Chapter 6

The Accounting Cycle: Statements and Closing Entries

149

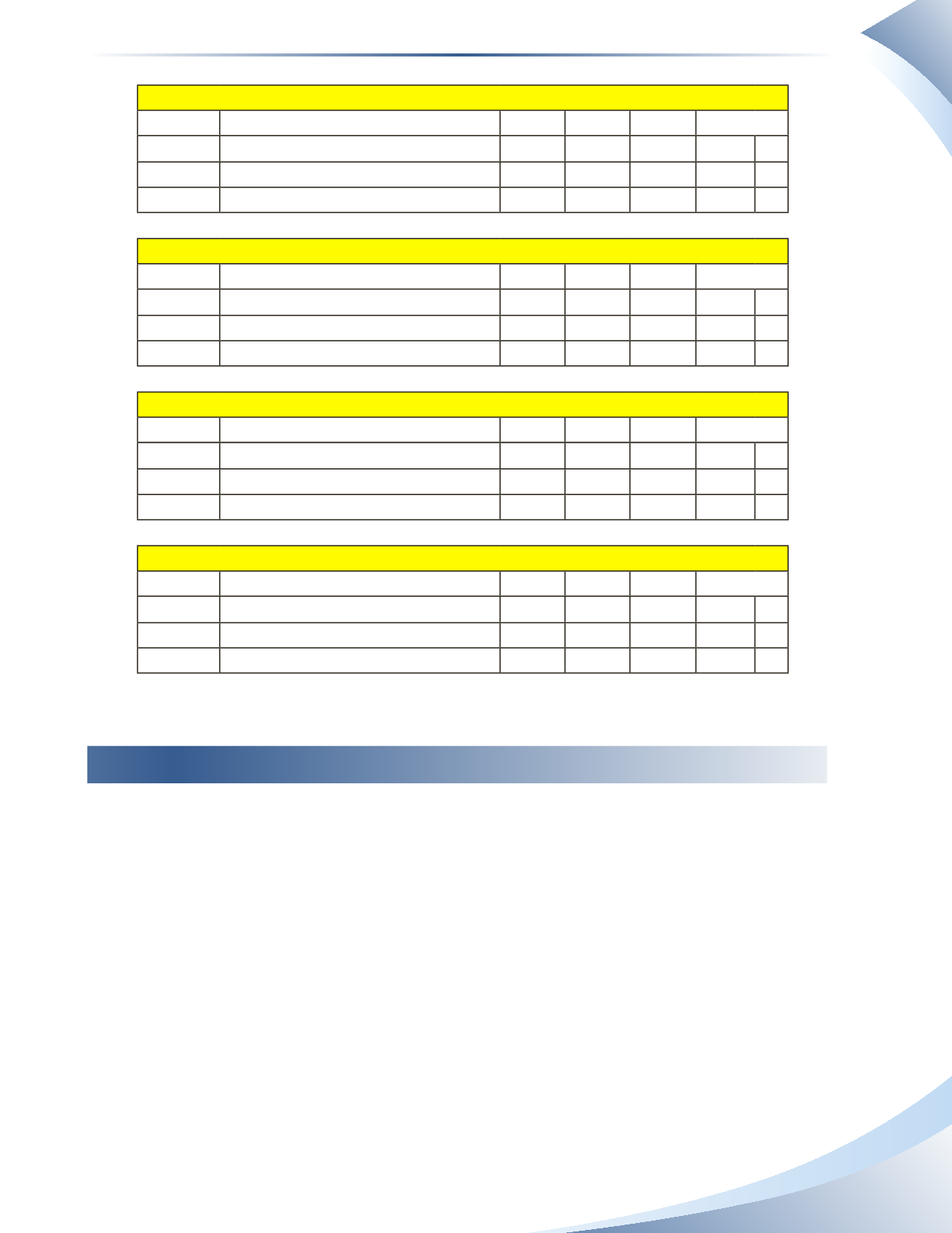

Account: Insurance Expense

GL. No. 515

Date

Description

PR DR CR Balance

2016

Jan 31 Adjustment

J2

100

100 DR

Jan 31 Closing Entry

J3

100

0 DR

Account: Interest Expense

GL. No. 520

Date

Description

PR DR CR Balance

2016

Jan 31 Adjustment

J2

25

25 DR

Jan 31 Closing Entry

J3

25

0 DR

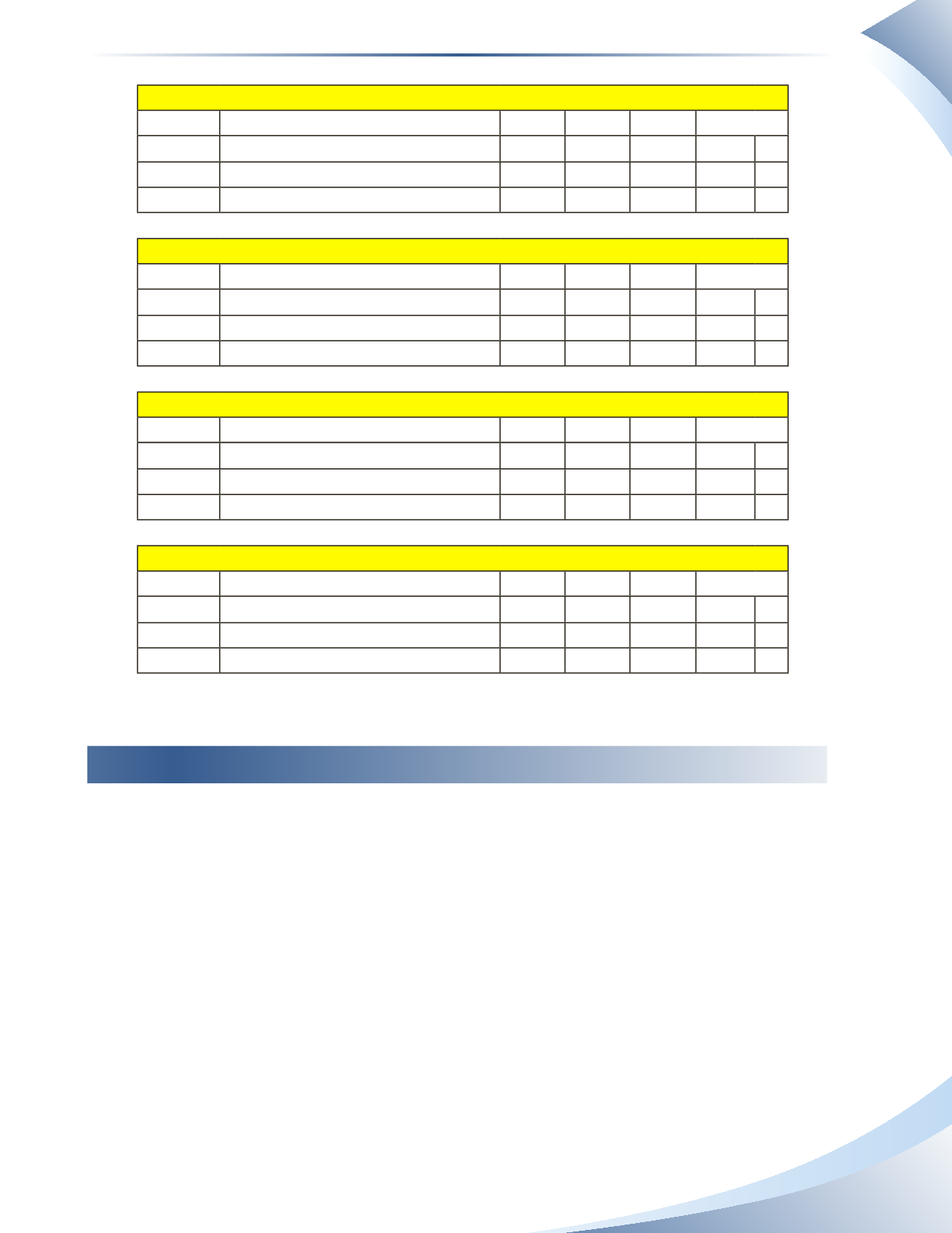

Account: Rent Expense

GL. No. 540

Date

Description

PR DR CR Balance

2016

Jan 3

J1

800

800 DR

Jan 31 Closing Entry

J3

800

0 DR

Account: Telephone Expense

GL. No. 550

Date

Description

PR DR CR Balance

2016

Jan 20

J1

250

250 DR

Jan 31 Closing Entry

J3

250

0 DR

________________

Figure 6.19

Post-Closing Trial Balance

Once the closing entries are completed, it is necessary to ensure that the balance sheet still balances.

This is done by completing another trial balance called the post-closing trial balance. The

post-

closing trial balance

only lists accounts that have a balance. Since the closing entries have been

journalized and posted, only assets, liabilities and owner’s capital should have a balance.The post-

closing trial balance is shown in Figure 6.20.