Chapter 3

The Accounting Framework

64

Private enterprises may choose to adhere to IFRS, or may follow the

Accounting Standards for

Private Enterprises (ASPE)

, developed by the AcSB. These standards are less complex and are

used only by private companies in Canada.

Both ASPE and IFRS conform to an underlying

conceptual framework

. This framework forms

the basis to determine how business transactions should be measured and reported. It ensures the

external users (e.g. shareholders) have the most consistent, reliable and useful information when

reviewing a company’s financial reports. Although it is not possible to create a specific rule for

every situation, the principles under the conceptual framework allow accountants to make appro-

priate decisions under different circumstances.This is referred to as

principles-based accounting

.

In other words, ASPE and IFRS are designed as guidelines and accountants are allowed to flexibly

apply these standards when preparing financial information. On the other hand, under

rules-based

accounting

, the accounting standards are stated as a list of specific, detailed rules that must be

followed when preparing financial information. To apply these rules, accountants have little room

to make their own judgments. Not every country adopts principles-based accounting. For example,

U.S. GAAP is primarily rules-based.

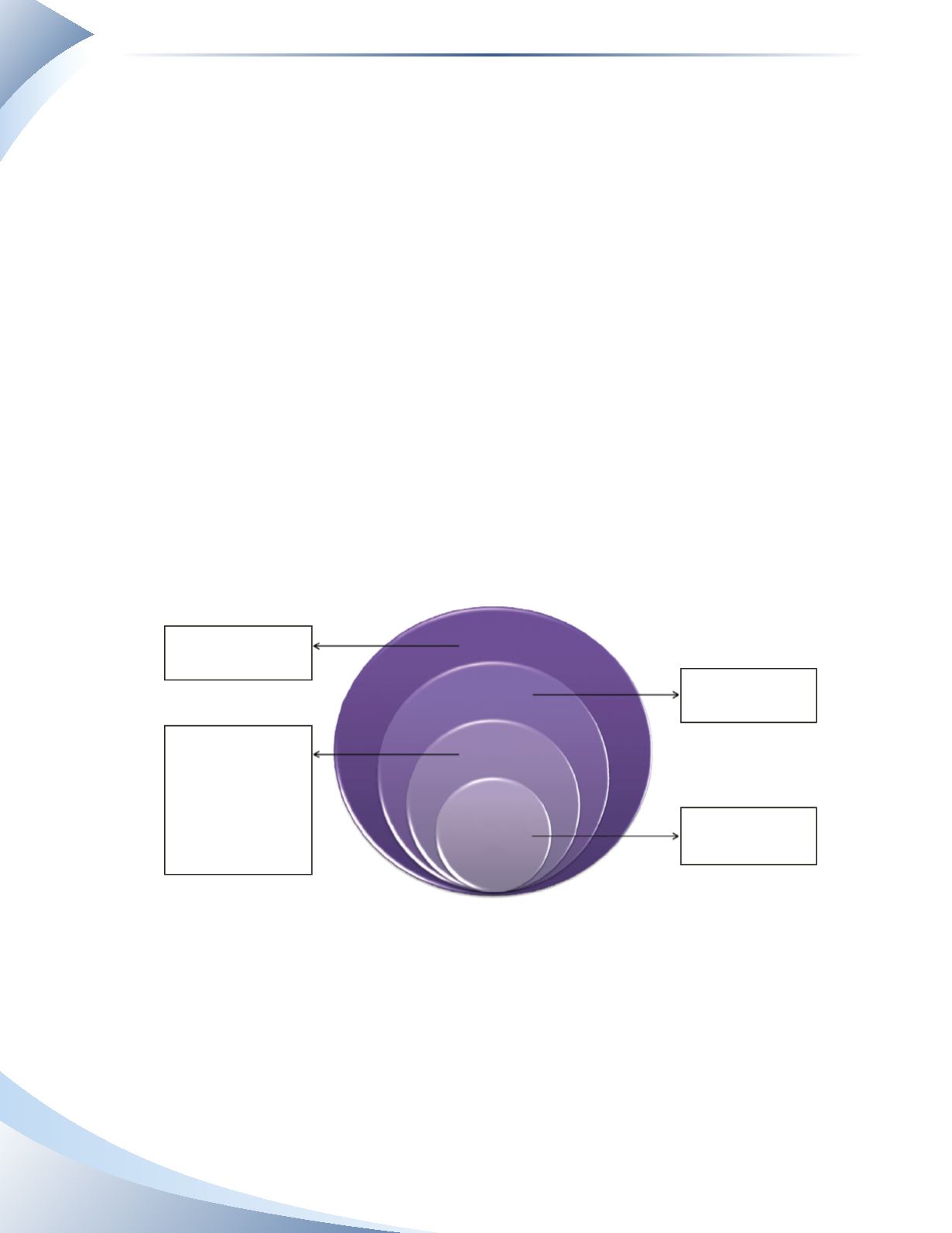

Next, we will examine the important characteristics, assumptions, and principles that form the

conceptual framework of accounting. Figure 3.5 illustrates the framework.

The Conceptual Framework of Accounting

To provide useful financial

information to a wide

range of users

Relevance, reliability,

understandability and

comparability

Assumptions

Principles

Business Entity, Going

Concern, Monetary Unit

Revenue Recognition,

Expense Recognition,

Consistency, Materiality,

Time Period, Disclosure

Assets, liabilities,

owner’s equity,

revenues and expenses

Objective of

Financial

Statements

Characteristics

of Financial

Information

Basic Assumptions

and Principles

Components of

Financial

Statements

______________

FIGURE 3.5

The fundamental objective of financial reporting is to provide useful and complete information to

the users. However, an underlying constraint in the accounting framework is the

cost constraint

.

It ensures that the value of reported financial information outweighs the costs incurred to report it,

even if the information would improve the accuracy and completeness of the financial statements.

For example, a company may find some information that is not required by accounting standards to

be somewhat useful, however it is costly to prepare. If the value of this information does not outweigh

the costs, the company should not prepare it.