Chapter 3

The Accounting Framework

62

amount they have invested in the form of shares. Thus, owners or shareholders have limited

liability.

Moreover, the life of a corporation is indefi-

nite and is independent of the lives of the

shareholders.The corporation’s operations are

not directly controlled by its shareholders, but

they elect a board of directors to oversee the

corporation. Members of the board of direc-

tors and senior management can be finan-

cially and legally accountable for the actions

of the corporation. The behaviour of officers

of the corporation is governed by a number of

rules including those relating to responsible

accounting and cash management.

The balance sheet of a corporation uses the

term shareholders’ equity for the equity

section, and it is equal to the difference between assets and liabilities, just like a sole proprietor-

ship or partnership. For example, if the assets are worth $100,000 and the liabilities are worth

$60,000, the shareholders’ equity is equal to $40,000. If the corporation were to sell all its assets

for $100,000 and use some of the cash to pay the liabilities of $60,000, the remaining $40,000

cash would represent the shareholders’ equity and would belong to the shareholders. If there

were two equal shareholders, each one would be paid $20,000. If there were 20 equal share-

holders, each would be paid $2,000. In other words, the shareholders’ equity is divided among

the shareholders in proportion to the number of shares that they own.

Corporations can be set up as either public or private enterprises. A public corporation allows

its shares to be sold to anyone in the general public who wishes to buy them. This gives the

public corporation access to a large amount of cash to help grow the business. Typically, a public

corporation will have thousands of individual shareholders. Stock exchanges such as the Toronto

Stock Exchange or the New York Stock Exchange allow buyers and sellers to trade shares of

public corporations.

A private corporation does not allow its shares to be sold to just anyone, and often the shares

are held by a few individuals. Private corporations are subject to less stringent reporting require-

ments than public corporations, and private corporations in Canada sometimes receive income

tax benefits that are unavailable to public corporations.

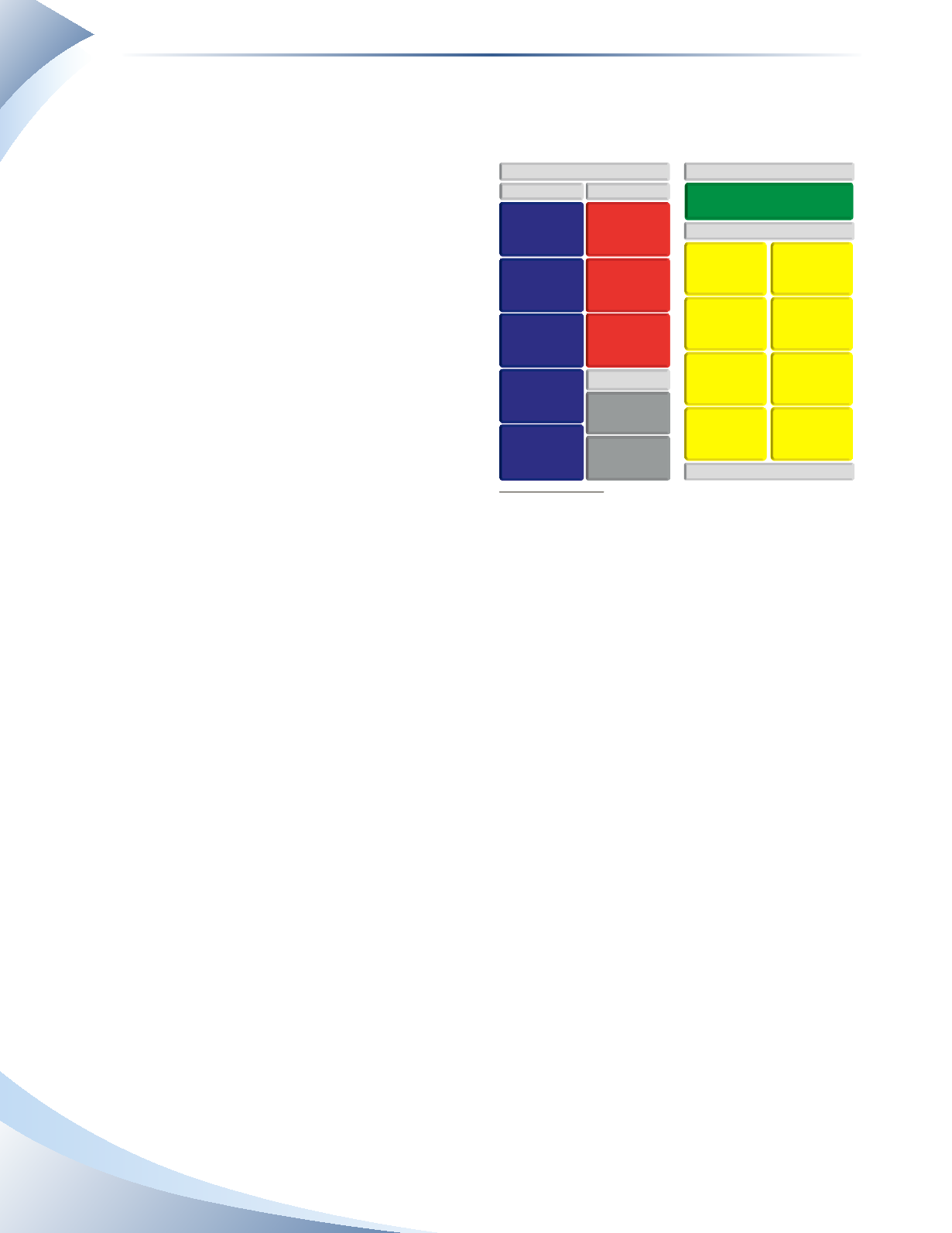

FIGURE 3.3

INCOME STATEMENT

NET INCOME (LOSS)

EXPENSES

2

ASSETS

BALANCE SHEET

LIABILITIES

CASH

ACCOUNTS

RECEIVABLE

PROPERTY, PLANT

& EQUIPMENT

PREPAID

EXPENSES

OFFICE

SUPPLIES

ACCOUNTS

PAYABLE

UNEARNED

REVENUE

LOANS

PAYABLE

REVENUE

SHAREHOLDERS’EQUITY

COMMON

SHARES

RETAINED

EARNINGS

TRAVEL

INSURANCE

DEPRECIATION

INTEREST

MAINTENANCE

SALARIES

RENT

UTILITIES