Chapter 3

The Accounting Framework

61

Partnerships are private enterprises. A part-

nership, like a proprietorship, is not legally

separated from its owners. Depending on the

type of partnership, partners may be subject to

unlimited liability, which means that the part-

ners are jointly responsible for all the debts

of the partnership. In a partnership,

mutual

agency

exists. Mutual agency means that each

partner is able to speak for the other partners

and bind them to business contracts. In other

words, each partner is bound by the business

actions of the other partners.

There are three types of partnerships that can

be created.

1.

A

general partnership

is a partnership in which all partners are subject to unlimited liability.

All partners are considered to be general partners. Unless special provisions are made (as

described below), all partnerships are general partnerships.

2.

A

limited partnership

includes at least one general partner who accepts unlimited liability

and one or more limited partners with liability limited to the amount they invested. All

partnerships must have at least one general partner. The limited partners are sometimes

referred to as silent partners, because they are not allowed to provide management input for

the business.

3.

A

limited liability partnership

(LLP) allows partners to have limited liability regarding the

misconduct or negligence of the other partners. For example, if a partner in a law firm that

is an LLP is sued for misconduct, only the partner in question will be responsible for paying

damages. However, all partners remain personally liable for all other debts of the business.

Corporation

A

corporation

is a business that is registered with the provin-

cial or federal government as a separate legal entity from its

owners, the shareholders. As a separate legal entity, the corpo-

ration has all the rights of a person and is responsible for its

own activities and is liable for its own debts. It can enter into

contracts and buy and sell products or assets. It can also sue

others and be sued.

A

shareholder

is an owner of the business through ownership

of

shares

. Each share provides partial ownership of the business. For example, if a person owns

one share and there are 100 shares available, the person owns 1/100

th

of the corporation. If a

shareholder owns more than 50% of all the shares of a corporation, they can control the business.

Shareholders are legally distinct from the business and their financial risk is limited to the

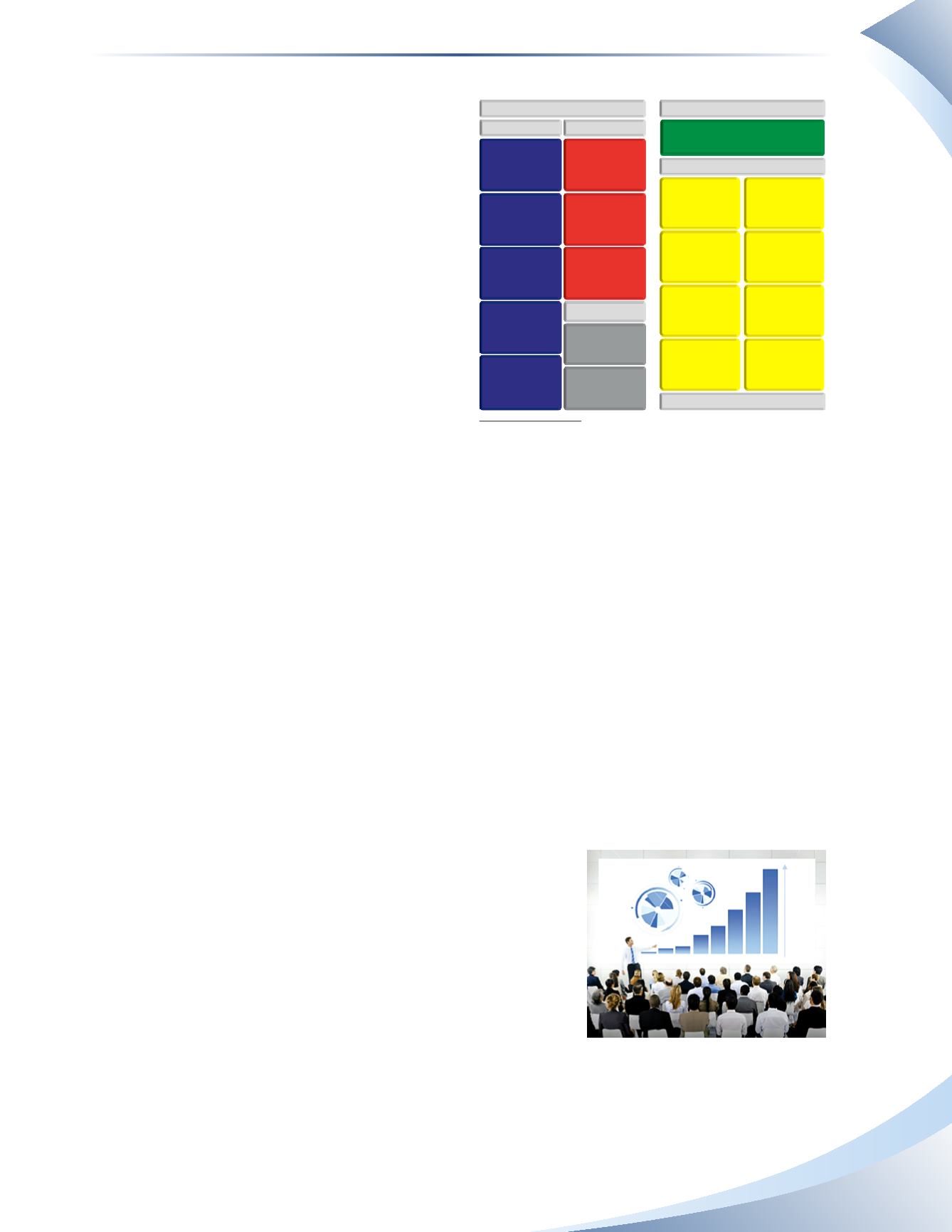

FIGURE 3.2

INCOME STATEMENT

NET INCOME (LOSS)

EXPENSES

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

LOANS

PAYABLE

REVENUE

OWNER’S EQUITY

PARTNER’S

A CAPITAL

PARTNER’S

B CAPITAL

TRAVEL

INSURANCE

DEPRECIATION

INTEREST

MAINTENANCE

SALARIES

RENT

UTILITIES