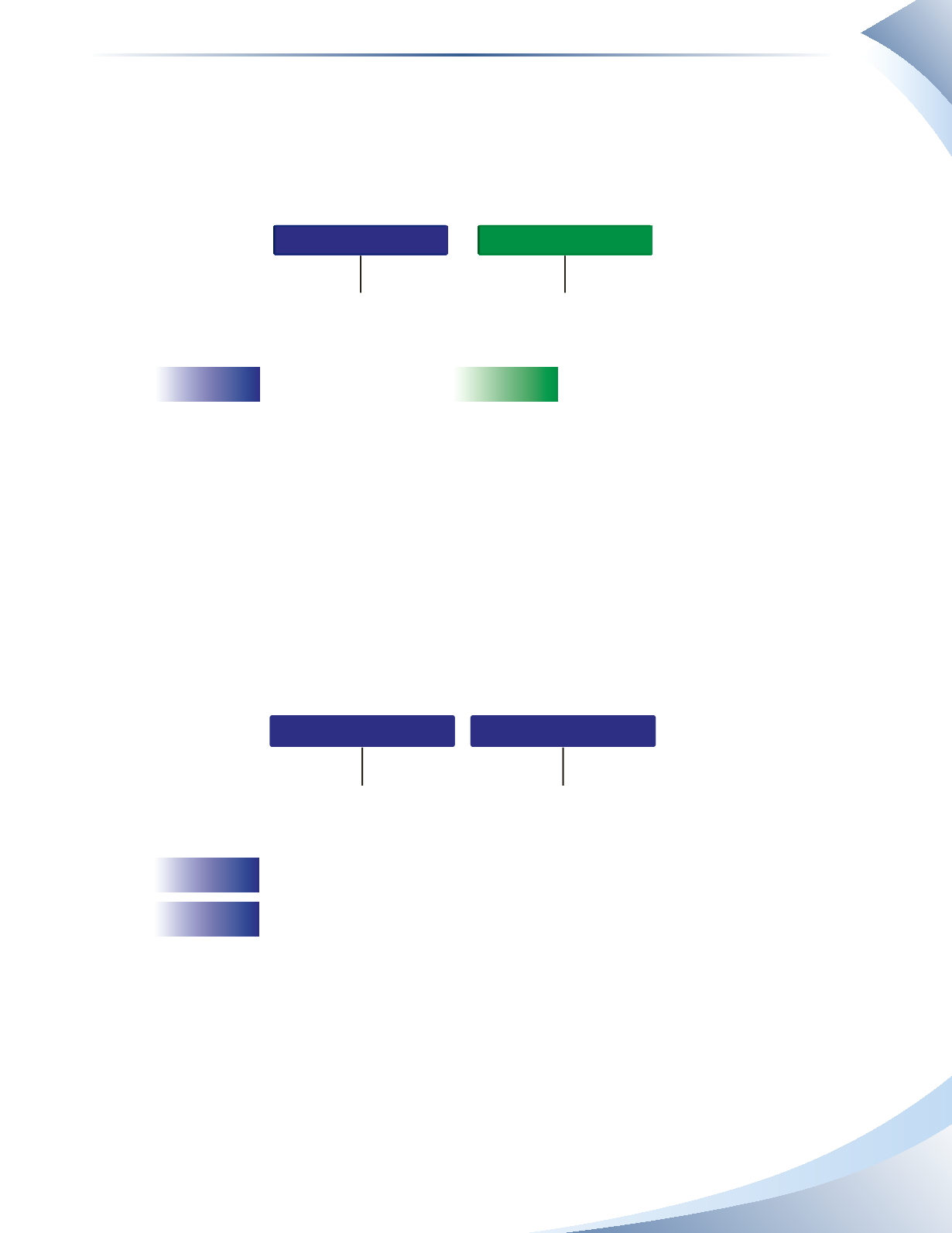

Record the transaction in the T-accounts

ACCOUNTS RECEIVABLE

SERVICE REVENUE

+

-

-

+

4,000

4,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

+ 4,000

+ 4,000

*Explanation of changes to Owner’s Equity

Revenue earned

Explanation*

______________

FIGURE 2.22

Transaction 7: Prepaid insurance for one year with cash

It is common for a business to prepay various expenses such as insurance, web-hosting fees,

consulting fees and legal fees. Recall from the previous chapter how prepaid expenses are recorded.

The same concept is practiced in business.The item that is prepaid is initially recorded as an asset on

the balance sheet. Figure 2.23 shows how the prepayment for insurance is recorded by decreasing

cash and increasing prepaid insurance. The transaction to convert this asset to an expense will be

covered in a later chapter.

