Chapter 3

The Accounting Framework

69

more complex and more costly to account for. Is this $100 a material amount? It depends on the

size of the company and the judgment of the accountant. If the company typically lists more than

$100,000 in assets, the $100 is not likely to affect any user’s decision and is therefore immaterial.

On the other hand, if the company typically lists total assets of $1,000, the treatment of $100 in

office supplies may impact the decision of an investor.

Disclosure

states that any and all information that affects the full understanding of a company’s

financial statements must be included with the financial statements. Some items may not affect

the accounting records directly. These items would be included in the notes accompanying the

statements. Examples of such items are outstanding lawsuits, tax disputes and company takeovers.

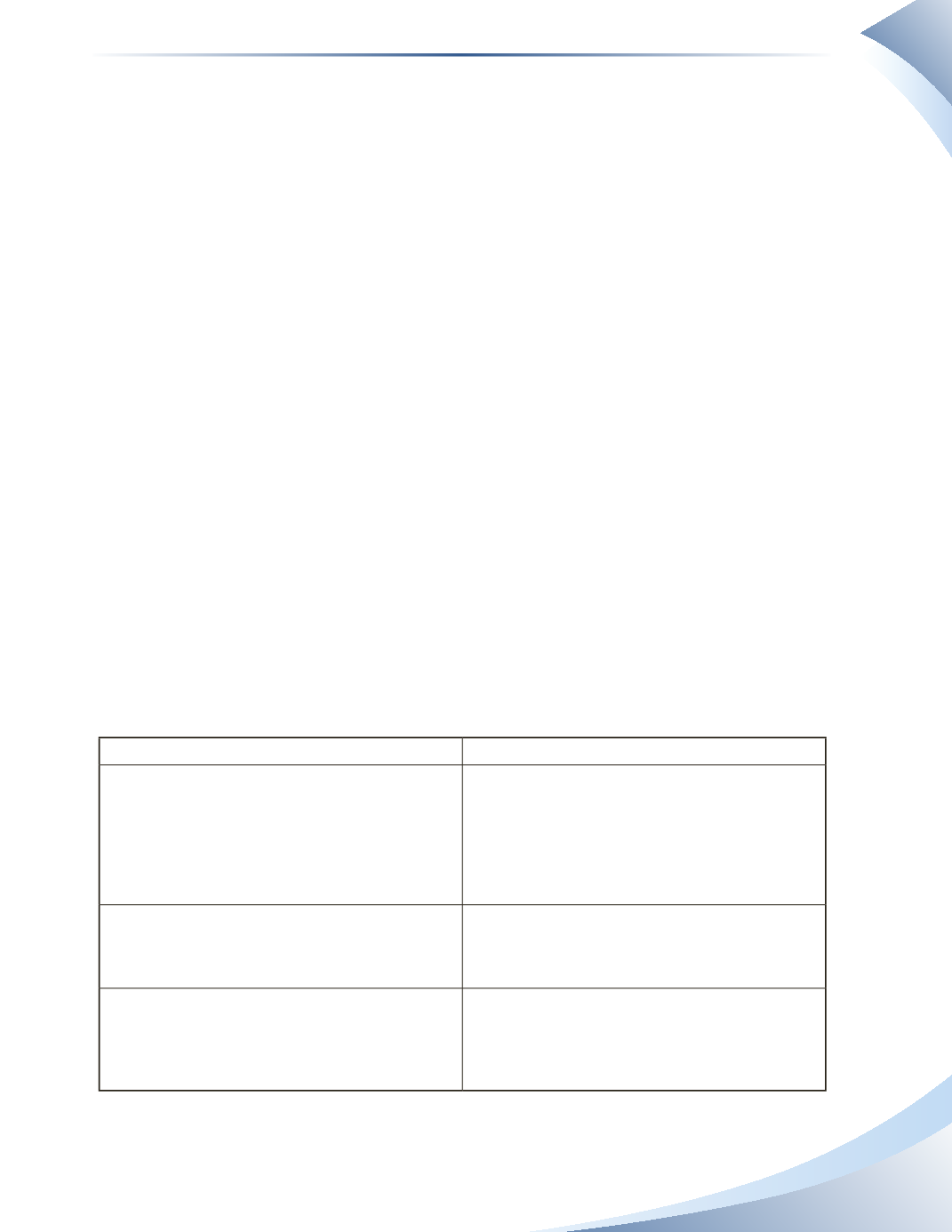

ASPE or IFRS?

Although both ASPE and IFRS have very similar accounting frameworks, the decision of choosing

which to implement is an important one. Public companies do not have a choice and must report

accounting information under IFRS. Advantages of IFRS include allowing for better compara-

bility among and more streamlined reporting of multinational corporations.

On the other hand, IFRS can be costly to implement and is generally more rigorous in its reporting

requirements than ASPE.

Private companies in Canada have a choice of whether to implement ASPE or IFRS. If the

company plans to become a public corporation at some point in the future, it would be better to

implement IFRS now rather than needing to switch from ASPE to IFRS later. If there are no

plans to become a public corporation, then ASPE is likely the best choice because it is easier to

implement and maintain. See Figure 3.7 for a more detailed comparison of ASPE and IFRS.

ASPE

IFRS

When to Use

•

Private organization (sole proprietorship,

partnership, private corporation)

•

No plans to become public in the near future

•

Competitors also use ASPE

When to Use

•

Public corporation or owned by a public

company

•

Private organization has plans to become

public in the near future

•

Competitors have already adopted IFRS

•

Private enterprises can elect to use IFRS

Advantages

•

Less costly and simpler to implement

•

Fewer disclosures are required

Advantages

•

More relevant, reliable and comparable on a

global scale

•

Long-term accounting standards

Disadvantages

•

Banks may require statements to conform to

IFRS before offering a loan

•

ASPE may eventually evolve into IFRS in the

future

Disadvantages

•

Can be costly to implement

•

Fewer hard-and-fast rules; more judgments

required

•

More disclosures are required

______________

FIGURE 3.7