Chapter 3

The Accounting Framework

63

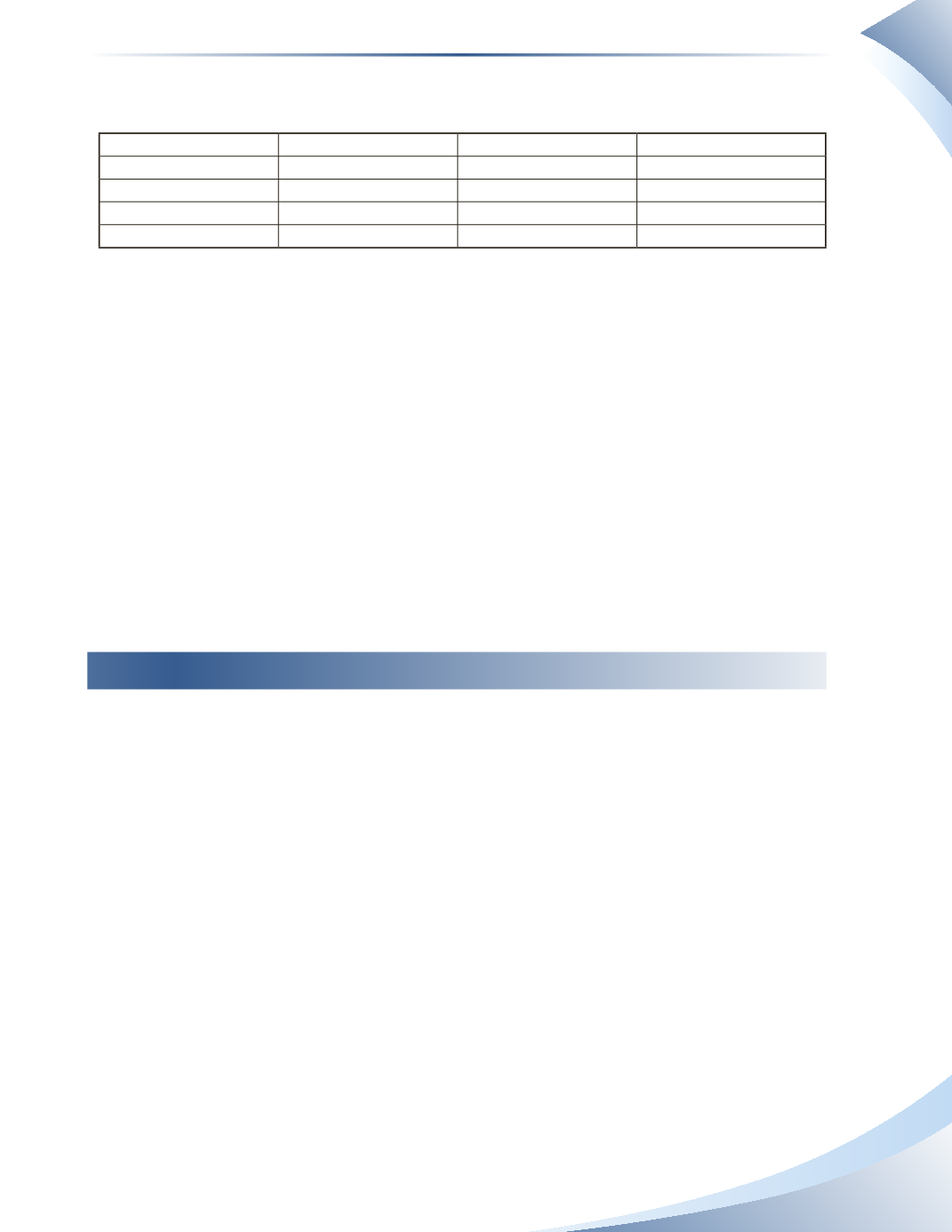

The major differences between the three forms of organization are summarized in Figure 3.4.

Sole Proprietorship

Partnership

Corporation

Title of Owners

Proprietor (One)

Partners (Two or More)

Shareholders (One or More)

Public or Private

Private

Private

Public or Private

Equity Section

Owner’s Equity

Partners’ Equity

Shareholders’ Equity

Owner’s Liability

Unlimited

Limited or Unlimited

Limited

______________

FIGURE 3.4

Not-for-Profit Organizations

Unlike regular businesses, profits made by

not-for-profit organizations

are paid out (redistrib-

uted) to the community by providing services. While the primary objective of other forms of

organization is to maximize profits, not-for-profit organizations aim to improve society in some

way. They usually obtain funding from donations and government grants. Not-for-profit orga-

nizations include religious organizations, community care centres, charitable organizations and

hospitals. They do not have an identifiable owner but require financial statements because they

are accountable to donors, sponsors, lenders, tax authorities, etc.

Accounting records provide key information pertaining to the activities of not-for-profit orga-

nizations, enabling them to operate as permitted. This textbook will not focus on not-for-profit

organizations.

The Conceptual Framework of Accounting

Imagine a hockey or a football game with no rules or consistent method to keep score.The players

and spectators would quickly become frustrated because of the lack of consistency. By having rules

to follow and a consistent method to keep score, players know how to play the game and spectators

know what to expect as they watch.

Accounting in a business is similar. If there were no rules to follow, business owners and accoun-

tants could make up rules regarding what to report. External users would find the reports to be

unreliable and inconsistent. Thus, the accounting profession has created standards which provide

guidance on how financial information should be reported.These standards are commonly referred

to as

generally accepted accounting principles (GAAP)

.

In Canada, the Accounting Standards Board (AcSB) is responsible for setting accounting standards.

In the past, Canadian GAAP was used as the standard for all companies in Canada. However, in

recent years, there has been recognition of the different reporting needs of public companies and

private companies. Therefore, the AcSB decided that Canadian businesses must adhere to one of

two sets of standards, depending on the form of the organization.

Public enterprises must prepare financial information in accordance with the

International

Financial Reporting Standards (IFRS)

. IFRS was developed by the International Accounting

Standards Board (IASB) and is used globally.