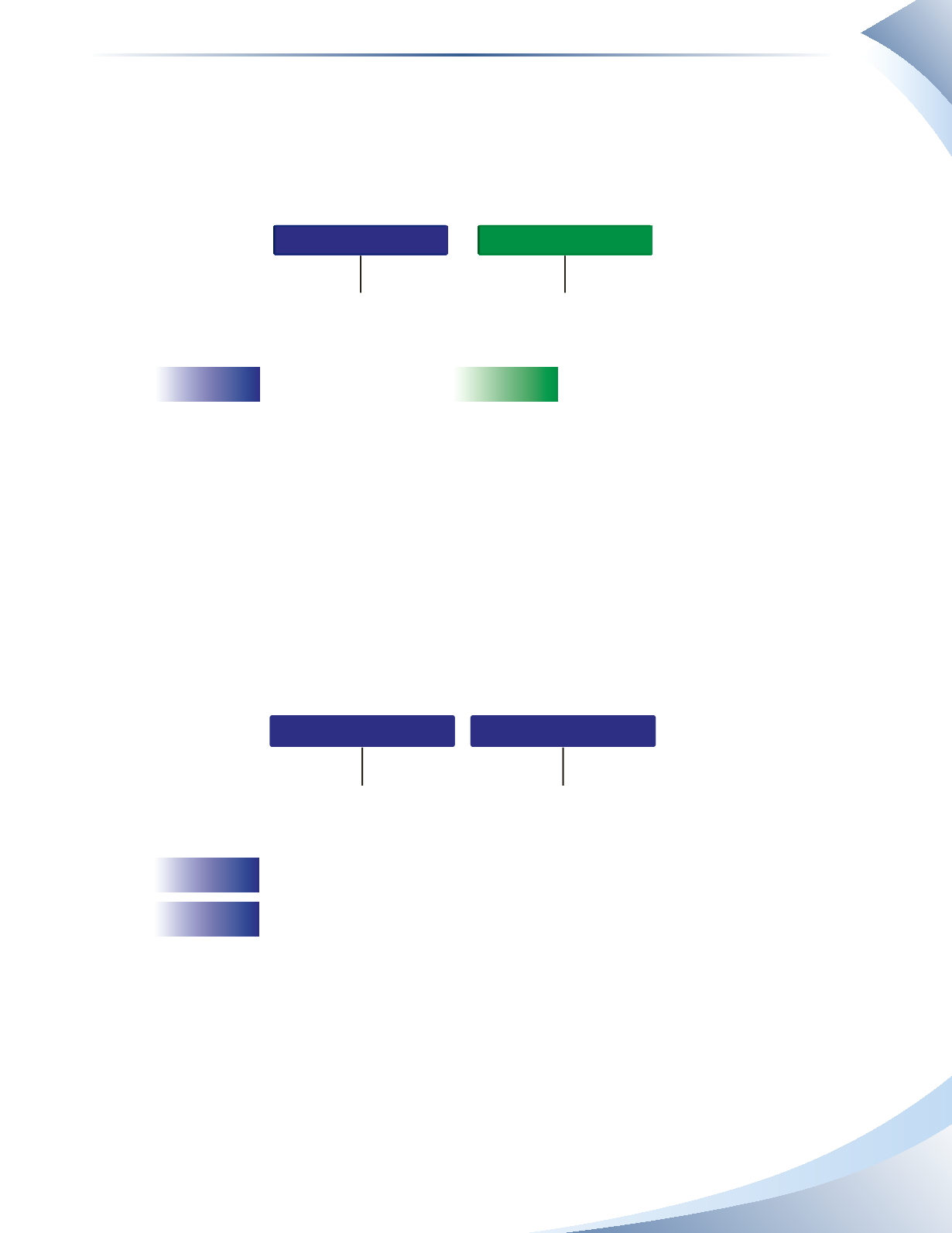

Record the transaction in the T-accounts

CASH

PREPAID INSURANCE

+

+ -

-

6,000

6,000

Analyze the impact on the accounting equation

Assets = Liabilities + Owner’s Equity

- 6,000

+ 6,000

*Explanation of changes to Owner’s Equity

Explanation*

______________

FIGURE 2.23

Transactions 8 through 10: Paid cash for expenses

All these transactions relate to cash expenses.The transactions are recorded by decreasing the value

of the cash account and increasing the value of the appropriate expense account. These expenses

were incurred by the business in order to run the business and help generate revenue. Remember,

the equity in the business decreases and is recorded as an increase to expenses.