Chapter 1

Financial Statements: Personal Accounting

15

2. Repay your friend: you have less cash, but your net worth still does not change.

The T-account entries are shown in Figure 1.26.

+

CASH

-

INCREASE

DECREASE

-

LOANS

+

DECREASE

INCREASE

1. $100

2. $100

2. $100

1. $100

______________

FIGURE 1.26

Only assets and liabilities are affected, so there is no entry on the income statement. There is no

change to net worth.

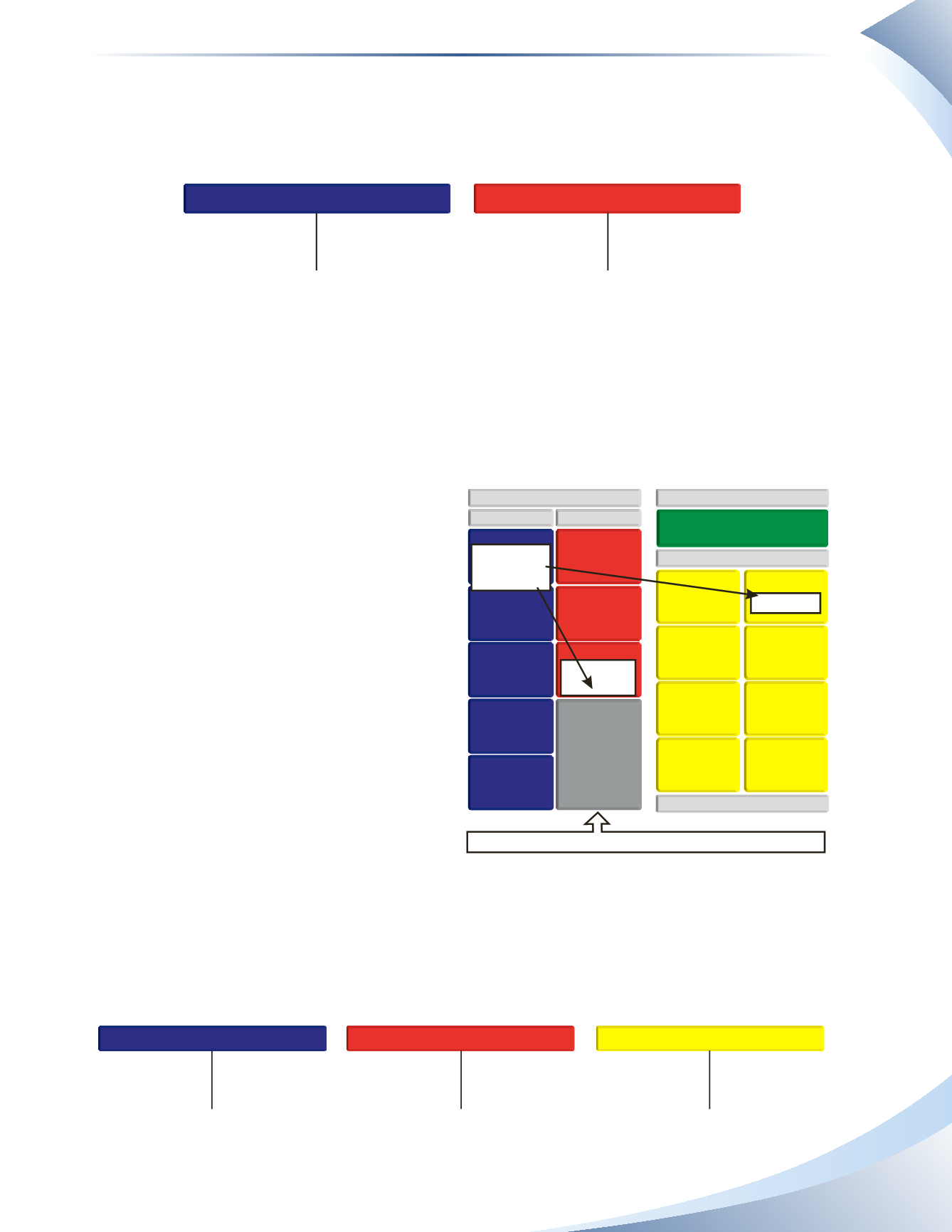

Figure 1.27 demonstrates that not all the cash you spend would necessarily be used to pay expenses.

For example, you arrange for a loan of $15,000 and your loan repayments are $500 each month.

There are three transactions to consider.

Transaction 1

Receiving the loan will

increase cash and increase

the loans liability. There is no

impact to net worth.

Transaction 2

Pay the interest

portion of

$400. Net worth has decreased

and an expense should be

recognized.

Transaction 3

Pay the principal

of $100,

thereby reducing the amount

owing to the loan company.

Your net worth does not

change and there is no need to record this transaction on the income statement.

The transactions would appear on the T-accounts, as in Figure 1.28.

+

+

CASH

INTEREST EXPENSE

-

-

INCREASE

INCREASE

DECREASE

DECREASE

-

LOANS

+

DECREASE

INCREASE

3. $100 1. $15,000

2. $400

3. 100

1. $15,000

2. $400

______________

FIGURE 1.28

Cash balance

decreased by $500

($400 to pay interest

and $100 to reduce the

debt principal).

PERSONAL INCOME STATEMENT

SURPLUS (DEFICIT)

EXPENSES

2

ASSETS

PERSONAL BALANCE SHEET

LIABILITIES

CASH

PREPAID

EXPENSES

HOUSE

AUTOMOBILE

CONTENTS

OF HOME

UNPAID ACCOUNTS

MORTGAGE

LOANS

NETWORTH

1. +$15,000

2. - 400

3. - 100

1. +$15,000

3. - 100

REVENUE

DEPRECIATION

FOOD

ENTERTAINMENT

INTEREST

MAINTENANCE

MISCELLANEOUS

UTILITIES

GASOLINE

Net worth decreased by $400

2. + $400

______________

FIGURE 1.27